POST-MARKET SUMMARY 6th January 2025

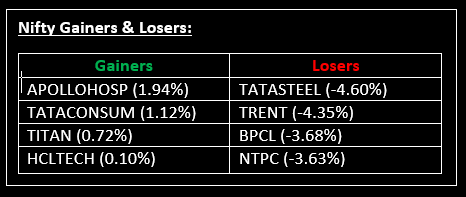

On January 6, Indian equity markets faced a significant downturn as benchmark indices declined sharply, driven by concerns over Human Metapneumovirus (HMPV), which dampened investor sentiment. Top Gainer: APOLLOHOSP | Top Loser: TATASTEEL

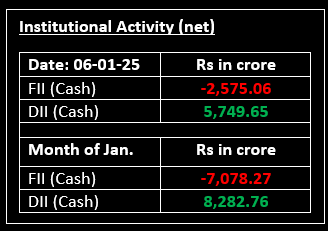

On January 6, Indian equity markets faced a significant downturn as benchmark indices declined sharply, driven by concerns over Human Metapneumovirus (HMPV), which dampened investor sentiment. After a positive start to the day, the market experienced profit-booking in the initial hours, erasing all gains. As the session progressed, selling pressure intensified, leading to extended losses.

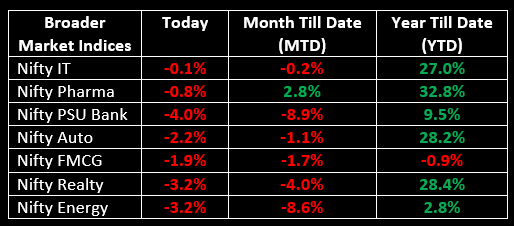

Among sectors, all indices ended in the red, with the PSU Bank index declining by nearly 4%, weighed down by weak quarterly business performance. Metal, realty, energy, PSU, power, and oil & gas sectors also faced sharp declines, each dropping by approximately 3%.

Meanwhile, in the primary market, the grey market premium (GMP) for Standard Glass Lining Technology’s IPO surged to 69%. Get exclusive insights on the IPO here.

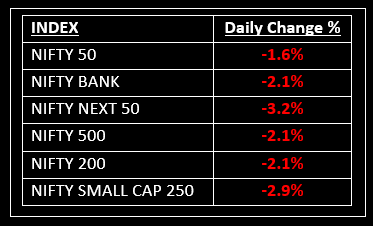

NIFTY: The index opened 41 points higher at 24,045 and made a high of 24,089 before closing at 23,616. Nifty has formed a long bearish candlestick pattern on the daily chart, with a lower high-lower low formation. Its immediate resistance level is now placed at 23,700 while immediate support is at 23,550.

BANK NIFTY: The index opened flat at 50,990 and closed at 49,922. Bank Nifty has formed a long bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed around 50,200 while immediate support is around 49,700.

Stocks in Spotlight

▪ Union Bank of India: Stock tumbled over 7% after the state-owned lender posted the weakest December quarter business update among banks so far. The bank reported a modest 4% YoY growth in deposits to Rs 12.2 lakh crore in Q3FY25, but a 2% decline on a QoQ basis.

▪ Titan Company: Stock gained over 2% intraday, after reporting a 24% YoY growth for the December quarter. The company’s total retail network, including CaratLane and international stores, expanded by 69 outlets during the quarter, reaching 3,240 stores.

▪ Easy Trip Planners: Stock soared over 17% intraday after its former CEO and promoter Nishant Pitti confirmed that there would be no further sale of promoter stake in the company.

Global News

▪ Oil prices steadied at their highest since mid-October as colder weather spurred buying while further support came from expectations of tighter sanctions on Iranian and Russian oil exports.

▪ Gold prices held steady on Monday as rising U.S. Treasury yields offset the impact of a weaker dollar and investors awaited economic data for clues on the Federal Reserve’s interest rate trajectory after it flagged a slower pace of cuts this year.

▪ The dollar slumped 1% on Monday after a report said President-elect Donald Trump was mulling tariffs that would only be applied to critical imports, potentially a relief for countries that were expecting broader levies.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.