The Whale that Swallowed the World's Silver

India imported nearly 6,000 metric tons of silver in 2025, absorbing almost 25% of global supply. From solar and EV demand to silver ETFs and savings trends, discover why India’s silver buying spree is reshaping global prices and what it signals for silver price predictions in 2026.

In 2025, India didn’t just enter the silver market. It swallowed it. 6,000 metric tons. 190 million ounces. Nearly 25% of global supply — absorbed by one country in one year.

Even more shocking? They did it while the price was rising, not falling. Normally, when prices shoot up, Indian demand drops, since Indians are notoriously price-sensitive. Not this time, though. This time, they didn’t buy the dip, they bought the rip.

Why India’s Silver Demand Is Exploding

India has officially become the world’s top importer of refined silver, with a whopping $9.2 billion worth of silver pouring into the country in 2025, marking a massive 44% jump from the previous year.

At the same time, silver prices in India have skyrocketed, tripling in value over the past year. What started at Rs 80,000-Rs 85,000 per kg in early 2025 has now surged past Rs 2.5 lakh per kg by January 2026.

You might think this is all about a spike in jewellery demand. Sure, India loves its silver jewellery, from anklets to silverware, especially during the wedding season. But 6,000 tons? That’s far beyond jewellery. This is a structural shift in the economy.

This demand is driven by something deeper—a collision between India’s industrial rise and a global monetary panic. So, what’s going on?

Solar Boom

Look closely at India’s solar energy revolution. The government’s Production Linked Incentive (PLI) scheme is pushing the nation to build gigafactories at record speed, gunning for 500 GW renewables by 2030. Now each solar panel consumes about 20 grams of silver paste. But there’s a problem: India doesn’t have its own silver mines. So, every single ounce has to be imported.

Now, imagine an Indian billionaire deciding to build a 10 gigawatt solar factory. What does he do? He doesn’t just buy the machines—he buys the raw materials. And what’s at the top of that list? Silver. He heads straight for the London Bullion Market Association (LBMA) and buys tons of silver bars, which he then stores in his warehouse. Because without that silver, his factory is nothing but a paperweight.

Electronics & EV Push

When it comes to electronics and semiconductors, silver’s the unsung hero. Its top-tier electrical conductivity makes it a must-have in the manufacturing process.

EVs take it further. Silver is crucial for everything from battery connections to thermal management and other key electronic components. With India’s EV and semiconductor markets booming, silver’s role is only going to get bigger.

Silver Shortage & Global Supply Crisis

India sees the writing on the wall. They see China’s export bans and the tightening global silver supply. So, they’re buying up as much silver as possible before the shortage becomes critical. They’re draining the LBMA vaults, buying up silver in bulk and securing their future. This is a calculated move to front-run the inevitable supply crunch.

The numbers tell the story. According to the Silver Institute’s 2025 report, global mined supply barely reached 835 million ounces, while demand surged past 1 billion ounces.

Silver ETFs & the New Age Indian Saver

Now let’s add the monetary lens to this story. The typical Indian saver has always relied on gold for wealth storage. But here’s the problem: gold is getting expensive—currently hovering over $4,500 an ounce. That’s out of reach for most people, especially the working class.

This is where silver steps in. In India, silver is quietly emerging as the new-age savings asset. Once seen as the poor man’s gold, it is now becoming the smart investor’s alternative — affordable, accessible and positioned for long-term demand growth.

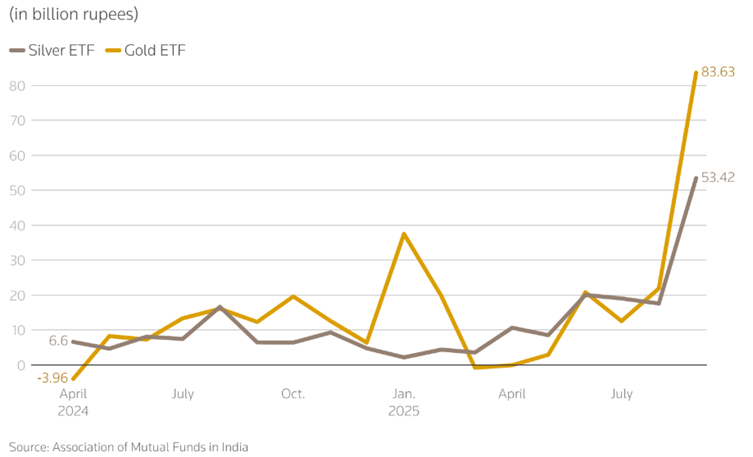

And this shift is being powered by Silver ETFs. In September, inflows into Gold and Silver ETFs surged to record highs, reflecting this changing investor behaviour.

Earlier, investing in silver meant buying physical bars, paying heavy premiums and worrying about storage. But now, thanks to silver ETFs, the middle class can invest in silver from their smartphones. No more dealing with storage or high premiums.

What’s Next? Silver Price Prediction for 2026

As silver prices soar, short-term pullbacks in 2026 are inevitable. Profit-booking, portfolio reshuffles and shifting global growth expectations will create temporary waves. But those are surface ripples. Beneath them lies a deeper current — silver’s irreplaceable role as both a precious store of value and a critical industrial metal.

Add China’s new export licensing rules for large producers to the mix and the global silver deficit could deepen even further. Supply is tightening. Demand is accelerating.

Moreover, silver is emerging as a more affordable alternative to gold for investors seeking stability, especially amid rising geopolitical uncertainties and stock market volatility.

So the real question is not whether silver moves higher — but how far. When the global shortage bites and arbitrage drags the West along, will we finally see triple digits?

Because the whale hasn’t left the ocean. It’s still feeding, and it’s only growing bigger.

Investor Tip: Focus on Asset Allocation, Not Predictions

In an environment filled with uncertainty, the real focus for investors should be on balancing risk and return. Getting asset allocation right matters far more than chasing short-term targets.

If you want to understand how to position your portfolio for the year ahead, do check out our detailed guide on why asset allocation is crucial in 2026.