POST-MARKET SUMMARY 8th September 2025

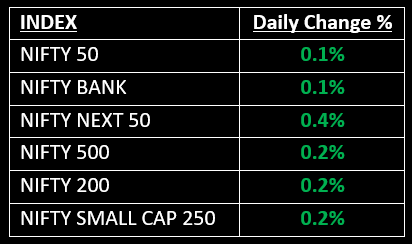

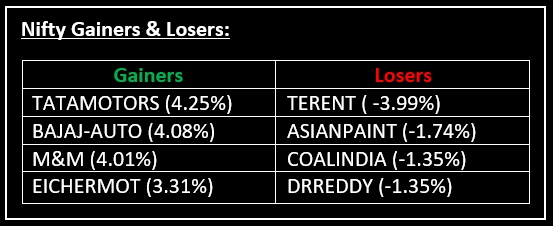

Indian indices struggled to maintain their intraday gains and ended marginally higher in a volatile session on September 8, with Nifty closing above 24,750. Top Gainer: TATAMOTOTS | Top Loser: TERENT

Indian indices struggled to maintain their intraday gains and ended marginally higher in a volatile session on September 8, with Nifty closing above 24,750. The session started positively, with the benchmark indices extending their gains as the day progressed. Nifty reached a high of 24,885.50, but profit-booking in the final hour erased most of the gains, leaving the index to close near its lows.

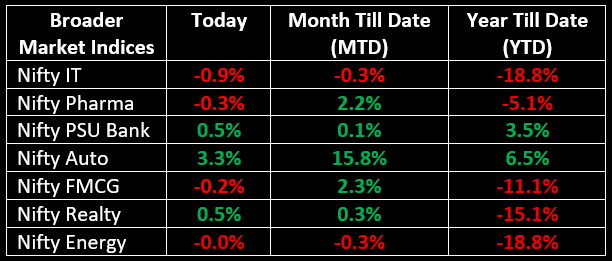

Among broader indices, the BSE Midcap and Smallcap indices rose by 0.3% each. On the sectoral front, the Auto index surged 3.3%, while Realty, Oil & Gas, PSU Banks and Metals gained between 0.25% and 0.5%. The IT index, however, shed 0.9%.

NIFTY: The index opened 61 points higher at 24,802 and made a high of 24,885 before closing at 24,773. Nifty has formed a small bearish candle with a long upper shadow on the daily chart. Its immediate resistance level is now placed at 24,855 while its immediate support is at 24,730.

BANK NIFTY: The index opened 101 points higher at 54,215 and closed at 54,186. Bank Nifty has formed a Doji-like candlestick pattern on the daily chart. Its immediate resistance level is now placed around 54,550 while immediate support is around 54,070.

Stocks in Spotlight

▪ Servotech Renewable Power System: Stock surged nearly 6% after the company entered into an exclusive partnership with China’s Zhuhai Piwin for Battery Energy Storage Systems in India.

▪ Adani Power: Stock jumped nearly 4% after the company signed a pact with Druk Green Power Corporation to develop a 570 MW hydroelectric project in Bhutan.

▪ JSW Steel: Stock rose over 2.5% following the company’s August business update, showing a 17% YoY growth in crude steel production to 27.03 lakh tonnes.

Global News

▪ Major global stock markets edged higher on Monday, buoyed by rising expectations of a U.S. Federal Reserve rate cut this month, after U.S. job growth weakened sharply in August.

▪ Oil prices climbed over $1 on Monday, recovering some of last week's losses. This rise was attributed to OPEC+'s modest output hike and concerns about potential additional sanctions on Russian crude.

▪ Gold prices crossed $3,600 on Monday, setting another record high as expectations of U.S. interest rate cuts and concerns about central bank independence fuelled a sharp rally in the safe-haven metal.

Also read: "Is Gold the New Treasury?" A 30-year record has just been broken — full story inside!

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.