POST-MARKET SUMMARY 9th February 2024

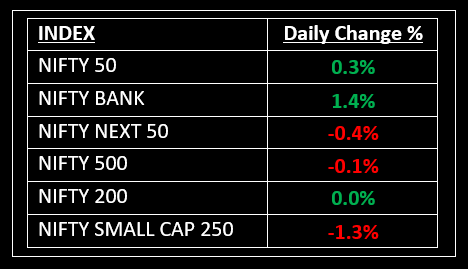

On February 9, equity benchmarks, namely the Sensex and the Nifty, concluded with slight gains amidst a volatile day of trading as investors awaited additional triggers. Top Gainer: GRASIM | Top Loser: M&M

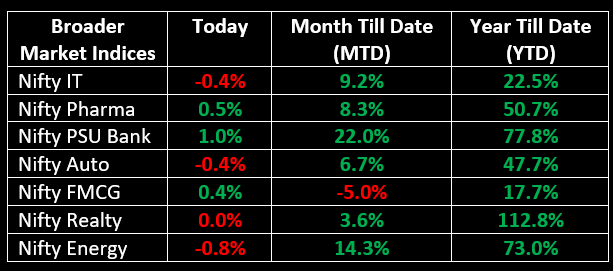

On February 9, equity benchmarks, namely the Sensex and the Nifty, concluded with slight gains amidst a volatile day of trading as investors awaited additional triggers. Banks witnessed purchasing during declines, whereas the metals and realty sectors experienced selling pressure. The sectoral landscape displayed a mixed performance. Following a day of substantial selling, Nifty Bank regained buyers, surging by 1.38%. This was trailed by an approximately 1% increase in Nifty Healthcare and a 0.5% uptick in Nifty Pharma.

NIFTY: The index opened flat at 21,727 and made a high of 21,804 before closing at 21,782. Nifty has formed a bullish candlestick with a lower shadow on the daily chart. Its immediate resistance level is now placed at 21,835 while immediate support is at 21,700.

BANK NIFTY: The index opened flat at 44,986 and closed at 45,634. Bank Nifty has formed a long bullish candlestick on the daily chart. Its immediate resistance level is now placed at 45,900 while support is at 45,450.

Stocks in Spotlight

▪ Torrent Power: Stock went down 2.6% a day after the company reported a 47% year-on-year decline in Q3 net profit hit by lower topline and dismal operating numbers with higher fuel cost.

▪ Bharti Airtel: Stock plunged 1.94% after the cabinet approved spectrum auctions in eight bands for mobile phone services.

▪ Biocon: Stock fell 3% even after the company reported profits in the December quarter.

Global News

▪ The pan-European Stoxx 600 was up 0.1% in early afternoon deals, with sectors trading in mixed territory. Tech stocks were 1% higher, while food and beverage dropped 1.1%.

▪ Gold prices were subdued on Friday, hurt by a stronger dollar and higher Treasury yields, while investors looked ahead to next week’s U.S. inflation reading for clues on when the Federal Reserve could begin cutting interest rates.

▪ The dollar headed for a fourth weekly gain on Friday, pushing the yen to a 10-month low, as traders dialed back bets on how quickly the Bank of Japan might raise interest rates and how soon the Federal Reserve will cut them.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.