POST-MARKET SUMMARY 9th September 2025

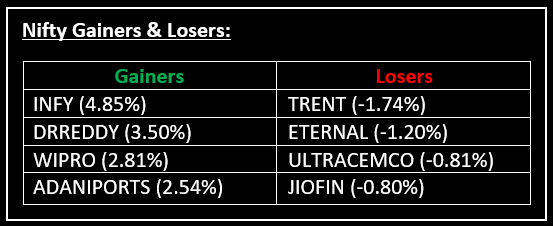

Indian equity indices closed at a two-week high on September 9, with Nifty surpassing 24,850, driven by gains in IT, pharma and FMCG stocks. Top Gainer: INFY | Top Loser: TRENT

Indian equity indices closed at a two-week high on September 9, with Nifty surpassing 24,850, driven by gains in IT, pharma and FMCG stocks. Positive global cues helped the indices open higher and despite some intraday profit-booking, the market held onto its gains. Nifty approached 24,900 during the session before closing near the day's high.

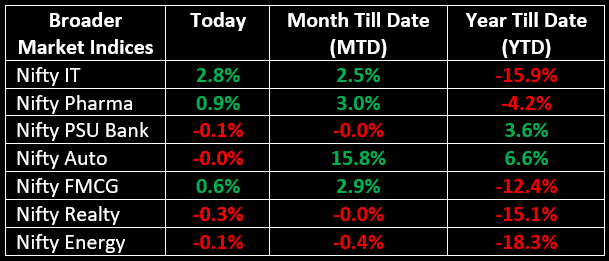

The BSE Midcap and Smallcap indices saw a modest rise of 0.2% each. On the sectoral front, the IT index gained 2.8%, pharma rose by 0.9% and FMCG added 0.6%, while the oil & gas and realty indices dipped by 0.3% each.

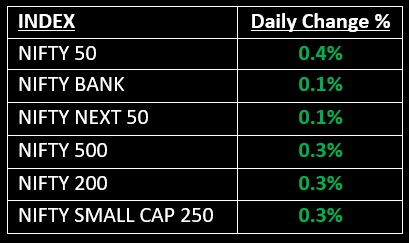

NIFTY: The index opened 87 points higher at 24,864 and made a high of 24,891 before closing at 24,868. Nifty has formed a Doji-like candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,920 while its immediate support is at 24,825.

BANK NIFTY: The index opened 144 points higher at 54,330 and closed at 54,216. Bank Nifty has formed a bearish candlestick with a lower shadow on the daily chart. Its immediate resistance level is now placed around 54,370 while immediate support is around 54,100.

Stocks in Spotlight

▪ Infosys: Stock surged 5% after the IT giant announced that its board will meet on September 11 to consider a buyback proposal.

More details here: Infosys Share Buyback 2025.

▪ Railtel Corporation: Stock jumped over 5% after the company secured multiple orders worth Rs 713.55 crore from the Bihar Education Project Council.

▪ Glenmark Pharmaceuticals: Stock rose over 3% after its subsidiary, Ichnos Glenmark Innovation (IGI), secured $700 million upfront from AbbVie under an exclusive global license for ISB 2001, a trispecific antibody for multiple myeloma.

Global News

▪ Global shares were mixed on Tuesday as attention turned to U.S. economic data due later this week, which may influence the Federal Reserve's decision on interest rates.

▪ Oil prices extended gains, supported by a smaller-than-expected output hike from OPEC+, expectations of continued Chinese oil stockpiling and concerns over potential new sanctions on Russia.

▪ Gold hit a record high, staying above $3,600. The rise was driven by expectations of a U.S. rate cut, which weakened the dollar and lowered bond yields, boosting demand for the precious metal.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.