Budget 2026: The "3.2% Rule" That Every Investor is Watching

As India gears up for the February 1st Budget, the focus is on a high-octane capex push and a tight fiscal deficit target. Discover the "Goldilocks" balance that could trigger a relief rally in infra and banking stocks.

As Finance Minister Nirmala Sitharaman prepares for her ninth Union Budget on February 1, 2026, financial sector stakeholders—from industry bodies to brokerages—are zeroing in on capex hikes and fiscal discipline.

Let's break down their expectations.

Capex Push: Backbone for Infra-Led Growth

Industry bodies like the CII and global brokerages are in rare agreement—India’s economic momentum depends on the government's ability to keep its "capital expenditure" foot on the gas.

- The Numbers: Expectations are pegged at a 12-14% hike, moving the capex needle from ₹11.21 trillion to roughly ₹12.5-13.1 trillion for FY27.

- The "3.2% Rule": Most analysts, including BofA and Nomura, expect capex to hold steady at ~3.2% of GDP. This is seen as the "sweet spot" that sustains infrastructure development without overheating the fiscal deficit.

State Support via Interest-Free Loans

A critical secondary engine for growth is state-level spending. To support this, the Budget is expected to continue—and potentially expand—the scheme of 50-year interest-free loans to states.

- The Ask: Stakeholders anticipate an allocation of ₹1.5 lakh crore to ₹1.75 lakh crore (a 10-17% increase).

- Impact: This ensures that the "infrastructure boom" isn't just a central phenomenon but reaches local roads, urban development and state-specific industrial corridors.

- For investors, this signals a broader demand for cement, steel and construction services nationwide.

- For the banking sector, this translates into a surge in project financing and credit demand at the grassroots level.

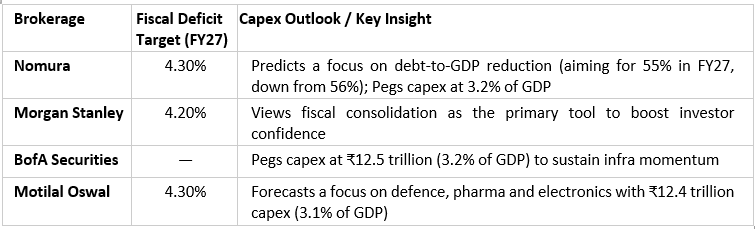

The Common Thread: Brokerage Consensus on Capex & Deficit

While growth is the goal, fiscal health is the guardrail. Leading brokerage firms have provided distinct perspectives on how the government will manage its books in FY27.

The Bottom Line

These numbers suggest three key investment themes:

- Fiscal Credibility: By targeting a deficit of 4.2–4.3%, the government is signalling to global bond markets that India is a safe harbor. This reassures investors, helping to keep borrowing costs manageable for Indian Inc and supporting corporate earnings growth.

- Industrial & Capital Goods: The growth in capex ensures a healthy order book for companies in power, railways and defence.

- The Consumption Barbell: A "barbell strategy" works well by combining high-growth capex stocks with "quality consumption" stocks (such as Auto and FMCG). With lower inflation and a stable fiscal deficit, more disposable income is expected to flow into urban areas, boosting demand in these sectors.

The Verdict

The anticipation surrounding Budget 2026 is anchored in a high-stakes balancing act: maintaining a high-octane infrastructure engine while keeping a disciplined eye on the national balance sheet.

For investors, the math is simple but significant. If the Finance Minister delivers on the ₹13 trillion capex milestone while successfully compressing the fiscal deficit to 4.3% or lower, it would signal a perfect "Goldilocks" scenario—growth that is fast enough to excite, but responsible enough to remain sustainable.

Such a result could trigger a "relief rally" in infrastructure and banking stocks. Conversely, any deviation from fiscal prudence could lead to volatility in the bond markets and a "wait-and-watch" approach from foreign institutional investors.

Keep your eyes on the screen this February 1; the announcements made in this session will define the trajectory of the Indian economy—and your portfolio—for the year to come.