POST-MARKET SUMMARY 8th January 2025

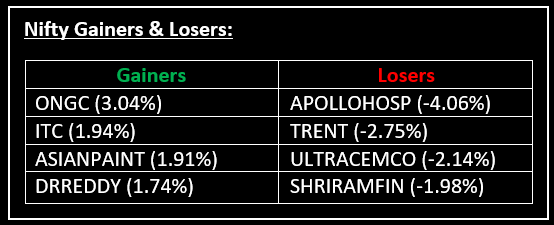

On January 8, Indian equity indices managed to recover most of their intraday losses, ending the session nearly flat, thanks to a sharp rebound in the second half driven by buying in heavyweights. Top Gainer: ONGC | Top Loser: APOLLOHOSP

On January 8, Indian equity indices managed to recover most of their intraday losses, ending the session nearly flat, thanks to a sharp rebound in the second half driven by buying in heavyweights. Despite weak global cues, the market opened higher but struggled to sustain gains, trading lower for most of the day. However, last-hour buying helped erase the losses.

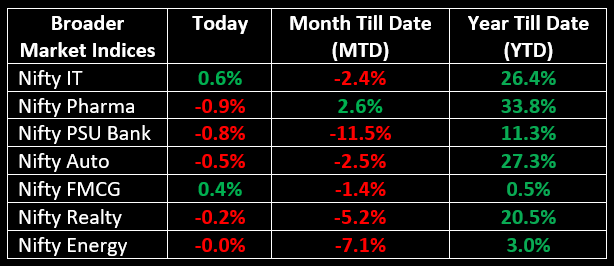

Sectorally, FMCG, oil & gas, and IT rose between 0.3% and 1.5%, while PSU bank, pharma, metal, media, banking, and auto sectors declined by 0.4% to 1%.

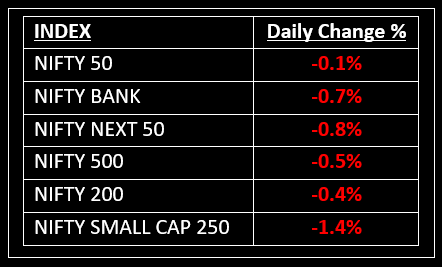

NIFTY: The index opened 39 points higher at 23,746 and made a high of 23,751 before closing at 23,688. Nifty has formed a hammer candlestick pattern on the daily chart. Its major resistance level is now placed at 23,800 while major support is at 23,550.

BANK NIFTY: The index opened flat at 50,201 and closed at 49,835. Bank Nifty has formed a hammer like candlestick pattern on the daily chart. Its immediate resistance level is now placed around 50,000 while immediate support is around 49,600.

Stocks in Spotlight

▪ Borosil Renewables: Stock was locked in the 5% upper circuit after the promoter increased stake in the company from 3.57% to 3.64%.

▪ One97 Communications: Stock fell over 8% after the release of a UBS report stating that Paytm did not gain any UPI market share in December, according to NPCI data.

▪ Suven Life Sciences: Stock jumped over 11% after the company announced the commencement of Phase 1 clinical trials in the USA for SUVN-I6107, a drug targeting cognitive disorders.

Global News

▪ European markets edged lower on Wednesday by afternoon after preliminary data showed that the regional economic sentiment had dropped in December.

▪ The British pound fell to $1.234, its lowest level since April 2024, as a stronger US dollar overshadowed elevated UK borrowing costs, which are near their highest in 27 years.

▪ The yield on the US 10-year Treasury note rose for a fourth consecutive session to 4.73% on Wednesday, its highest since October 2023, driven by concerns over inflationary policies from the incoming Trump administration and reduced expectations of further Fed rate cuts.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.