RBI’s New Credit Norms for Brokers (2026): A Strategic Guide for Investors

RBI’s new framework for bank lending to brokers, effective April 1, 2026, mandates 100% collateral and a 25% cash trap for bank guarantees. We analyse the impact on markets and brokerage stocks like Angel One & BSE.

The Reserve Bank of India (RBI) has announced a major regulatory shift for capital market lending, effective April 1, 2026. Under the revised framework, banks must ensure that all credit facilities extended to stockbrokers and intermediaries are 100% secured by eligible collateral.

This post breaks down the key mandates, the new collateral "haircuts" and what this means for your portfolio.

The Core Mandate: Full Collateralization

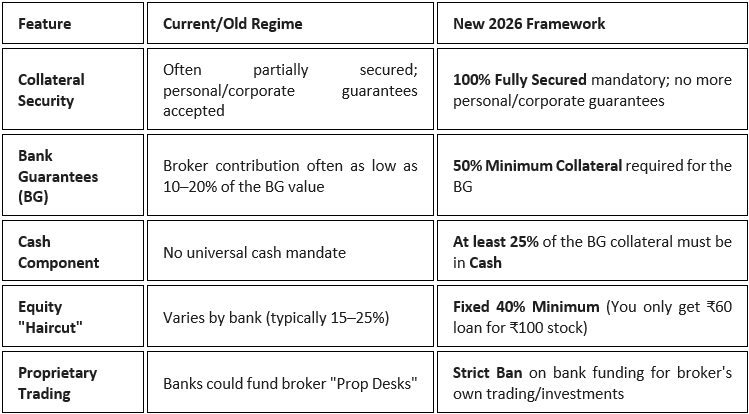

The transition from flexible lending to a strictly fully secured basis is the most significant change. For every rupee lent to a Capital Market Intermediary (CMI), banks must now hold an equivalent amount of high-quality, liquid collateral.

Historically, banks could offer flexible funding lines—sometimes supported by personal or corporate guarantees. From April 2026, those "unsecured" or "partially secured" days are over. Every ₹100 of credit must be matched by ₹100 of tangible, valued collateral.

Stricter Rules for Bank Guarantees (BGs)

Banks providing guarantees to stock exchanges must now implement a "Cash Trap":

- 50% Minimum Collateral: All BGs must be backed by at least 50% collateral.

- 25% Cash Component: At least one-fourth of the total collateral must be in cash.

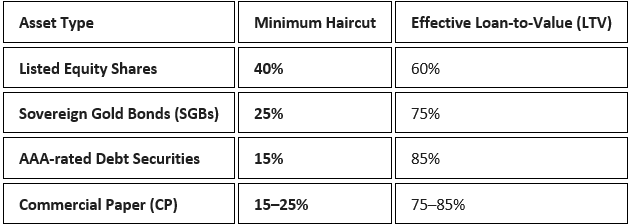

Standardized "Haircuts"

To ensure a safety buffer, the RBI has prescribed uniform "haircuts" (valuation discounts). If you pledge ₹100 worth of shares, the bank will only give you credit for ₹60.

Investor Note: Banks will now monitor collateral values continuously. Banks are required to monitor these values continuously. If market prices drop and the "haircut-adjusted" value falls below the loan amount, brokers will face immediate margin calls to provide more security or reduce their debt.

The "Prop-Desk" Squeeze: Prohibiting Speculative Funding

The RBI has drawn a clear line between market utility and speculation.

- The Ban: Banks are strictly prohibited from financing a broker's proprietary trading or own-account investments.

- The Exception: Banks can still provide working capital for market-making, settlement timing mismatches and Margin Trading Funding (MTF) for clients.

This is designed to prevent "contagion"—where a broker’s bad bet on their own account could jeopardize the bank’s capital.

Market Impact: Who Wins, Who Loses?

The RBI’s announcement on February 16, 2026, sent ripples through Dalal Street, with the Nifty Capital Markets Index underperforming the broader market.

🔴 The Losers: Brokers, Prop-Desks & Arbitrageurs

The immediate reaction was a sharp sell-off in capital market-linked stocks like BSE, Angel One and Groww, as investors priced in higher costs and lower volumes.

- Prop-Trading Squeeze: Proprietary-trading firms, which contribute over 50% of equity options turnover and ~30% of cash trading, will face a massive capital blockage. Under the old system, brokers could secure bank guarantees at just 1–2%, contributing only ₹10–20 crore for a ₹1,000 crore exposure. The new rules require at least 50% cash collateral, sharply raising operational costs.

- Arbitrage & Liquidity Risks: High-frequency traders (HFTs) and arbitrageurs operate on razor-thin margins. A near-100% collateralization could make cash-futures arbitrage and options market-making unviable. This may lead to wider bid-ask spreads and lower price discovery.

- MTF "Non-Starter": The Margin Trading Facility (MTF) business, currently worth ₹1,00,000 crore, is under pressure. While banks can technically fund MTF, the mandate for 50% cash collateral makes it unattractive for brokers to borrow against assets they already own.

🟢 The Winners: Stable Corporates & Tier 1 Banks

While the trading ecosystem feels the heat, the broader corporate landscape sees new doors opening.

- M&A & Takeovers: In a major surprise, the RBI increased the acquisition finance limit to 20% of Tier 1 capital (up from the 10% suggested in earlier drafts). Banks can now fund up to 75% of acquisition costs for stable, profit-making companies.

- Systemic Safety for Banks: By eliminating "unsecured" exposure to a volatile market, banks are now better protected against "Black Swan" events. The risk of a broker’s bad bet causing a banking crisis is now virtually zero.

Comparative Analysis: Pre-2026 vs. New 2026 Norms

To help you visualize the shift, here is how the lending landscape changes on April 1, 2026:

Frequently Asked Questions (FAQ)

- Why is the RBI tightening these lending norms now?

The RBI wants to prevent "systemic contagion." By ensuring broker funding is fully collateralized, a sudden stock market crash won't jeopardize the stability of the lending banks.

- How does this affect brokerage stocks like Angel One or BSE?

The 25% cash mandate for Bank Guarantees "locks up" liquidity, which increases operational costs for brokers. For a broker seeking a Rs 100-crore bank guarantee, this means Rs 25 crore must now be locked away in non-productive cash.

- Will this reduce stock market liquidity?

In the short term, yes. High-Frequency Trading (HFT) and proprietary desks that rely on cheap, semi-secured bank funding will have to scale back. This may lead to wider "bid-ask spreads" in less liquid stocks.

- What does "Haircut" mean in this context?

A haircut is the discount applied to the value of an asset when it is used as collateral. A 40% haircut on shares means if you pledge ₹1,00,000 worth of Reliance or HDFC stock, the bank will only treat it as ₹60,000 worth of security.

- Can brokers still use Bank Guarantees (BGs) for exchange margins?

Yes, but it becomes much more expensive. Under the new rules, a broker must provide the bank with 50% collateral to get a BG, and half of that (25% of the total BG) must be in cash. This "locks up" money that brokers previously used for business expansion.

- Can banks still fund proprietary trading?

No. The new amendments explicitly prohibit banks from financing a broker's own trading (proprietary) positions to prevent banks from indirectly fuelling market speculation.

Subscribe to our blog to stay updated on the latest developments in the financial world.