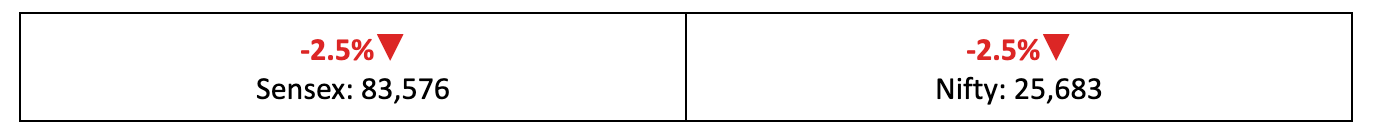

Weekly Recap: Nifty Falls 2.5%, Top Stock Picks & Key Insights

Last week, the markets faced significant volatility with a 2.5% drop, largely driven by geopolitical uncertainties. Get the full market breakdown, top stock winners, losers and expert insights for the week ahead.

Last week saw the markets trending downward, with a fair share of volatility, all against the backdrop of global geopolitical uncertainty.

Here’s a look at the past week, a few stories you might have missed, and our take on what’s next, in your weekly report.

Bumpy Terrain

- The markets slid 2.5%, marking their worst week in over three months, largely due to factors beyond domestic control.

- Broader indices took a hit as well, with the BSE Large Cap index down by 2.5%, BSE Midcap falling 2.6% and the BSE Small Cap seeing a significant drop of 3.9%.

- The India VIX fear gauge spiked 15.6%, reflecting growing nervousness among investors due to geopolitical uncertainties.

The Big Stories

- Market volatility was kicked up largely by the United States’ surprise military move in Venezuela, where it ousted President Nicolás Maduro and signalled it would take a hands‑on role in running the country’s oil sector — including selling Venezuelan crude.

- Trade uncertainty also spiked as investors fretted over the US Supreme Court’s looming review of the legality of President Trump’s sweeping tariffs. With talk of duties as high as 500% on the table and no clear ruling yet, selling pressure intensified across markets.

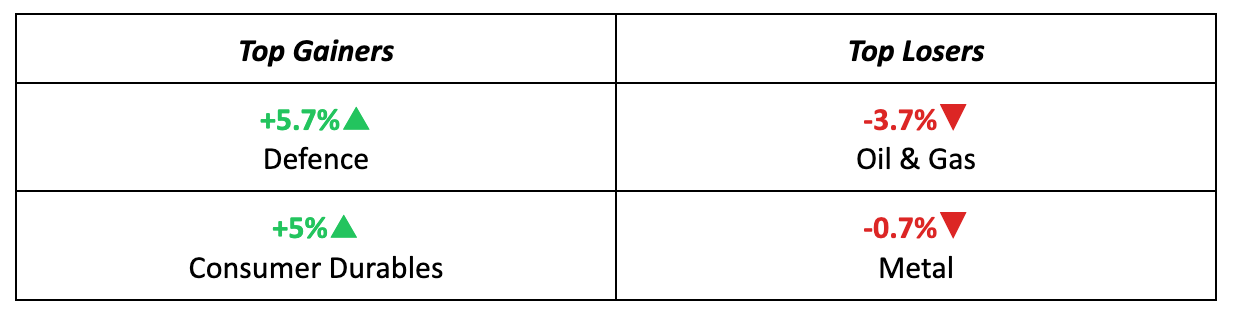

The Winners

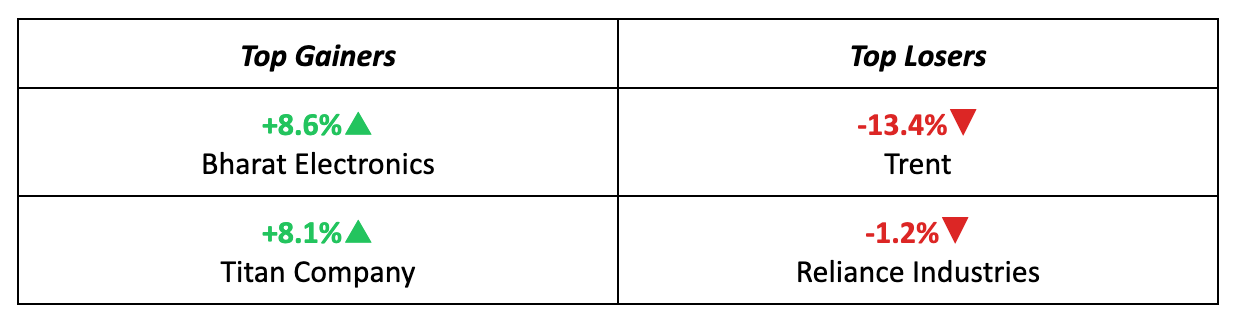

- Leading the charge last week was Bharat Electronics, the defence stock that surged 3.8% after securing orders worth Rs 596 crore in January, bolstering its already strong order book.

- Titan Company wasn't far behind, with a solid 3.7% gain, driven by impressive Q3 results showing a 40% jump in sales for the December quarter.

The Losers

- Trent took a big hit, dropping a staggering 9.9% last week, as worries about slowing growth momentum overshadowed its 17% revenue growth in Q3.

- Reliance Industries also struggled, with a 7.3% loss for investors, driven by profit-booking, geopolitical tensions and uncertainty in the Russian crude oil market.

Meanwhile…

- India’s Services PMI for December eased to an 11-month low of 58, indicating a slowdown as the economy moves into a more normalized phase after a long stretch of strong growth.

- In the US, job creation hit its weakest point since the Covid lockdowns in December, though the unemployment rate saw a small dip to 4.4%.

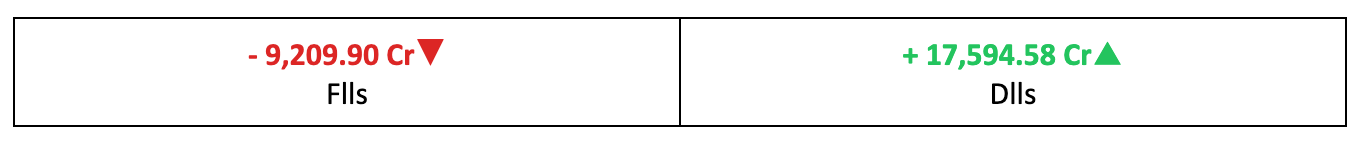

Market Brief

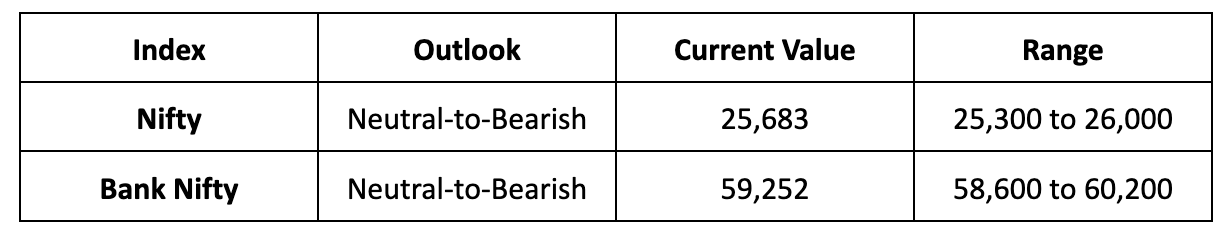

Market Outlook

Our Take

- After a few weeks of upmove in the Nifty, investors appear to be turning cautious, especially in light of global macro and geopolitical uncertainties.

- With these factors still unresolved, we anticipate the Nifty to trend neutral-to-bearish in the coming week, forecasting a trading range between 25,300 and 26,000.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.