Weekly Market Wrap: Nifty Slumps Amid Volatility, Metals Shine

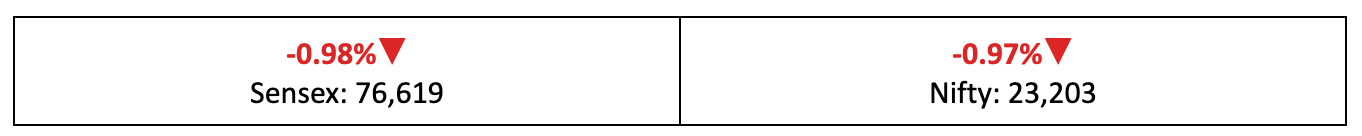

Markets faced a second week of decline with Nifty down 0.97%. Discover key market trends, sector performance, and expert insights in our weekly stock market review.

Markets fell for the second consecutive week, dropping over 3% in the past two weeks. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Weekly Recap

Downward Drift

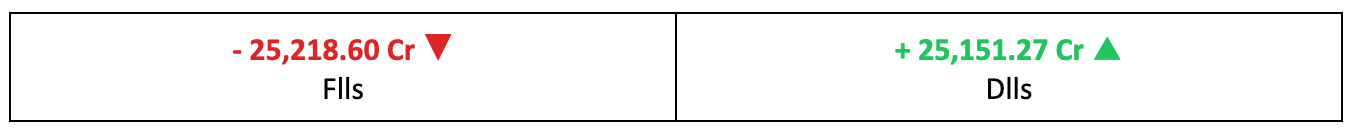

- Staying true to our forecast, the Nifty slipped back into the red last week, weighed down by sustained FII outflows, mixed global cues, a depreciating rupee, and rising crude oil and dollar prices.

- Despite some positive developments compared to the prior week, the Nifty closed 0.97% lower in a week marked by intense volatility.

- Broader indices followed suit, continuing their losing streak for the second consecutive week, with declines ranging between 0.5% and 1%.

Why so gloomy?

- Global market dynamics turned unfavourable for investors here at home, as stronger-than-expected U.S. payroll data dampened hopes for a Fed rate cut.

- Adding to the uncertainty, the upcoming inauguration of the second Trump administration brings concerns of potential trade wars fuelled by tariff policies.

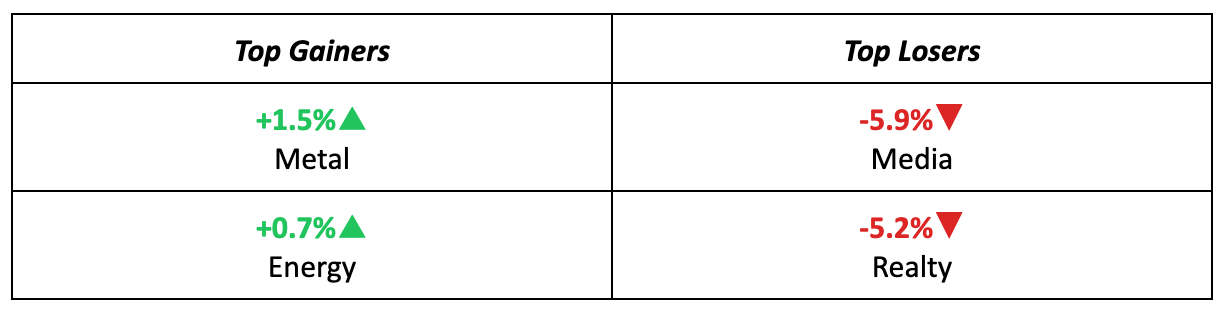

The winners

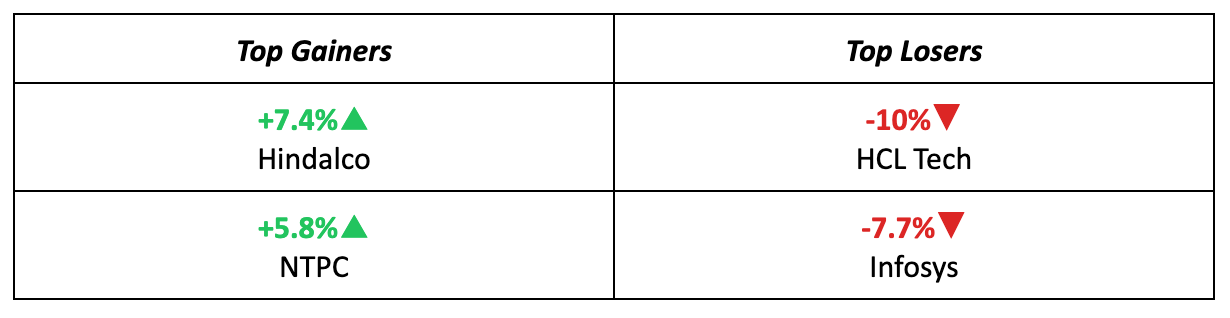

- Hindalco saw a 7.4% rise in its stock price over the week, driven by bullish brokerage calls on Indian metal and mining stocks, along with the allocation of a new coal block in Odisha.

- Energy stocks also performed well, with the sectoral index gaining 0.7% over the week and players like JSW Energy faring well.

The losers

- HCL Tech had a rough week, plunging 10% despite positive Q3 results. The decline was attributed to the scaling down of a planned telecom deal and delays in key projects.

- Similarly, Infosys saw its stock tumble by 7.7%, even after delivering a strong Q3. The drop was driven by concerns about potential de-growth in the upcoming quarter. Read more: Infosys Q3FY25 Results: Profit Climbs 11.6%, Revenue Guidance Raised

Meanwhile…

- Crude oil prices surged to multi-month highs, driven by significant drawdowns in U.S. stockpiles and fresh sanctions on Russia. However, the gains were partially offset by the Israel-Hamas ceasefire agreement.

- Global bond markets also faced turbulence, with yields spiking amid persistent inflation concerns, hitting Britain particularly hard.

Market Brief

Market Outlook

Our Take

- Markets have remained volatile and in the red for two weeks, offering a chance to reassess valuations and opportunities.

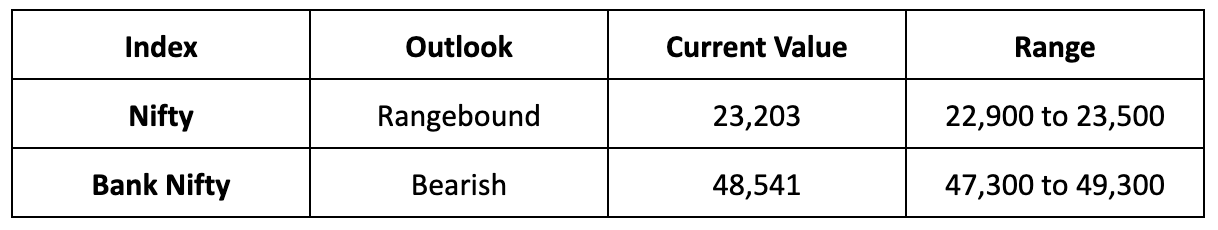

- We believe the worst of the decline is behind us, with the Nifty likely to stay rangebound between 22,900 and 23,500 levels next week. However, stock-specific action could intensify, driven by December quarter earnings updates.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.