POST-MARKET SUMMARY 7th February 2025

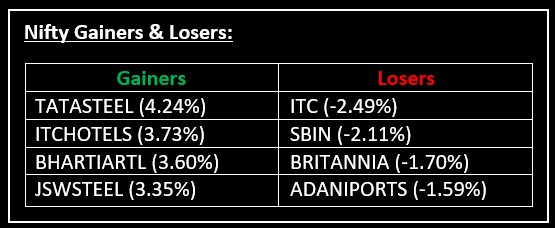

On February 7, Indian equity markets showed little reaction to the Reserve Bank of India's (RBI) rate cut, with both benchmark indices closing lower for the third consecutive session. Top Gainer: TATASTEEL | Top Loser: ITC

On February 7, Indian equity markets showed little reaction to the Reserve Bank of India's (RBI) rate cut, with both benchmark indices closing lower for the third consecutive session. The muted response was driven by the absence of a clear policy direction from the central bank. RBI reduced the repo rate by 25 basis points to 6.25%—its first cut in nearly five years—to boost growth.

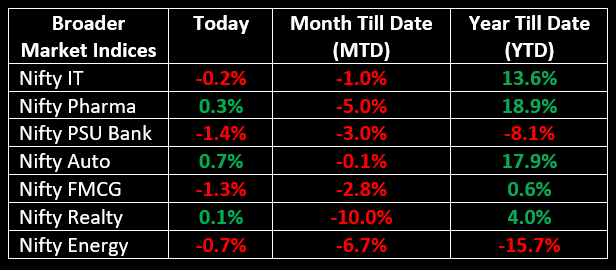

Sector-wise, the metal index advanced 2.7%, consumer durables gained 1%, while FMCG declined 1.3% and oil & gas edged lower by 0.9%.

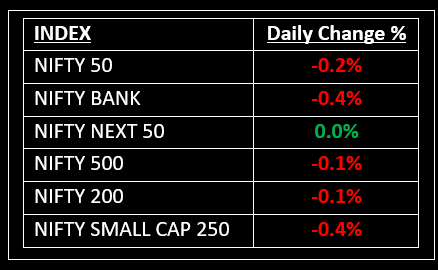

NIFTY: The index opened 46 points higher at 23,649 and made a high of 23,694 before closing at 23,560. Nifty has formed a bearish candlestick pattern on the daily chart. Its critical resistance level is now placed at 23,700 while critical support is at 23,450.

BANK NIFTY: The index opened 102 points higher at 50,484 and closed at 50,158. Bank Nifty has formed a bearish candlestick on the daily chart. Its critical resistance level is now placed around 50,500 while critical support is around 49,900.

Stocks in Spotlight

▪ Cochin Shipyard: Stock fell 5% intraday after the company reported a 27% year-on-year decline in profit for Q3FY25 to ₹177 crore, raising concerns about short-term growth prospects.

▪ Gulf Oil: Stock jumped 8% after the company reported a 22% year-on-year increase in net profit for the quarter. Additionally, the firm announced a dividend of ₹20/ share for its shareholders.

▪ Bikaji Foods International: Stock tumbled over 10% after the company reported weak Q3 results, with net profit plunging 39% from ₹46.6 crore to ₹28.6 crore due to high input costs.

Global News

▪ The Hang Seng Index advanced 242 points (1.2%) to close at 21,133, marking a three-month high. The rally was driven by increased investor interest in China's internet firms, fuelled by the launch of a more competitive AI model from DeepSeek.

▪ Major European stock markets lacked clear direction, with the STOXX 50 and STOXX 600 trading near the flatline after hitting 25-year and record highs, respectively, in the previous session.

▪ U.S. stock futures stabilized as investors awaited payroll data, maintaining cautious optimism about avoiding a full-blown trade war.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.