Revving Up: India's Auto Sales Zoom Ahead with a 21% Increase in December

Driving Growth: India's auto sales leap 21% in December. Delve into top Automakers' performances and the future prospects of the industry

India’s automobile retail sector experienced a significant growth of 11% in 2023, as reported by the Federation of Automobile Dealers Associations (FADA). This upswing was reflected across all vehicle categories. Sales in the two-wheeler category rose by 9.5%, three-wheelers by 58.5%, passenger vehicles (PVs) by 11%, tractors by 7%, and commercial vehicles (CVs) by 8%.

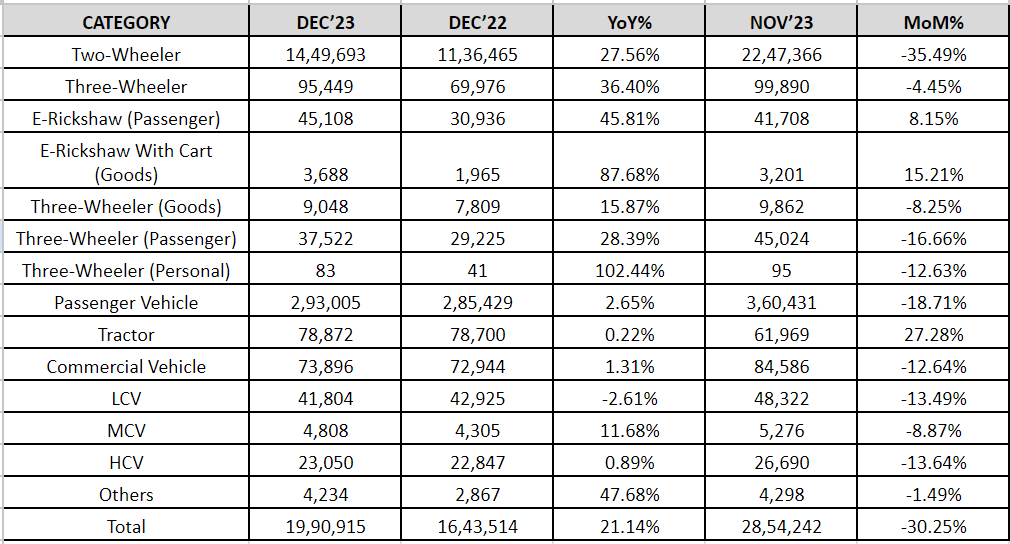

December, particularly, stood out with an impressive 21% surge in auto retail sales, signifying a strong end to the year. In this month alone, sales reached an impressive 1,990,915 units, significantly higher than the 1,643,514 units sold in the same month the previous year. However, the December sales were 30.25% lower compared to November sales of 2,854,242 units. Notably, in this period, the electric rickshaw and tractor segments were the only ones to record growth over the previous month's festive-driven sales.

A Closer Look at the Stats

Source: FADA

Leading Indian Automakers' Performance

Maruti Suzuki, the biggest car manufacturer in India, saw a decline of 6.5% in its domestic passenger vehicle (PV) sales, selling 1,04,778 units in December as opposed to 1,12,010 units in the same month the previous year.

The firm’s overall domestic sales, including passenger vehicles, commercial vehicles, and third-party supplies, dropped by 5.9% to 1,10,667 units from 1,17,551 units.

M&M witnessed a 24% increase in its total domestic PV sales, reaching 35,174 units in December 2023 compared to 28,445 units in December 2022.

In the Utility Vehicles (UV) category, the firm’s domestic sales stood at 35,171 vehicles, marking a 24% growth. Including exports, the total sales were 36,349 vehicles.

Tata Motors saw a 9% rise in its total domestic PV sales, including electric vehicles, with sales reaching 43,470 units in December 2023, up from 40,043 units in December 2022.

Total sales were up 4.7% at 77,855 units as against 74,356 units in the year-ago period.

- Two-Wheelers and CVs

In the two-wheeler segment, Bajaj Auto and TVS Motor recorded a rise in sales, whereas Royal Enfield saw a 4% decrease in its sales for December compared to the previous year.

As for the commercial vehicle market, sales trends were varied throughout the month.

In the tractor industry, both Mahindra & Mahindra and Escorts Kubota reported a 17% drop in sales, each.

Path Ahead

Key factors to observe in FY24 encompass both positive and negative elements. Positive drivers include the forthcoming festive season, stable pricing across various segments, enhanced consumer attitudes in both rural and urban areas leading to a rise in demand for discretionary products, and a relatively low base for some segments. Additionally, the upcoming election is projected to boost spending in the automotive industry. Other factors like beneficial crop pricing and the likelihood of reduced fuel costs are expected to enhance consumer sentiment and stimulate demand.

Conversely, significant headwinds would include the impact from rising interest rates, escalating inflation, heightened competition, and repercussions of a weak global economy leading to a slowdown.

Indian Consumer Sentiment Reaches New Heights

There has been a significant resurgence in Indian consumer sentiment, as evidenced by the CMIE Index of Consumer Sentiments for December 2023. This index has surpassed levels last seen before the COVID-induced lockdown in March 2020, indicating a strong rebound in consumer confidence. This revival points to an optimistic forecast for CY 2024.

Long-Term Outlook: FADA's Perspective

Despite a projected slowdown during the “Kharmas” period (December 16 to January 15), the auto sales outlook remains optimistic. FADA predicts a positive long-term trajectory for retail sales across categories. It foresees a boost in the two-wheeler sector, propelled by the launch of new models, particularly in the first half of the year, and enhanced by an improving economy and increased electric vehicle (EV) penetration. Factors such as reduced fuel costs and payments to farmers are expected to uplift customer sentiments, thereby spurring demand.

In the passenger vehicle sector, continuous launch of new products is expected to drive growth. The industry is optimistic about better vehicle availability and heightened demand, especially with numerous Original Equipment Manufacturers (OEMs) releasing their EVs.

The outlook for the commercial vehicle segment is also positive, driven by projected increases in government spending linked to elections, infrastructure projects, and demands in critical industries such as coal, cement, and iron ore.

Ask LiMo, India’s first-ever AI copilot for stock investing that provides both a judgement and the reasoning behind it. For an in-depth grasp of the financial markets and potential investment avenues, delve deeper with Liquide. Boasting advanced tools like LiMo and thorough market insights, Liquide equips you with the knowledge to make informed investment decisions.

Download the Liquide app now from the Google Play Store or Apple Appstore and embark on a journey of informed and successful investing. Don't miss out on the tools that can shape your financial future.