Weekly Stock Market Review: Key Investment Insights & Future Outlook

Dive into our weekly market review as we dissect the factors influencing the Nifty. Discover key insights on the latest stock trends, sector performances and investment opportunities.

Markets ended lower for the third consecutive week, marking their longest losing streak of 2024. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly market report.

Weekly Recap

On shaky ground

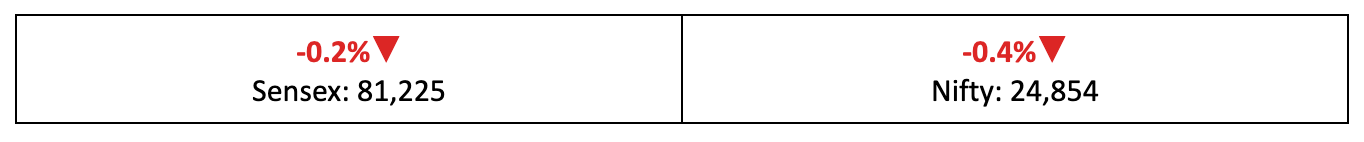

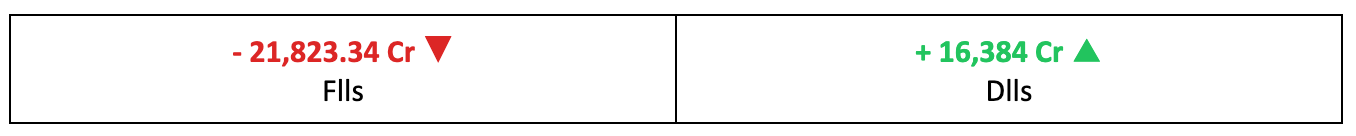

- As we anticipated, indices were in for another shaky week, trending mostly downward and closing 0.44% below last Friday's levels, influenced by muted second-quarter earnings, persistent FII outflows, and ongoing tensions in the Middle East.

- The broader indices underperformed the main indices after two weeks of outperformance, with the BSE Mid-Cap shedding 1%, BSE Large-Cap falling 0.7% and BSE Small-Cap nearly flat.

A bird’s-eye view

- Last week, concerns grew over potential downgrades to FY25 earnings forecasts for Indian companies, driven by weakening demand and increasing cost pressures.

- On the macroeconomic front, inflation unexpectedly surged to a nine-month high of 5.49% in September, primarily due to rising food prices.

The winners

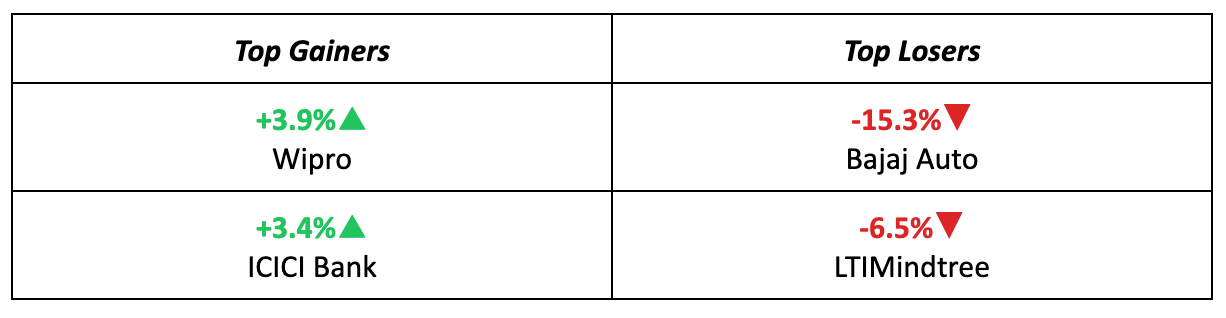

- Wipro soared 3.9% over the week due to better-than-expected Q2 results and the announcement of a bonus share issue.

- ICICI Bank also performed strongly, up 3.4%, with brokerages noting its consistent net earnings growth, low NPA ratios, and high-yielding portfolios.

The losers

- Bajaj Auto was far and away the week’s biggest loser, plummeting by a whopping 15.3% due to disappointing September quarter results, weak demand, and margin pressures.

- LTIMindtree also struggled, dropping 6.5% as mixed reactions to its quarterly results left investors uneasy.

Meanwhile…

- Wall Street indices reached record highs last week, buoyed by a positive Netflix earnings report and gains in tech stocks.

- In the broader US economy, initial jobless claims fell below economists' estimates, and retail sales were stronger than expectations.

Market Brief

Market Outlook

Our take

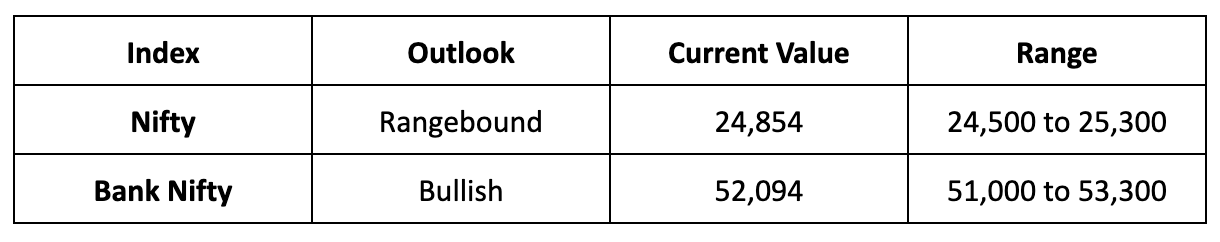

- As earnings call season progresses, we expect market sentiment to remain cautious and generally rangebound, although selective stock picks could still yield profits.

- Consequently, we forecast the Nifty to trade within a range of 24,500 to 25,300 in the coming week. A sustained upward movement from this point is essential to confirm a significant bottom reversal pattern.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple App Store, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download today and enhance your financial journey with Liquide's cutting-edge features.