Trading Tips for Budget 2024 | Investment Strategies to Protect Your Portfolio on Budget Day

Budget 2024: Essential Trading Tips to Safeguard Your Portfolio.

The Indian financial space is filled with excitement as Finance Minister Nirmala Sitharaman gears up to unveil the 2024 interim Budget in the Lok Sabha at 11 a.m. on February 1st. This time is especially enticing for traders, with many feeling the urge to establish positions prior to the significant announcement. However, with the recent market volatility, it's crucial to tread carefully. Let’s explore the essential do's and don'ts for traders aiming to safeguard their investments on Budget day.

Understanding Volatility and Strategic Hedging

As we approach Budget 2024, keeping a close eye on market volatility is paramount. Historical patterns, like the fluctuating India VIX levels, indicate that spikes in volatility are common during such significant events. Savvy traders often employ hedging strategies, such as the put ratio back spread, which has been effective in past budgets, to shield their portfolios from negative outcomes. Check out Liquide Academy to know more on Option Strategies.

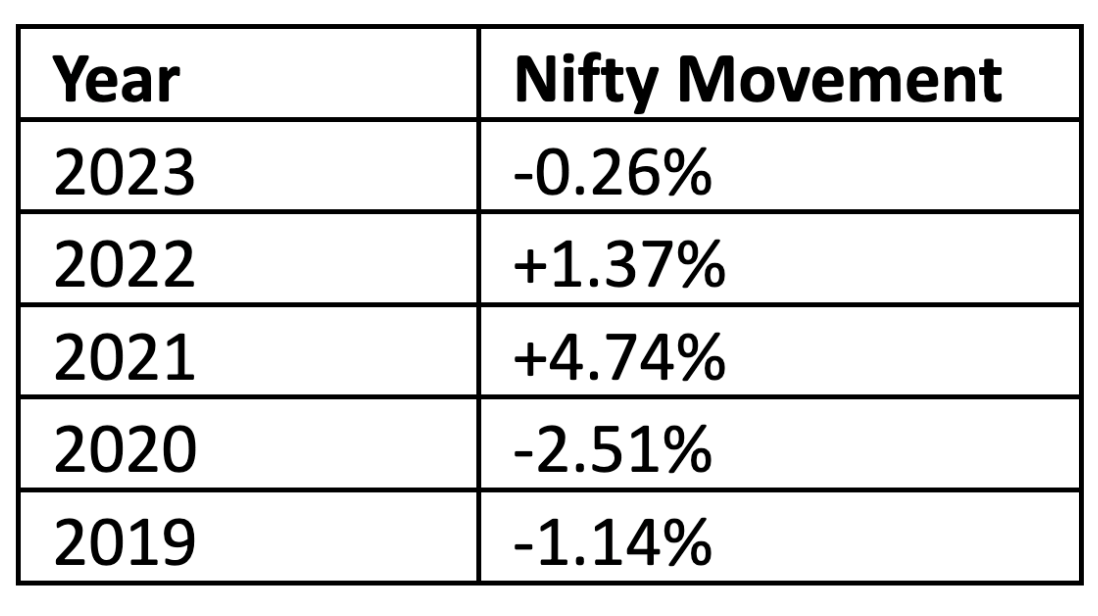

Here’s how the Nifty has performed on previous Budget days under FM Sitharaman:

The Prudent Approach: Avoid Naked Positions

Seasoned traders rarely expose themselves to unnecessary risk on Budget day. Being well-informed about potential risks, they seek opportunities, using available information to their advantage. A key piece of advice is to avoid over-leveraged positions and stick to large-cap stocks. These stocks are more resilient in volatile sessions and offer better chances of recovering any potential losses.

Timing Your Entry: Last Hour Insights

Entering trades during the last hour of trading can be advantageous. This timing allows traders to better understand the budget's impact and identify crucial market levels for future movements.

Discipline and Calculated Risks

Budget day is notorious for extreme market fluctuations. Intra-day traders and smaller investors need to exercise caution. Maintaining trading discipline and taking calculated risks is essential. It is important to avoid impulsive decisions based on unverified information and to conduct thorough research before trading.

Understanding the Market Psychology

Given that the interim budget typically doesn't bring major reforms, the markets may perceive it as insignificant. This perception stems from a tendency within the financial markets to anticipate significant policy changes or favourable announcements during budget presentations. When these expectations are not met, even the lack of negative news can create a pessimistic sentiment among investors.

It is crucial for traders to recognize this nuanced market psychology, as it can significantly influence market trends especially when policy announcements may not align with market expectations.

Also Read: Anticipating Interim Budget 2024: Key Insights and Sector-Specific Expectations

Key Trading Tips for Budget Day

- Stay flexible and adaptable during the Budget announcement.

- Keep an eye on global developments, which also influence market direction.

- Base your trading decisions on solid research, avoiding speculative actions.

Enhance Your Trading Experience with Liquide

To navigate through the market's volatility on this crucial day, make sure to connect with the Liquide App and Website. We promise exclusive, unmatched coverage of the 2024 Budget, providing real-time updates, thorough analysis, and valuable trading insights. Join us as we decode the market dynamics and guide you through each twist and turn of this eventful day.

Prepare yourself for any unexpected moves as FM Sitharaman, in her landmark sixth budget presentation, outlines the government's financial plans and revenue expectations for the year 2024-25.

Also Read: Anuj Bajpai, Founder & CEO of Liquide, shares his expert predictions for this interim Budget

Stay ahead in the world of finance with the most relevant business news and market updates. Access in-depth market analysis, expert advice, and real-time updates through the Liquide app. Download it today from the Google Play Store or Apple App Store and begin your journey towards informed and successful investing.