POST-MARKET SUMMARY 9th December 2024

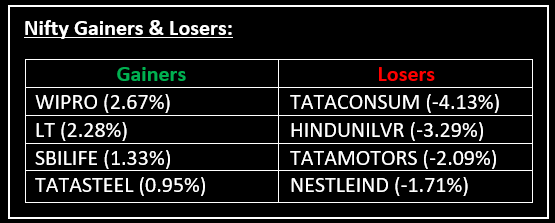

On December 9, the Indian equity markets traded in a narrow range and ended lower for the second consecutive session amid selling pressure. Top Gainer: WIPRO | Top Loser: TATACONSUM

On December 9, the Indian equity markets traded in a narrow range and ended lower for the second consecutive session amid selling pressure. FMCG and media sectors fell 2% each, while pharma, PSU Bank, auto, and energy dipped 0.5% each. In contrast, the metal sector rose 0.6%, and consumer durables added 0.5%.

NIFTY: The index opened 34 points lower at 24,633 and made a high of 24,705 before closing at 24,619. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,670 while immediate support is at 24,550.

BANK NIFTY: The index opened 129 points lower at 53,380 and closed at 53,407. Bank Nifty has formed a gravestone doji kind of candlestick pattern on the daily chart. Its immediate resistance level is now placed around 53,700 while immediate support is around 53,250.

Stocks in Spotlight

▪ Star Health & Allied Insurance: Stock tanked over 4% after it received a Show Cause Notice from the Insurance Regulatory & Development Authority of India (IRDAI) for non-compliance with various IRDAI regulations and guidelines.

▪ CEAT: Stock jumped over 10% after the company announced a $225 million all-cash deal to acquire Michelin's Camso Off-Highway construction equipment tyre and tracks business.

▪ Roto Pumps: Stock closed 8% higher after the company secured major orders for its Solar Submersible Pumping Systems across Australia, South Africa, and the Indian states of Chhattisgarh and Maharashtra. Also read: Small-Cap Stock Surges 13.5% on 400+ Major Orders

Global News

▪ The pan-European Stoxx 600 edged higher on Monday as investors reacted to geopolitical tensions in the Middle East following the ousting of Syrian President Bashar al-Assad. Attention also remains on the European Central Bank, expected to cut interest rates again this week.

▪ Gold prices climbed 1% on Monday as China’s central bank resumed gold purchases after a six-month pause, while expectations for an interest rate cut at the Federal Reserve’s meeting next week strengthened.

▪ Oil prices climbed over 1% on Monday as top importer China flagged its first move toward a loosened monetary policy since 2010 aiming to bolster economic growth.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.