Weekly Market Recap: Understanding the Impact of Global Shifts and RBI Decisions on Indian Stocks

Explore our comprehensive weekly market analysis covering key financial stories, top gainers and losers, and insights into future market trends.

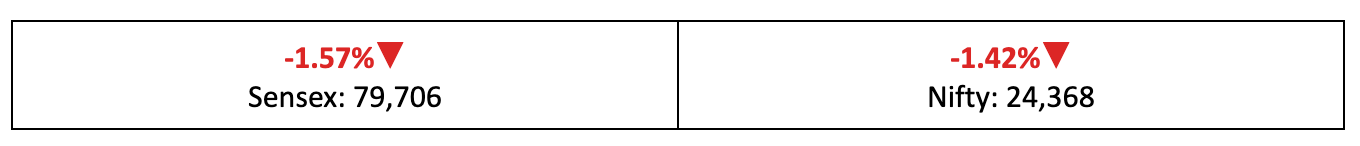

Markets ended lower for the second straight week, with major benchmark indices dropping over 1%. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly report.

Weekly Recap

Week of flux

- It was a highly volatile week for the Nifty, marked by gap-up and gap-down openings, resulting in a 1.42% decline from last Friday.

- The instability was exacerbated by a confluence of global factors stemming from recent events and mixed quarterly earnings. Read more: Decoding the Forces Behind This Week's Market Turbulence

The big stories

- Asian and American markets continued to be nervous about the macroeconomic picture and monetary policy, particularly in the US and Japan.

- Investors at home were also disappointed about the RBI’s hawkish monetary policy stance, which maintained the status quo on policy rates in its August meeting. Read more: Decoding RBI’s Signals in the Latest MPC Meeting!

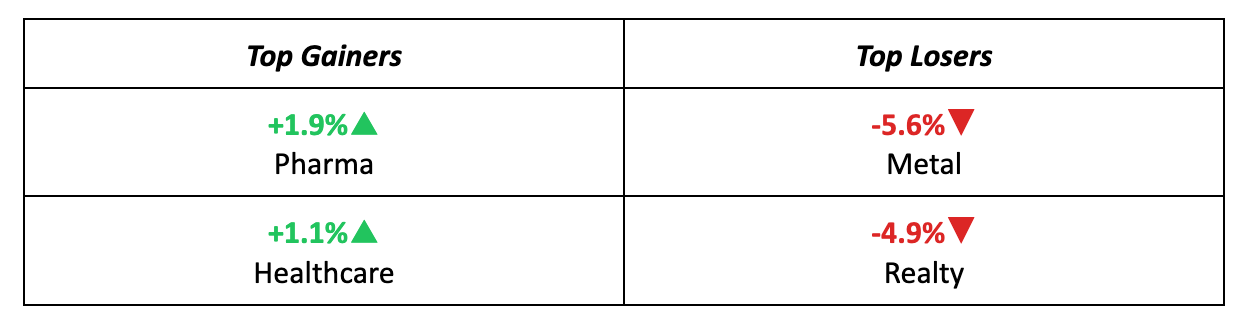

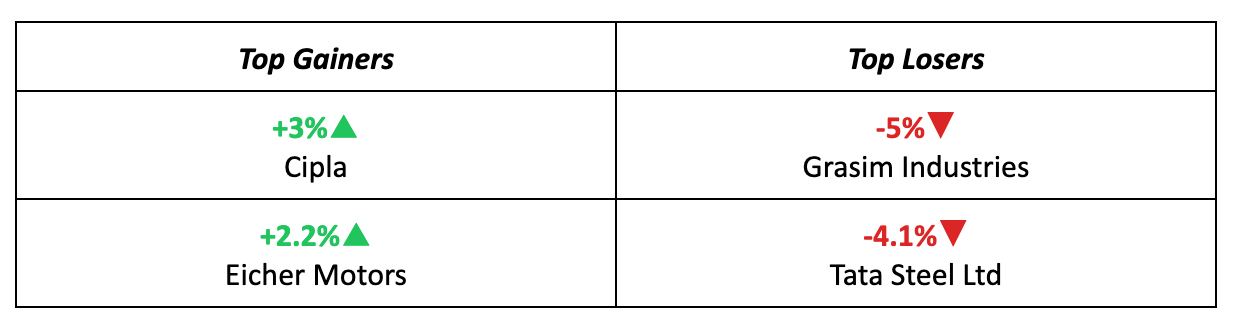

The winners

- Cipla emerged as the week's top gainer, rising by 3% as investors shifted to defensive stocks and responded to the company's robust sales growth in the US market.

- Eicher Motors also performed well, increasing by 2.2% after its Q1 earnings surpassed consensus estimates, though competitive pressures still loom.

The losers

- Grasim Industries led the week's losses, falling by 5% after reporting an unexpected standalone net loss of Rs 52 crore in Q1 and tighter margins.

- Tata Steel, along with other major metal companies, dropped 4.1% due to concerns about manufacturing data from the US and China, making it one of the weakest sectors on the Nifty.

Meanwhile…

- Wall Street may see some relief soon, as the Fed hinted on Friday at possible upcoming rate cuts, and jobless claims dropped more than anticipated.

- Crude oil prices continued to rise last week, buoyed by decreasing US stockpiles and escalating geopolitical tensions in the Middle East.

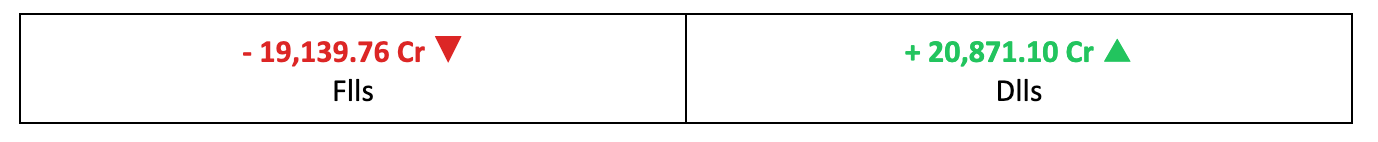

Market Brief

Market Outlook

Our take

- Investors have now turned more cautious, wary over valuations in domestic markets. Earnings and global macro events are likely to shape next week’s trade setup.

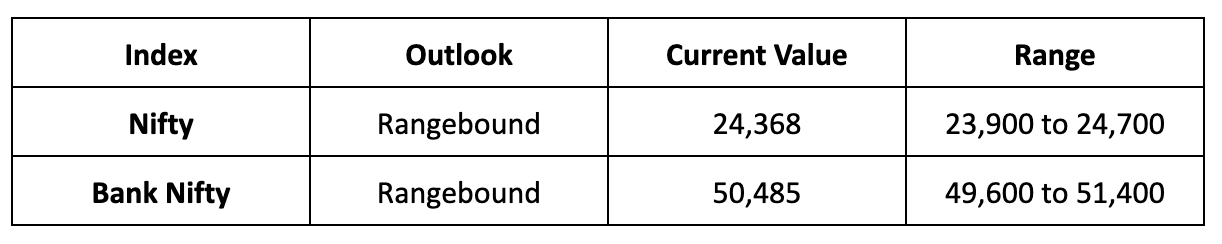

- The Nifty is projected to remain rangebound next week between 23,900-24,700 levels. A breakout from the 24,000-24,400 range could trigger significant momentum, making these levels crucial to monitor.

- It is also recommended to focus on individual stock actions and maintain a selective strategy. Since market movements have been primarily driven by global cues, it's essential to stay updated on those developments as well.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple App Store, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download today and enhance your financial journey with Liquide's cutting-edge features.