Weekly Market Recap: Samvat 2081 Starts With Gains Amid Volatility

Samvat 2081 kicks off with a positive start! Dive into our weekly stock market recap to uncover Nifty's performance, top gainers, sector highlights, and an outlook on key events ahead.

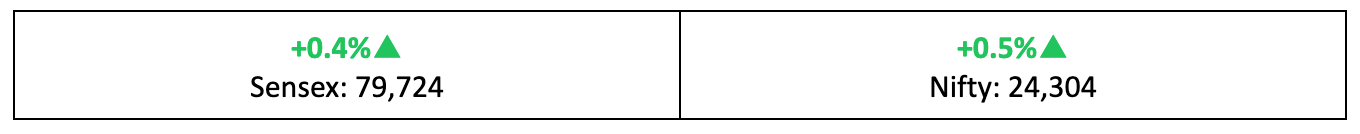

Markets welcomed Samvat 2081 by closing a volatile week in the green, up by 0.51%. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Weekly Recap

All’s well…?

- Samvat 2081 kicked off on a positive note, with the Nifty wrapping up a highly volatile week with a 0.51% gain.

- The India VIX, a measure of market fear, trended upward throughout the week, closing nearly 14% higher, indicating that while the indices cautiously edged up, nerves remain on D-Street.

See-sawing around the world

- Last week saw considerable global anxiety as tech giants drove the S&P 500 and NASDAQ to their worst performance in over a month on Thursday.

- This occurred amid growing concerns about the US election next week, geopolitical risks, and an inflation report for September that met expectations.

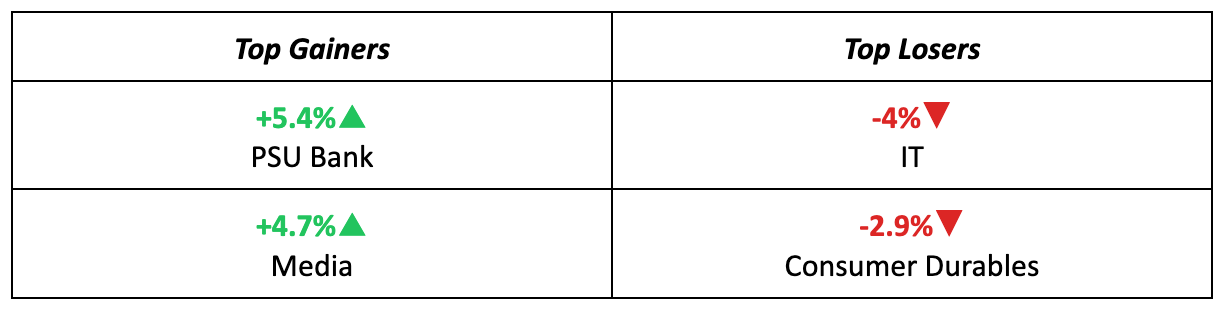

The winners

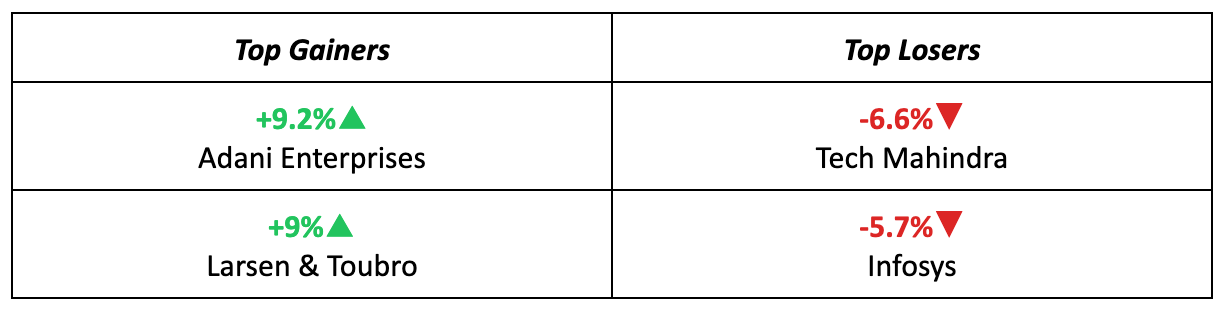

- Adani Enterprises led the pack last week, achieving a substantial 9.2% gain following what it described as a "record-breaking" performance for the September quarter.

- L&T came a close second, jumping 9% due to its September quarter results, which surpassed estimates with robust revenue growth alongside stable operating profit margins.

The losers

- The IT sector emerged as the most notable underperformer, with its sectoral index plummeting by 4%, making it the biggest loser of the week.

- The sector's downturn was led by Tech Mahindra and Infosys, which recorded losses of 6.6% and 5.7%, respectively. Both stocks were adversely affected by forecasts of disappointing cloud revenue and user growth in the near term.

Meanwhile…

- The UK's massive budget announcement saw a significant increase in tax and spending commitments, leading to a noticeable rise in gilt yields subsequently.

- Meanwhile, factory activity in China expanded for the first time since April. Despite this, Asian markets displayed mixed results last week amid expectations that the Bank of Japan will maintain interest rates at 0.25%.

Market Brief

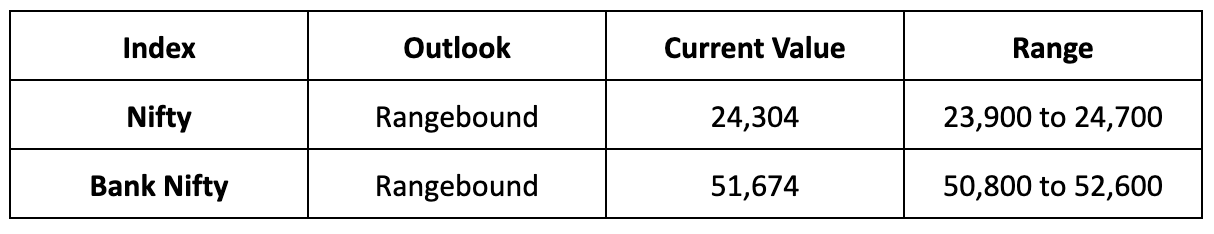

Market Outlook

Our take

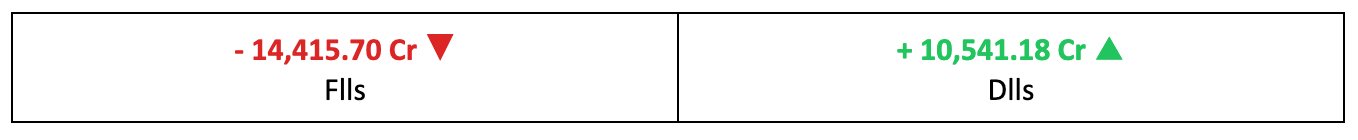

- The steady rise in the India VIX last week shows that investor worries are palpable, and we may not be out of the woods yet as valuation concerns may continue.

- Moreover, investors will closely watch two critical global events next week: the US elections and the Federal Reserve’s decision on interest rates.

- Consequently, we expect the Nifty to be rangebound next week, fluctuating within a trading range of 23,900 to 24,700, with 24,000 as a key level to monitor.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.