POST-MARKET SUMMARY 8th February 2024

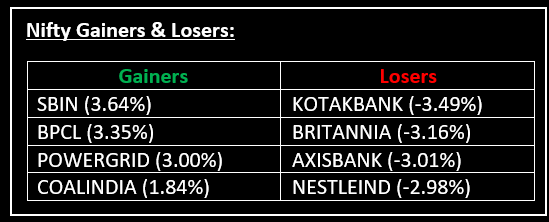

On February 8, the Indian equity benchmarks closed significantly lower after the Reserve Bank of India (RBI) decided to maintain key interest rates unchanged. Top Gainer: SBIN | Top Loser: KOTAKBANK

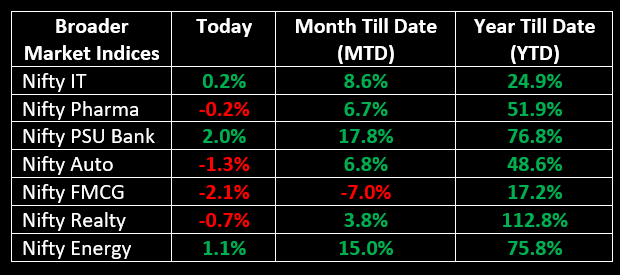

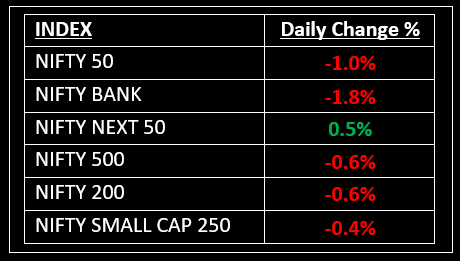

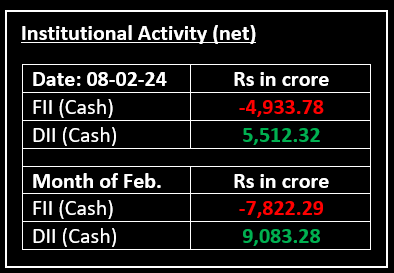

On February 8, the Indian equity benchmarks closed significantly lower after the Reserve Bank of India (RBI) decided to maintain key interest rates unchanged. Over the past few weeks, the market has experienced fluctuations within a certain range, leading investors to exercise caution. While broader markets also ended lower, they managed to outperform the benchmarks. The sectoral matrix displayed a mixed performance. The Nifty Private Bank suffered the most, dropping by 2.59%, while the Nifty FMCG declined slightly over 2% due to selling pressure in ITC. Both the Nifty Financial Services and Nifty Auto sectors were notable losers. On the positive side, the Nifty PSU Bank emerged as the top gainer, rising by 2%, followed by Nifty Media with gains of approximately 2%. Additionally, Nifty Oil & Gas registered an increase of about 1%.

ALSO READ: Steady RBI Rates, Unsteady Markets | Explore the disconnect

NIFTY: The index opened 79 points higher at 22,009 and made a high of 22,011 before closing at 21,717. Nifty has formed a bearish candlestick on the daily chart. Its immediate resistance level is now placed at 21,830 while immediate support is at 21,650.

BANK NIFTY: The index opened 155 points higher at 45,973 and closed at 45,012. Bank Nifty has formed a long bearish candlestick on the daily chart. Its immediate resistance level is now placed at 45,500 while support is at 44,900.

Stocks in Spotlight

▪ ITC: Stock fell 4% after its largest shareholder, British American Tobacco (BAT), said it was working towards completing the regulatory process to pare its stake in the diversified conglomerate.

▪ Cummins India: Stock surged 8% after the company reported impressive earnings for the quarter ended December 2023.

▪ Kalyan Jewelers: Stock surged 4.5% after a 4.63% stake in the company changed hands in eight block deals on February 8.

Global News

▪ Gold prices steadied on Thursday as a pushback from U.S. Federal Reserve officials on market hopes for early interest rate cuts offset safe-haven demand after Israel rejected a ceasefire offer from Hamas amid continuous talks to end the Gaza conflict.

▪ U.S. Treasury yields were little changed as investors considered remarks from Federal Reserve officials about the path ahead for interest rate cuts.

▪ Japan’s Nikkei led gains in Asia-Pacific markets on Thursday, hitting fresh 34-year highs, after a report suggested the country’s central bank would not aggressively tighten its monetary policy.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.