Weekly Recap: Diwali Cheer, Trade Tensions & Key Stock Moves

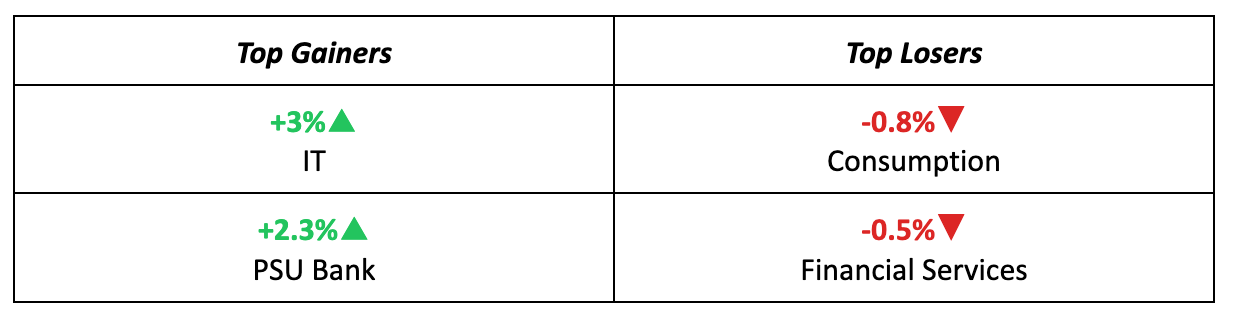

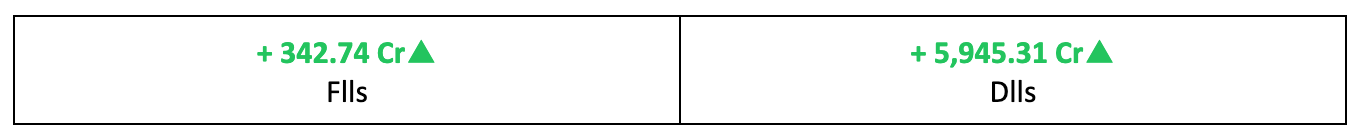

Indian markets extended their winning streak for the fourth week in a row, marking a solid start to Samvat 2082. Key sectors like IT, PSU Banks & Metals led the way. Read on to know the big stories, market updates & our outlook for the week ahead.

Markets extended their winning streak for the fourth straight week, marking the first time in 2025. Here's our take on this week gone by, some stories you might have missed out on and our thoughts on what to do going ahead, in your weekly report.

Happy Diwali!

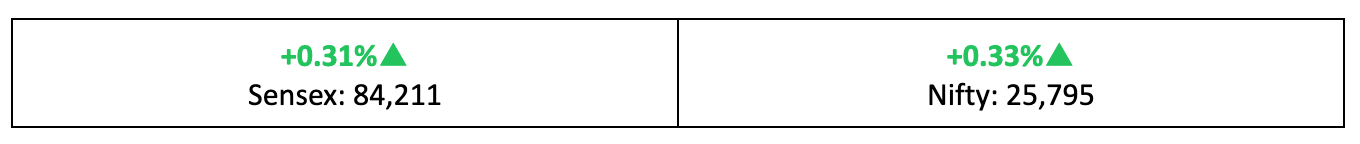

- Indian markets began the new Samvat on a cheerful note. However, early-week gains were trimmed by profit-booking towards Thursday and Friday.

- Within the broader indices, the BSE Large-Cap index rose 0.3%, the BSE Mid-Cap gained 0.5% and the BSE Small-Cap advanced 0.9%.

- The India VIX eased 0.33%, reflecting steady investor sentiment amid ongoing earnings announcements and geopolitical developments.

The Big Stories

- US inflation data released post-market hours on Friday showed a smaller-than-expected increase, boosting hopes for potential rate cuts by the Federal Reserve.

- Back home, investor sentiment turned cautious in the second half of the week, fuelled by growing uncertainty around the trade deal with the US.

The Winners

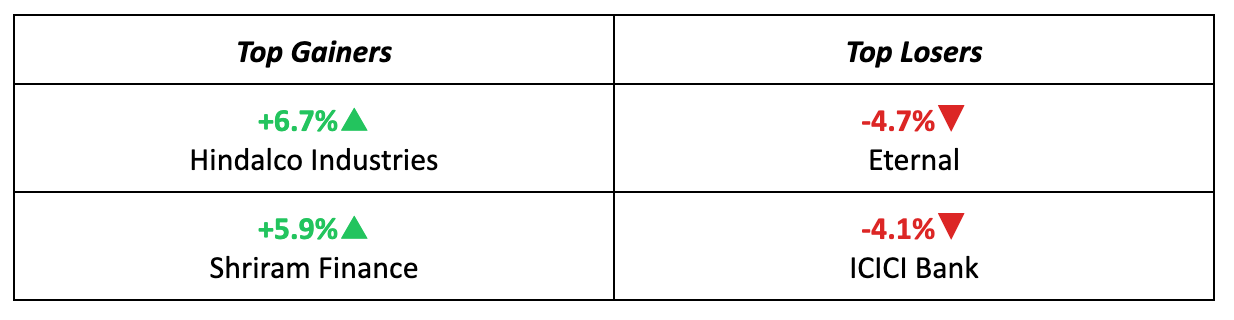

- Hindalco led the pack, surging 6.7% as aluminium prices crossed $2,850/ton, fuelled by tight global supply chains.

- Shriram Finance followed closely, gaining 5.9% as investors remained bullish on its earnings resilience and technical momentum.

The Losers

- Eternal was the biggest decliner of the week, dropping 4.7% after Ambit Capital projected nearly a 40% downside due to concerns over cash burn and intense competition.

- ICICI Bank followed, slipping 4.1% after its Q2 earnings raised investor concerns about its growth prospects compared to other major players in the sector.

Meanwhile…

- The Trump administration sparked fresh trade turmoil on Friday, paving the way for new tariffs on China and abruptly halting trade talks with Canada.

- India’s core sector growth slowed to 3% in September, down from 6.5% in August, primarily due to weaker performances in refineries, natural gas and crude oil.

Market Brief

Market Outlook

Sectors To Watch

Our Take

- With global trade tensions rising and earnings reports continuing to come in, investors are likely to remain cautious, closely monitoring opportunities and triggers in the coming week.

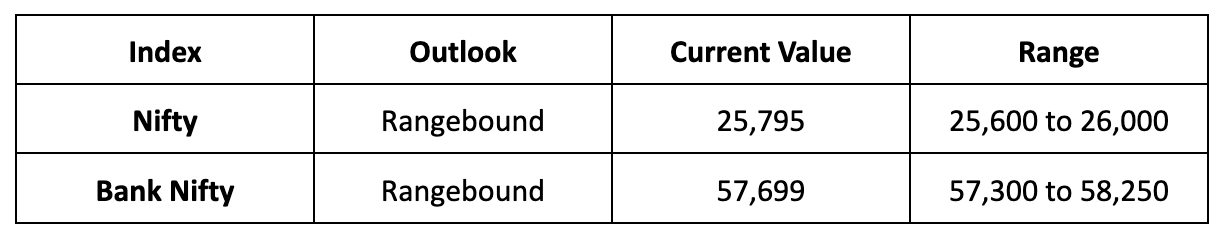

- We expect the Nifty to remain rangebound next week, with potential trading between 25,600 and 26,000 levels.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.