POST-MARKET SUMMARY 8th November 2024

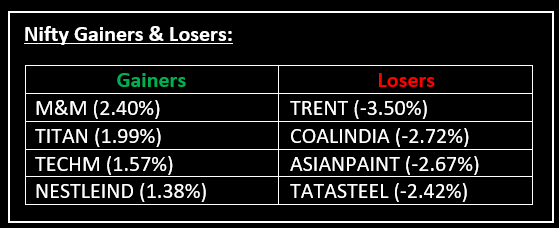

On November 8, Indian equities closed lower for the second straight session, moving against positive global market trends despite a quarter-point rate cut by the US Federal Reserve. Top Gainer: M&M | Top Loser: TRENT

On November 8, Indian equities closed lower for the second straight session, moving against positive global market trends despite a quarter-point rate cut by the US Federal Reserve. Also read: How Trump's Win and Fed’s Rate Cut Affect Indian Markets

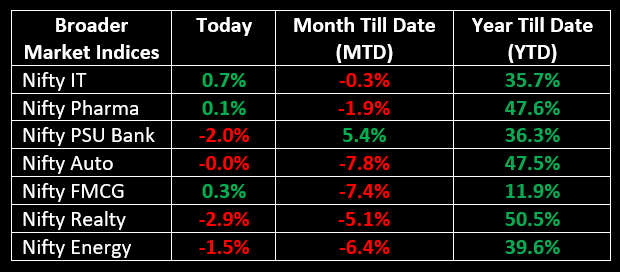

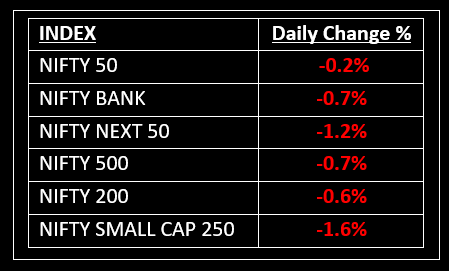

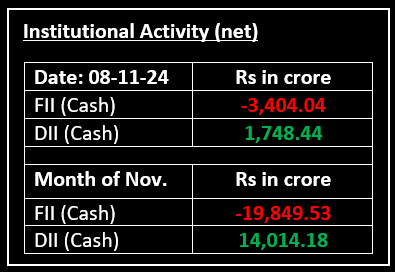

The Sensex fell 55.47 points, or 0.07%, to 79,486.32, while the Nifty declined 51.15 points, or 0.21%, to end at 24,148.20. Among sectors, the IT index rose by 0.7%, whereas media, PSU banks, metals, oil & gas, power, and realty sectors recorded declines of 1% to 2%.

NIFTY: The index opened flat at 24,207 and made a high of 24,276 before closing at 24,148. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,200 while immediate support is at 24,040.

BANK NIFTY: The index opened 47 points lower at 51,869 and closed at 51,561. Bank Nifty has formed a bearish candlestick pattern on the daily chart. Its major resistance level is now placed at 52,000 while major support is at 51,400.

Stocks in Spotlight

▪ Indian Hotels Company: Stock surged nearly 7% as investors welcomed strong Q2 earnings. The company posted a 232% YoY rise in net profit to Rs 554.6 crore, with operating revenue up 27% to Rs 1,826 crore.

▪ Waaree Energies: Stock fell over 6% due to concerns over a potential decline in renewable energy exports to the US under Donald Trump’s presidency.

▪ Indigo Paints: Stock plunged 6% after the company's profit declined by 7.7% year-over-year in the September quarter.

Global News

▪ Oil prices fell on Friday on receding fears over the impact of Hurricane Rafael on oil and gas infrastructure in the U.S. Gulf while investors also weighed up fresh Chinese economic stimulus.

▪ Gold prices eased on Friday but remained near the $2,700 level, as traders evaluated potential implications for the U.S. interest rate outlook.

▪ The dollar took a breather on Friday, on track to cap off a wild week with a slight gain as markets weighed the impact of Donald Trump’s impending return to the White House and what that would mean for the U.S. economy and its rate outlook.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.