Weekly Market Recap: Bears Tighten Grip, Nifty Falls 0.5%

Markets fell for the fourth consecutive week, marking the longest losing streak of 2025. Discover the key market trends, top gainers and losers and our outlook for the coming week in this detailed weekly stock market report.

Weekly Recap

Markets declined for the fourth consecutive week, marking the longest losing streak of 2025. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

A Little Grizzly

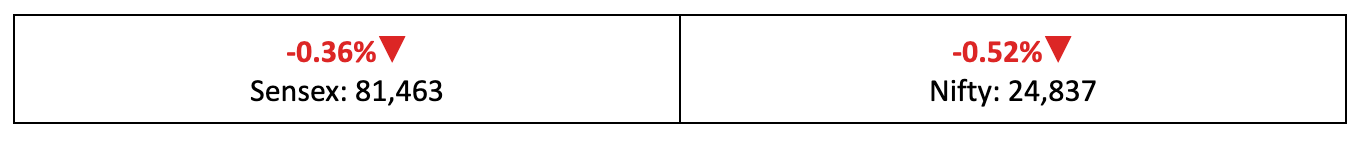

- Bears tightened their grip on the markets last week, causing the Nifty to drop by 0.52%. Among broader indices, the BSE Mid-Cap and Small-Cap indices wiped out the previous week's gains, falling 1.7% and 2.5%, respectively. Meanwhile, the BSE Large-Cap index extended its decline for the fourth consecutive week, finishing 0.7% lower.

- The India VIX fear gauge, after dropping significantly between Monday and Wednesday, spiked again on Thursday and Friday as market uncertainty intensified.

The Big Stories

- With global trade tensions escalating and the August 1 US tariffs deadline approaching, the UK and India sealed a significant trade deal on Thursday.

- Earnings season is in full swing on D-Street, providing investors with fresh opportunities to uncover potential winners in the market.

The Winners

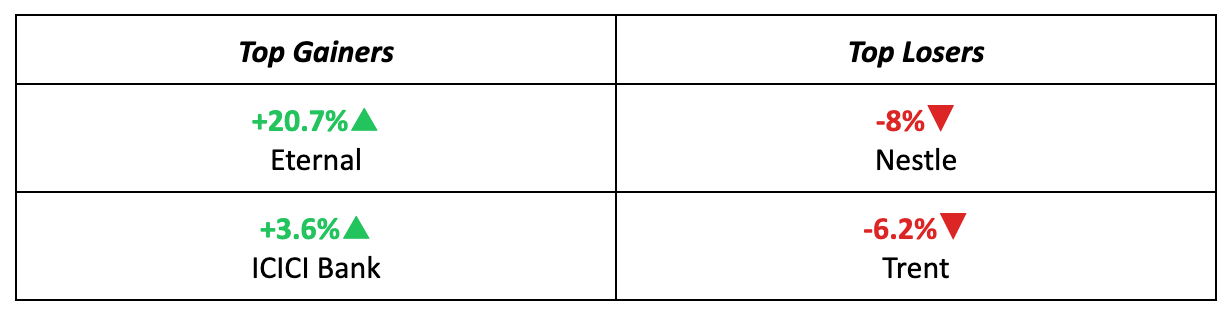

- Eternal emerged as the week's standout performer, surging an impressive 20.7% on the back of strong growth in its quick commerce segments.

- ICICI Bank secured second place, delivering a 3.6% return as its June quarter profits and loan growth exceeded analysts' expectations.

The Losers

- Nestle saw a notable decline last week, falling 8% after a 13% drop in profit after tax for the quarter, compounded by rising inflation concerns.

- Trent also took a hit, dropping 6.2% following a downgrade by Goldman Sachs from "buy" to "neutral," driven by concerns over growth and sales performance.

Meanwhile…

- US indices shrugged off the political noise surrounding President Trump’s public feud with Fed Chairman Jay Powell, continuing their upward trajectory to reach new record highs.

- India’s PMI for July surged to 59.2, the highest in nearly 17.5 years, indicating strong manufacturing growth. However, services growth showed a slight slowdown during the same period.

Market Brief

Market Outlook

Our Take

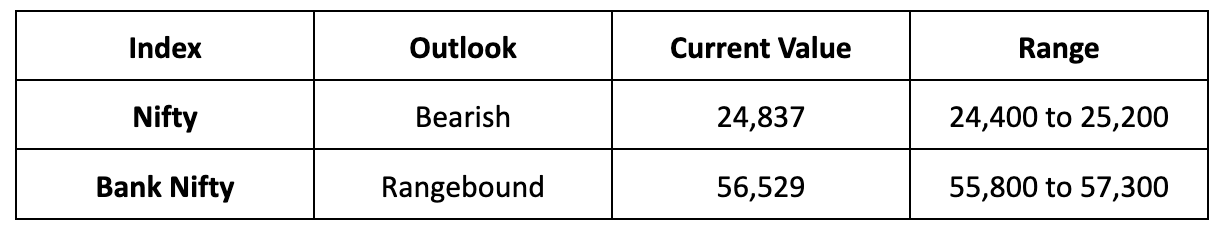

- Last week, India Inc. reported mixed results, amid rising global volatility and geopolitical tensions, which contributed to the bearish market momentum.

- We expect this bearish trend to persist in the near term, with the Nifty likely to stay within the 24,400 to 25,200 range in the coming week.

- Going forward, stock-specific movements will dominate, primarily driven by the outcomes of Q1FY26 results and subsequent management commentary.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.