Weekly Recap: Earnings Season and Global Cues Weigh on Markets

Markets declined for the second consecutive week due to a sluggish start to the earnings season and global uncertainties. Read our analysis on the week's key events, stock performances and the market outlook.

Weekly Recap

Markets declined for the second consecutive week, weighed down by a sluggish start to the earnings season and weak global cues. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Continued Slippage

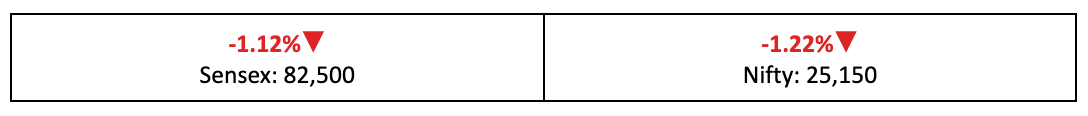

- Investors pushed the Nifty into another negative week, with a more significant decline of 1.22%, compared to last week's performance.

- Among broader indices, the BSE Large-Cap and Mid-Cap indices fell by 1% while the BSE Small-Cap index shed 0.6%.

- A mix of domestic and global cues led investors to book profits last week. Let’s break it down.

The Big Picture

- The major story last week was a weak start to the Q1 earnings cycle, especially in the IT sector, which dampened sentiment on D-Street and triggered profit booking.

- On the global front, the Trump administration's renewed rhetoric on tariffs has dashed earlier hopes for a swift resolution to the ongoing trade uncertainties.

The Winners

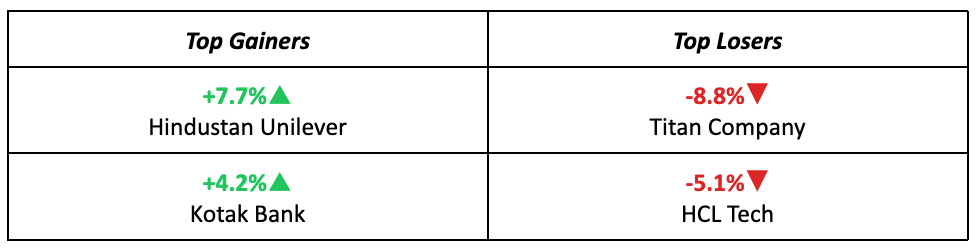

- Hindustan Unilever had a standout week, with its stock price rising 7.7%, as investors welcomed the appointment of new CEO Priya Nair.

- Kotak Mahindra Bank also performed well, surging 4.2% after publishing a strong Q1 business update that highlighted steady growth. Read more here.

The Losers

- Titan Company was the top loser of the week, plunging 8.8% as its Q1 update failed to meet expectations on D-Street. More details here.

- HCL Tech also faced a sharp decline, as revenue growth sentiment soured across the sector following disappointing Q1 results from IT giant TCS.

Meanwhile…

- The UK economy unexpectedly contracted by 0.1% in May, with analysts suggesting this may be a temporary dip, with a rebound expected in June.

- At home, SEBI has banned the renowned global market-maker Jane Street, accusing the firm of market manipulation.

Brief

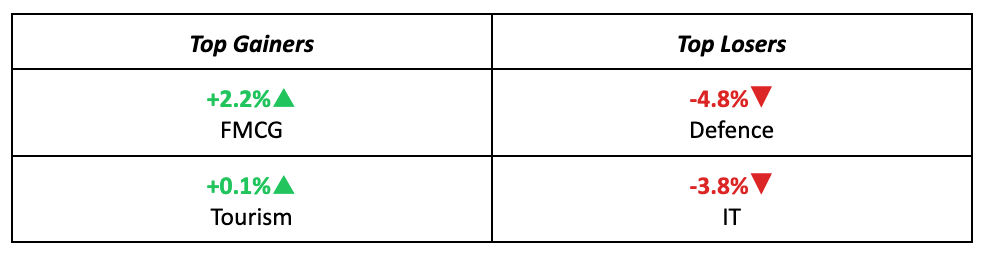

Sectors

Stocks

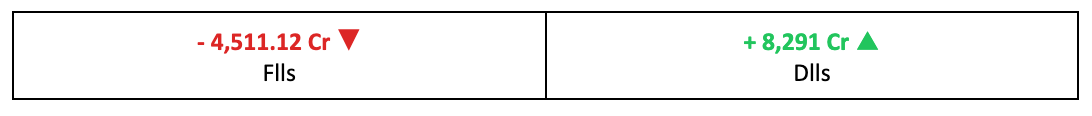

Other Key Data

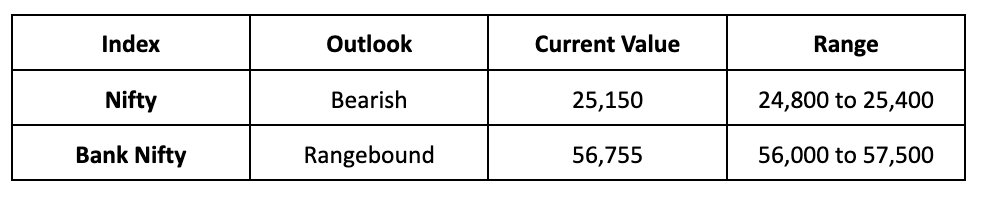

Market Outlook

Sectors to Watch

Our Take

- With earnings reports now taking center stage and the results thus far underwhelming, investors are likely to remain cautious, with stock-specific movements shaping the market.

- Unless positive surprises emerge from trade deals or earnings, we expect the Nifty to trend bearish next week, with a projected trading range between 24,800 and 25,400.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.