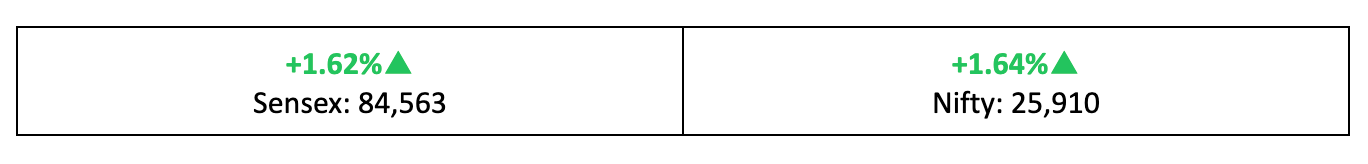

Weekly Recap: Nifty Rallies 1.64% as Bulls Regain Control | Winners, Losers & Outlook

Catch the latest Indian stock market weekly update — Nifty jumps 1.64% as bulls return, volatility cools and sector leaders outperform. See top gainers & losers, FIIs/DIIs flow, Nifty forecast, support & resistance levels and best stocks to watch next week.

Markets broke their two-week losing streak and recorded their strongest weekly gain in the last five months.

Here's our take on this week gone by, some stories you might have missed out on and our thoughts on what to do going ahead, in your weekly report.

Green’s Back!

- The bulls on D-Street had plenty to cheer last week, with the Nifty delivering a strong 1.64% weekly gain over last Friday’s close.

- Within the broader markets, the BSE Large-Cap Index advanced 1.4% and the BSE Mid-Cap Index gained 0.9%, while the BSE Small-Cap Index lagged slightly with a modest 0.15% rise.

- Volatility eased significantly as the India VIX dropped 4.9% through the week, reflecting reduced investor nervousness and suggesting that the near-term trend could remain upward.

The Big Stories

- Global cues remained mixed last week. Optimism around the US government shutdown being resolved was offset by renewed worries about a potential tech and AI bubble, along with fading expectations of an immediate Fed rate cut.

- At home, quarterly earnings continued to drive sentiment, while the Bihar election on Friday captured significant attention, with the NDA securing a decisive win.

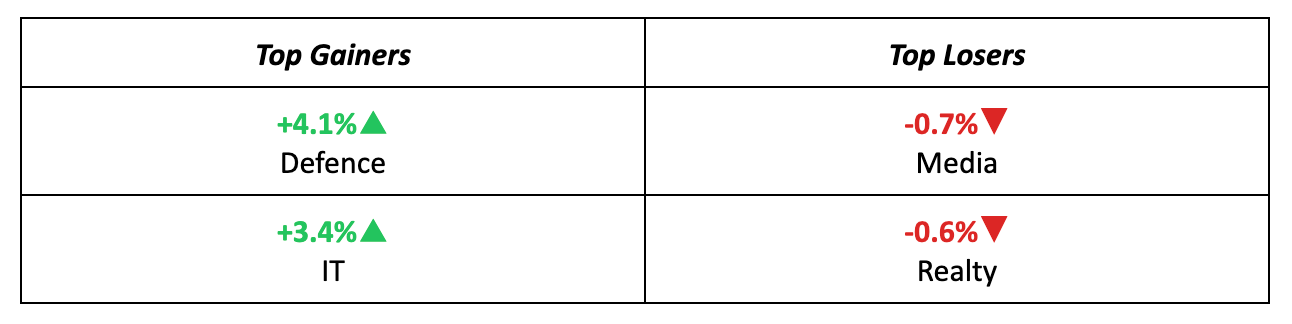

The Winners

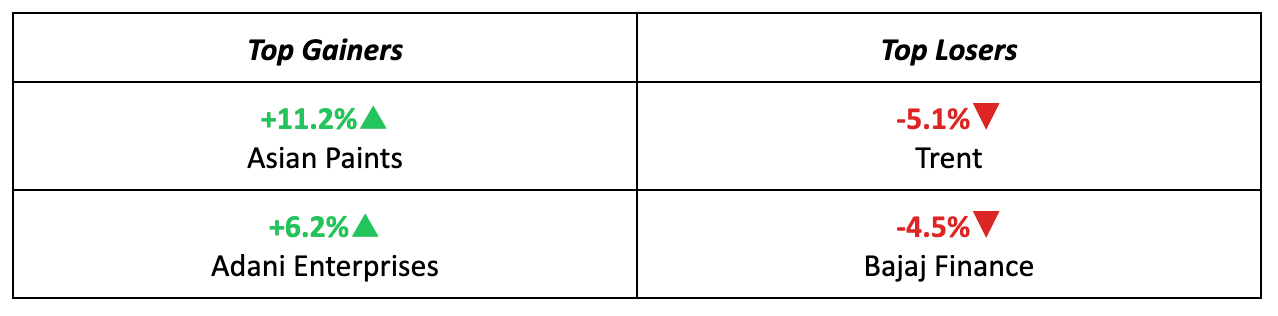

- Asian Paints emerged as the top performer of the week, rallying 11.2% after delivering strong quarterly earnings and volume growth that beat Street expectations.

- Adani Enterprises gained 6.2% for the week, securing the second spot on the leaderboard, buoyed by enthusiasm around its large upcoming rights issue.

The Losers

- Trent declined 5.1% last week, becoming the biggest laggard. The drop followed softer than expected Q2 revenue growth and a series of brokerage downgrades.

- Bajaj Finance slipped 4.5% despite reporting strong profit-after-tax numbers for the quarter, as investor sentiment weakened on heightened NPA concerns.

Meanwhile…

- In the US, recruitment consultancies reported a surge in October job dismissals, marking the highest layoffs for the month in 22 years, signalling potential stress in the labour market.

- At home, inflation eased to its lowest reading since current records began in 2013, dropping to 0.25% in October driven by a sharp decline in food prices.

Market Brief

Market Outlook

Our Take

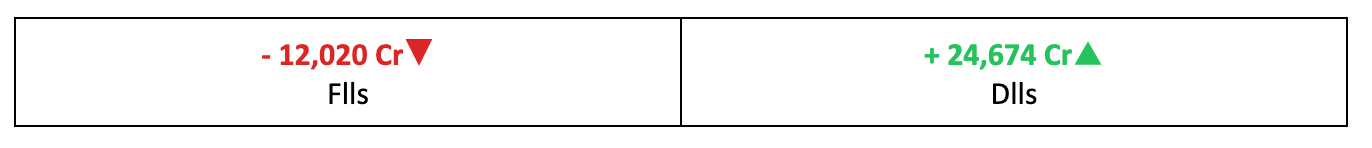

- Market momentum remained strong last week and India Inc’s earnings outlook continues to hold firm, which has revived buying interest on D-Street.

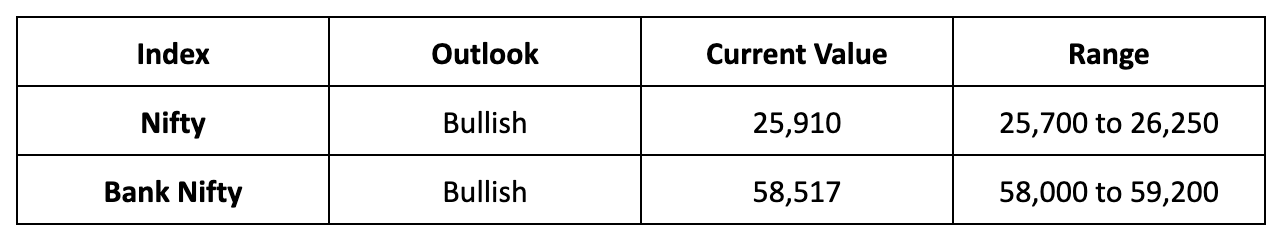

- Unless global cues turn sharply negative, we expect the bullish sentiment to extend into the coming week, with the Nifty likely to trade in the range of 25,700 to 26,250 for the week beginning 17th.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.