Ab Ki Baar, 90 Paar? The Rupee Story: Reality Vs Panic

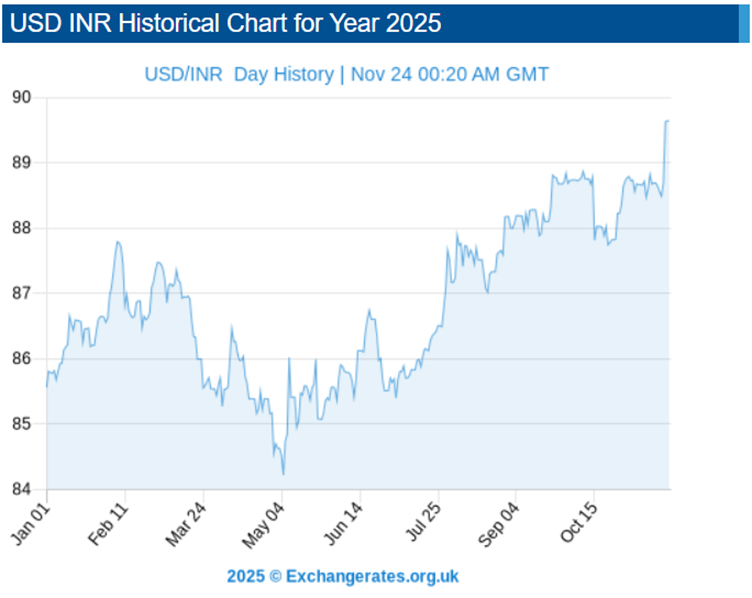

The Indian Rupee has weakened past Rs 89 against the dollar, raising questions about whether the USD to INR rate will touch 90. Here’s a data-backed analysis of why the Rupee is falling, what’s driving Dollar strength and where the currency is headed next.

The Indian rupee has been under some heat lately, slipping to a fresh record low of 89.49 against the US dollar on November 21. With the currency now above the Rs 89‐per-dollar mark, traders and analysts are taking notice again.

Let’s take a closer look at what’s really going on.

What’s Driving the Fall?

At first glance, this slide looks like part of the broader “strong dollar” story. The US economy continues to outperform expectations, keeping Treasury yields high at around 4.07% and the Federal Reserve hesitant to cut rates. Naturally, global money is flowing toward the dollar — the world’s favourite safe asset (or maybe the second favourite now, with gold stealing the spotlight recently).

The rupee has slipped about 4.5% in 2025, even though India’s economic fundamentals remain solid and the stock market is still flirting with all-time highs. India typically does a better job of defending its currency, thanks to strong forex reserves and a stable macro backdrop. But this time, some domestic factors are adding to the pressure.

The Homegrown Headwinds

India’s trade deficit has been inching higher again. In October 2025, the country’s merchandise trade deficit widened sharply to a record high of about $41.68 billion, compared with $32.15 billion in September, driven by a surge in gold imports and a drop in US-bound exports during the second month of steep US tariffs on Indian goods.

Adding pressure, foreign investors have been steadily trimming exposure to Indian equities. Foreign Institutional Investors have withdrawn approximately Rs 1,44,148 crore in 2025 so far, according to NSDL data.

There’s also a layer of uncertainty surrounding the India–US trade deal, which is keeping sentiment cautious and preventing any meaningful recovery in the currency for now.

Inflation: The Balancing Act

For the average Indian, a weaker rupee often means costlier imports — from crude oil to electronics. But with food inflation currently under control, the overall picture isn’t alarming. Still, prolonged weakness could push import prices higher, giving the RBI another inflation headache it doesn’t want right now.

RBI: Watching, Not Fighting (Yet)

So, should the Reserve Bank of India step in? Governor Sanjay Malhotra doesn’t think it’s time for drastic moves. “We do not target any level,” he said recently. The rupee, he emphasized, is a market-driven instrument — it moves with demand for dollars and rupees just like any other commodity.

The RBI’s approach so far has been to smooth volatility, not hold a line. With forex reserves at a comfortable $690 billion, it has plenty of firepower if things get disorderly. But for now, the central bank seems content to let markets do the talking — unless inflation starts to bite.

Rupee Outlook: Should You Worry?

Yes, the rupee has crossed 89, but it’s not a signal of economic distress. India remains the world’s fastest-growing major economy with stable inflation and strong reserves. The recent pressure largely stems from trade and portfolio flow disruptions triggered by US tariff concerns.

A Union Bank of India report suggests the rupee may gradually drift toward the 90 mark by March 2026. Their report highlights both technical and fundamental factors at play — equity inflows, trade progress with the US and geopolitical shifts will all influence the next move. But the keyword here is gradually, not freefall. A smooth resolution on the trade deal front could easily swing sentiment back and help the currency recover.

Impact on Equity Markets: Who Wins & Who Hurts

Rupee depreciation tends to spark risk-off sentiment and increases costs for sectors heavily dependent on imports. FIIs also grow cautious because weaker currency eats into dollar-adjusted returns. Midcaps and smallcaps typically feel the heat more due to higher leverage and valuation risk.

However, this isn’t a trend that is likely to derail markets right now, especially since valuations have moderated a bit. Export-heavy sectors — IT, pharma, textiles, gems & jewellery and auto ancillaries — stand to benefit as dollar revenues translate into higher rupee gains.

On the flip side, aviation, oil marketing, consumer electronics, power utilities and other import-dependent businesses may face margin pressure.

The Bottom Line

Yes, the rupee’s slip past 89 may look dramatic on the surface, but the broader context suggests no reason for panic. This is more of a currency adjustment driven by a stronger dollar cycle and temporary trade uncertainties — not a sign of weakening economic fundamentals.

India’s growth engine is still strong, inflation is manageable, reserves are healthy and RBI is alert but not alarmed. The rupee may test 90, but likely in a controlled manner rather than a crash. And if trade clarity improves, sentiment — and the currency — could recover sooner than expected.