Weekly Wrap: US-India Trade Deal & RBI Policy Fuel Markets; IT Stocks Slump

Indian markets closed 1.5% higher, marking a second week of gains as volatility eased. From the RBI’s rate decision to the US-India trade deal and major sectoral moves, explore the top gainers, losers, global triggers and next week’s outlook.

Markets closed the week on a positive note, ending 1.5% higher than last Friday. Explore the biggest developments, overlooked stories, and our outlook for the week ahead in your Weekly Report.

Regaining Ground

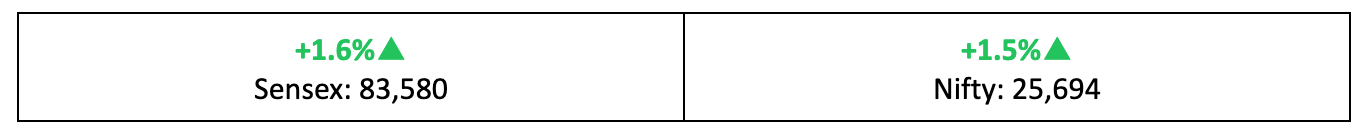

- In the extended Budget week, Indian equity indices built on their momentum, notching a second straight week of gains and closing 1.5% higher.

- Volatility also cooled considerably, as India VIX dropped 12%, signalling improving investor confidence amid evolving market cues.

The Big Stories

- The week both kicked off and wrapped up with big developments at home — from the Budget announcements to the RBI MPC deciding to keep repo rates unchanged at 5.25%.

- Globally, the spotlight was on the newly announced US-India trade deal, bringing tariffs on Indian exports down sharply from 50% to 18%.

The Winners

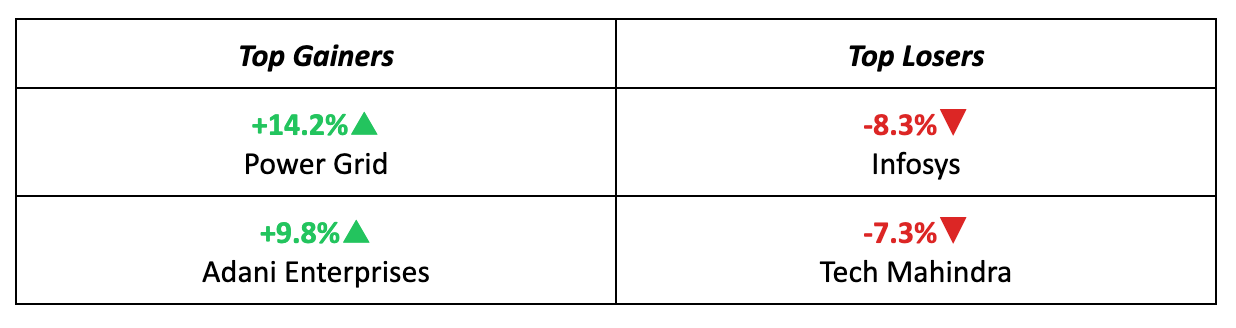

- Power Grid Corporation was the week’s top gainer after announcing higher-than-expected capex, while its Q3 profit also came in ahead of consensus estimates.

- Adani Enterprises followed close behind, with the stock surging 9.8% as brokerages identified group companies as key beneficiaries of the US-India trade deal.

The Losers

- The week’s biggest drags were tech heavyweights Infosys and Tech Mahindra, with Infosys logging its sharpest percentage fall since March 16, 2020.

- Both stocks were swept up in the broader global tech sell-off, as rising concerns around traditional IT services and outsourcing models intensified following rapid advances from Anthropic.

Meanwhile…

- India’s services sector bounced back in January after December saw the slowest expansion in 15 months, echoing a similar pickup in manufacturing activity.

- Oil prices moved higher last week amid escalating US-Iran tensions, as traders grew concerned that talks between the two nations were breaking down — raising the risk of potential military conflict.

Market Brief

Market Outlook

Our Take

- After a volatile week across global markets — especially in tech — investors back home may remain cautious in the near term as they track evolving global cues.

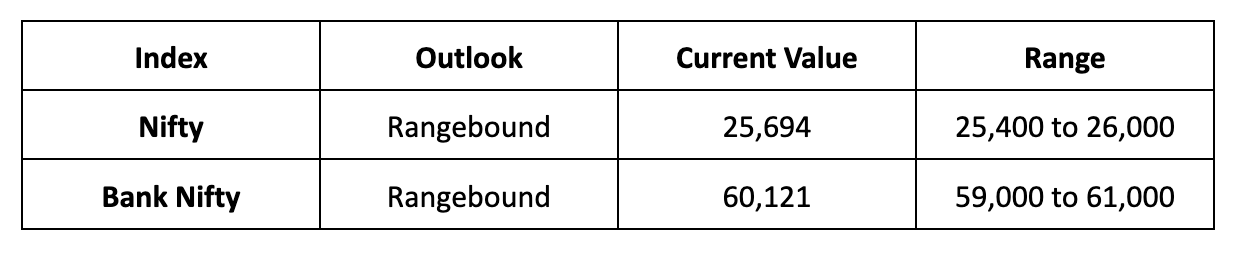

- We expect the Nifty to stay rangebound next week, likely trading between 25,400 and 26,000, with stock-specific moves driven largely by incoming earnings reports.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.