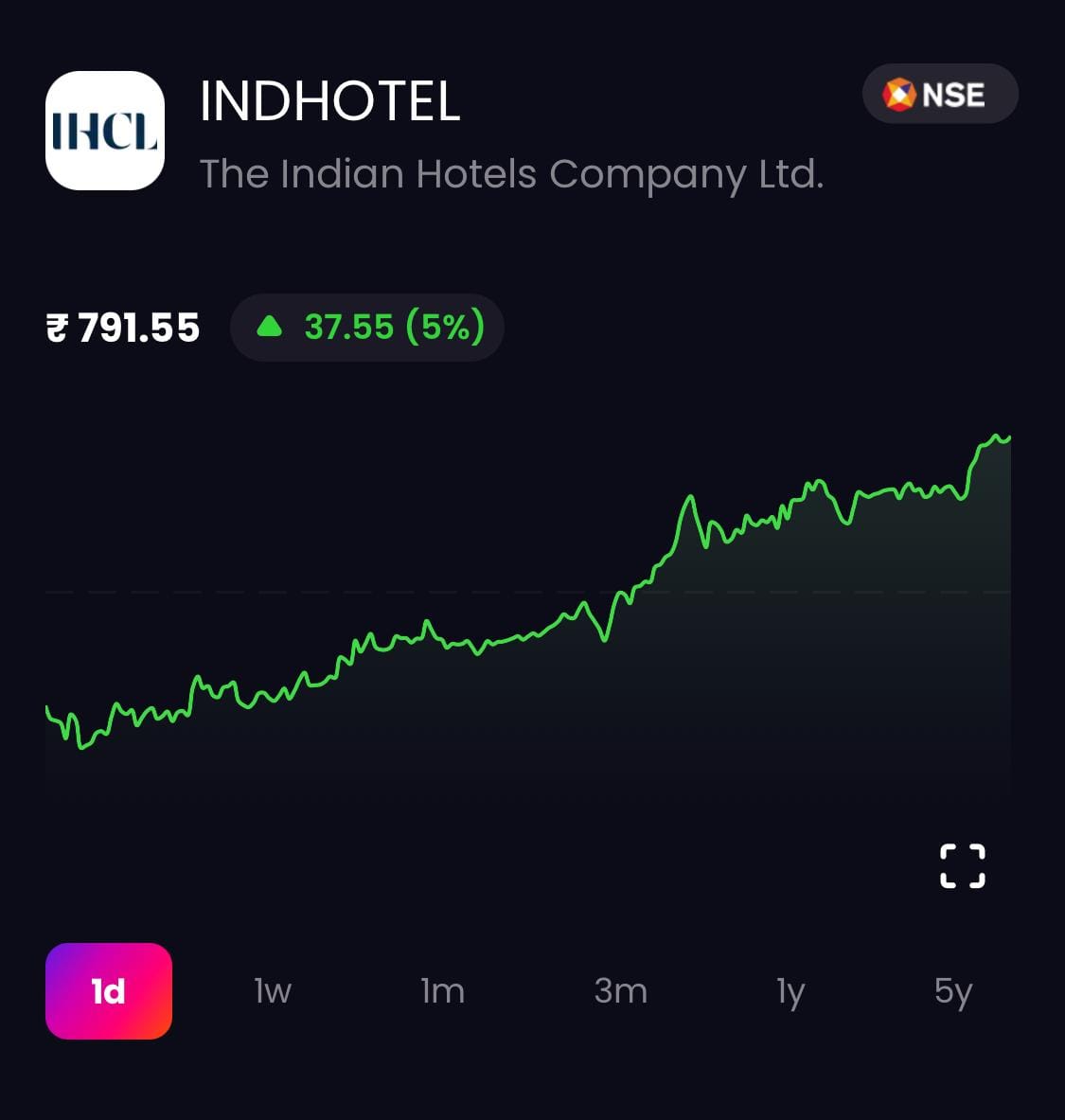

Tata Group Stock Soars 5% To Hit Record High!

Shares of Indian Hotels Company Ltd (IHCL) surge over 5% to hit a new all-time high. Learn about IHCL's ambitious "Accelerate 2030" plan and get expert investment guidance with Liquide.

Stocks in News | On November 21, 2024, Indian Hotels Company Ltd (IHCL) saw its shares soar to a record high of Rs 795, marking a 5% increase. This surge follows the announcement of the company’s bold and forward-thinking long-term strategy, “Accelerate 2030,” designed to solidify IHCL’s position as a leader in India’s rapidly growing hospitality sector.

IHCL’s 'Accelerate 2030' Strategy: A Roadmap to Leadership

As India’s largest hospitality company, IHCL has laid out an ambitious vision for the next decade. The company plans to double its consolidated revenue, expand its hotel portfolio to more than 700 properties, and achieve a 20% return on capital employed by 2030.

With 350 hotels currently operational, IHCL is committed to adding over 350 new properties by 2030, addressing the rising demand in India’s hospitality market.

Key Pillars of IHCL’s ‘Accelerate 2030’ Plan

IHCL’s growth strategy is centred around three key pillars that will drive its expansion and diversification:

- Brand Expansion and Portfolio Diversification

IHCL aims to expand its portfolio by introducing new brands and enhancing its existing offerings, which include iconic names like Taj, SeleQtions, Vivanta, Ginger, and Tree of Life. It plans to strengthen its presence in the luxury and upscale segments with the addition of the ‘The Claridges’ brand.

- Revenue Growth Through Traditional and New Business Models

The strategy envisions a balance of traditional and new revenue streams. Traditional businesses, including revenue per available room (RevPAR) leadership, asset management, and inventory expansion, will contribute 75% of the company’s revenue.

Meanwhile, emerging businesses like Ginger, Qmin, and amã Stays & Trails will contribute the remaining 25%. IHCL projects a compound annual growth rate (CAGR) of 30%+ in these new segments, diversifying and strengthening its overall revenue base.

- Sustainable and Profitable Growth

IHCL is committed to driving sustainable growth and maintaining industry-leading margins. Additionally, it plans to remain net cash positive while investing up to Rs 5,000 crore over the next five years in expansion and innovation to further support its growth trajectory.

A Look at IHCL’s Q2 Financial Performance

IHCL continues to post strong financial results, extending its growth streak for the tenth consecutive quarter. Key highlights from the company’s Q2 results include:

- A 28% year-on-year (YoY) increase in revenue, reaching Rs 1,890 crore.

- A 40% rise in EBITDA, totalling Rs 565 crore, with the EBITDA margin improving by 2.7 percentage points to 29.9%.

- A 232% surge in profit after tax (PAT), totalling Rs 555 crore, largely driven by the consolidation of TajSATS.

- A 16% increase in revenue and a 48% rise in PAT to Rs 247 crore, excluding the consolidation of TajSATS.

Conclusion

IHCL’s impressive financial performance and strong cash flow generation position it well for continued growth. The company’s capital allocation strategy focuses on enhancing its competitive edge and expanding its global footprint.

With a commitment to a healthy balance sheet and a dividend policy that distributes 20-40% of profits to shareholders, IHCL is well-poised to deliver long-term value for its investors.

Expert Stock Investment Advice with LiMo

Should you buy IHCL shares at current levels?

For those seeking expert guidance on stock investments, LiMo, the world's first AI copilot for stock investing, is available exclusively through Liquide. LiMo provides detailed analyses, judgment, and actionable insights based on technical indicators to guide you on when to enter and exit trades.

Start your Investment Journey with Liquide

For an in-depth grasp of the financial markets and potential investment avenues, delve deeper with Liquide. Boasting advanced tools like LiMo and thorough market insights, Liquide equips you with the knowledge to make informed investment decisions. Download the Liquide App now and embark on a journey of informed and successful investing.