POST-MARKET SUMMARY 7th January 2025

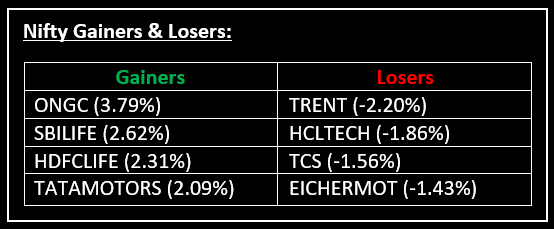

On January 7, Indian equity indices recovered some of their previous session losses and ended the day on a positive note in a volatile trading session. Top Gainer: ONGC | Top Loser: TRENT

On January 7, Indian equity indices recovered some of their previous session losses and ended the day on a positive note in a volatile trading session. The market opened strongly, supported by positive global cues, and extended gains through the day. However, profit booking in the second half pared some of the intraday gains, with investors appearing cautious at higher levels.

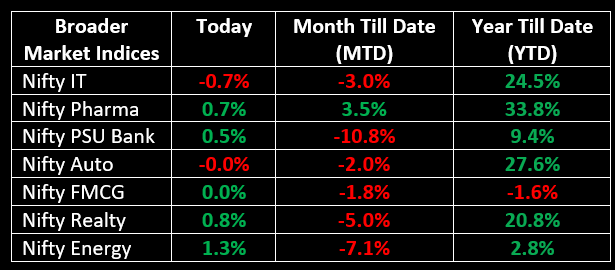

The rebound was driven by supportive global cues and diminishing concerns over the HMPV virus. Among sectors, all indices except IT ended higher, with oil & gas, realty, energy, banking, metal, and pharma sectors gaining between 0.5% and 1%.

Meanwhile, in the primary market, the grey market premium (GMP) for Quadrant Future Tek’s IPO surged to 72%. Get exclusive insights on the IPO here.

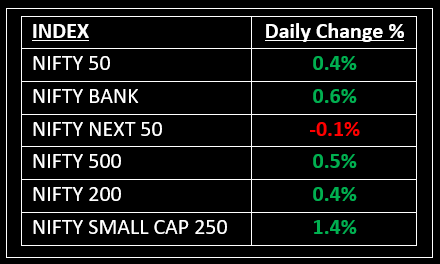

NIFTY: The index opened 63 points higher at 23,679 and made a high of 23,795 before closing at 23,707. Nifty has formed a small bullish candlestick pattern with a long upper shadow on the daily chart. Its immediate resistance level is now placed at 23,800 while immediate support is at 23,640.

BANK NIFTY: The index opened 139 points higher at 50,061 and closed at 50,202. Bank Nifty has formed an Inside Bar-like pattern on the daily chart. Its major resistance level is now placed around 50,500 while immediate support is around 50,000.

Stocks in Spotlight

▪ Ashoka Buildcon: Stock surged 5.4% following the announcement that its wholly-owned subsidiary signed a concession agreement with the National Highways Authority of India. The agreement is for the development of a four-lane economic corridor in West Bengal.

▪ Paras Defence & Space Technologies: Stock soared by 10%, hitting the upper circuit, after the company received permission from the Department for Promotion of Industry & Internal Trade (DPIIT) under the Arms Act to manufacture MK-46 and MK-48 belt-fed light machine guns.

▪ Zydus Lifesciences: Stock jumped over 5% after the company announced an agreement with US healthcare firm CVS Caremark to add its diabetes combination products to its template formulary.

Global News

▪ European markets edged higher on Tuesday as investors in the region focused on inflation data and corporate earnings releases.

▪ The U.S. dollar was close to a one-week low on Tuesday as markets await U.S. economic data while assessing whether President-elect Donald Trump’s policies on tariffs will align with his rhetoric.

▪ Gold prices rose on Tuesday as the U.S. dollar eased due to uncertainty around President-elect Donald Trump’s tariff plans, with further support coming from top consumer China’s central bank adding to its gold reserves for a second straight month.

▪ Oil prices climbed on Tuesday reversing earlier declines, as fears of tighter Russian and Iranian supply due to escalating Western sanctions lent support.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.