POST-MARKET SUMMARY 8th May 2025

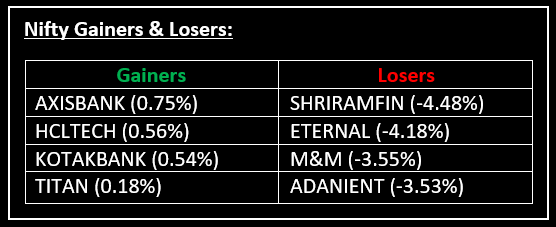

On May 8, Indian equity indices closed lower as investors remained concerned about escalating tensions between India and Pakistan following the neutralization of an air defence system in Lahore. Top Gainer: AXISBANK | Top Loser: SHRIRAMFIN

On May 8, Indian equity indices closed lower as investors remained concerned about escalating tensions between India and Pakistan following the neutralization of an air defence system in Lahore. The US Federal Reserve chief's comments on rising inflation and labour market risks, which could affect economic growth in the US, further dampened investor sentiment.

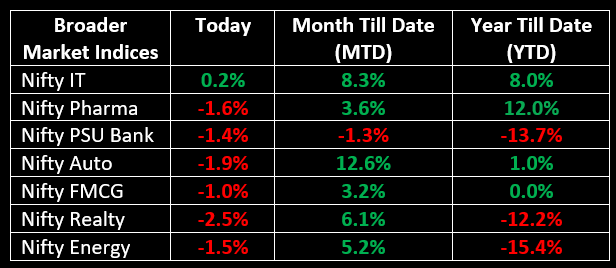

Most sectoral indices ended in the red, with metal, oil & gas, pharma, PSU Bank, auto, consumer durables and realty all down by 1-2%. Only IT and Media sectors showed an upmove.

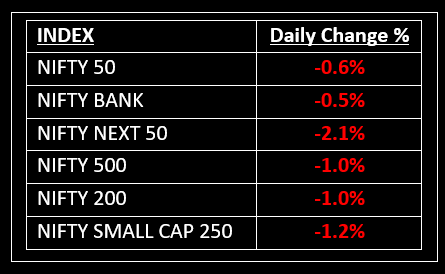

NIFTY: The index opened flat at 24,431 and made a high of 24,447 before closing at 24,273. Nifty has formed a bearish candle on the daily chart. Its major resistance level is now placed at 24,360 while its critical support is at 24,100.

BANK NIFTY: The index opened 191 points higher at 54,801 and closed at 54,365. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 54,600 while immediate support is around 54,000.

Stocks in Spotlight

▪ Coal India: Stock jumped 3% intraday, following the announcement of a solid performance for the March quarter (Q4FY25). Net profit climbed 12% to Rs 9,604 crore while margin expanded to 31.2% from 29.8% in the year-ago quarter.

▪ Niva Bupa: Stock surged 15%, reaching a four-month high, following the release of strong Q4 results that exceeded market expectations. Net profit jumped 31% to Rs 206 crore while net premium written grew 21% YoY to Rs 1,672 crore.

▪ Canara Bank: Stock gained nearly 3% after the bank reported a 33% jump in net profit to Rs 5,002.7 crore while net interest income climbed 1.4% YoY to Rs 9,442 crore.

Global News

▪ European markets inched higher on Thursday, buoyed by U.S. President Donald Trump’s announcement of a potential trade deal with the UK. Europe’s major stock indices approached recent highs, with Germany’s export-driven DAX showing a possible gain of over 1%, though the outcome remains uncertain.

▪ U.S. stock futures also rose on Thursday, with contracts for all three major indices climbing. Investors reacted positively to President Trump's trade deal announcement with the UK, ahead of a news conference scheduled later in the day.

▪ Gold continued its downward trajectory, falling to around $3,330 per ounce on Thursday. The decline was attributed to a cautious outlook on U.S. interest rates, which reduced the appeal of the non-yielding asset.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.