POST-MARKET SUMMARY 6th December 2024

On December 6, the Indian benchmark indices ended with marginal losses in a volatile session. Top Gainer: TATAMOTORS | Top Loser: ADANIPORTS

On December 6, the Indian benchmark indices ended with marginal losses in a volatile session. The Reserve Bank of India’s Monetary Policy Committee (MPC) kept the benchmark repo rate unchanged at 6.5% for the 11th consecutive time and announced a 50-bps reduction in the CRR to 4% to improve liquidity in the banking system. Also read: RBI Policy Meeting December 2024: Key Highlights & Insights

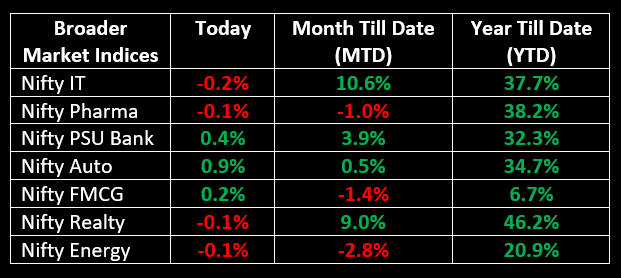

On the sectoral front, all indices except IT and Media ended in the green, with Auto, Metal, FMCG, Telecom, and PSU Bank gaining 0.3%-1%.

NIFTY: The index opened 21 points higher at 24,729 and made a high of 24,751 before closing at 24,677. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,760 while immediate support is at 24,560.

BANK NIFTY: The index opened 33 points higher at 53,634 and closed at 53,509. Bank Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed around 53,700 while immediate support is around 53,200.

Stocks in Spotlight

▪ Ceigall India: Stock surged nearly 4% after the company announced receiving an arbitration award worth Rs 54.21 crore in its favour in the Greater Mohali Area Development Authority (GMADA) case.

▪ Zaggle Prepaid Ocean Services: Stock hit the 5% upper circuit after the company secured three new orders from AGP City Gas, Hitachi India and Blink Commerce.

▪ RITES: Stock jumped over 3% after the company secured a Rs 148.25 crore project from the Indian Institute of Management, Raipur.

Global News

▪ Asian markets edged lower, tracking a drop in US shares ahead of jobs data that may help shape the direction of the Federal Reserve’s policy path later this month.

▪ The pan-European Stoxx 600 rose 0.1% at the end of a data-heavy week on Friday, which also saw the French government topple, plunging the eurozone's second-largest economy into political uncertainty.

▪ Gold prices edged higher on Friday, but were poised for a second straight weekly decline as investors remained cautious ahead of the U.S. non-farm payrolls data that could shape the Federal Reserve’s rate cut path.

▪ Oil prices slipped in early Asian trading on Friday, with weak demand in focus after the OPEC+ group postponed planned supply increases and extended deep output cuts to the end of 2026.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.