POST-MARKET SUMMARY 5th September 2024

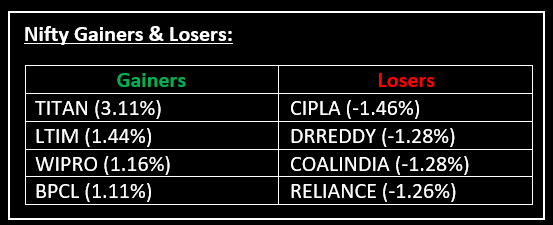

On September 5, the Sensex and Nifty closed in the red during the weekly expiry of Nifty derivative contracts. Top Gainer: TITAN| Top Loser: CIPLA

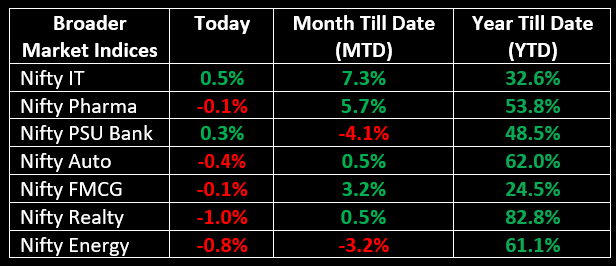

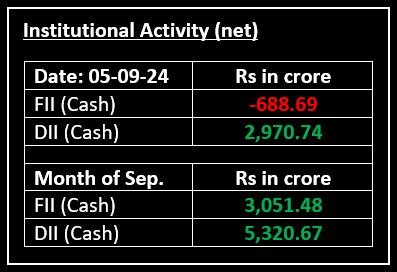

On September 5, the Sensex and Nifty closed in the red during the weekly expiry of Nifty derivative contracts. Investors remained cautious ahead of key US economic data releases, which are expected to provide insights into the potential scale of the Federal Reserve's anticipated rate cut in its September meeting. Automobile and oil & gas stocks weighed down the Nifty 50, while Nifty IT and Nifty Media were the top sectoral gainers, rising 0.8% and 0.5%, respectively.

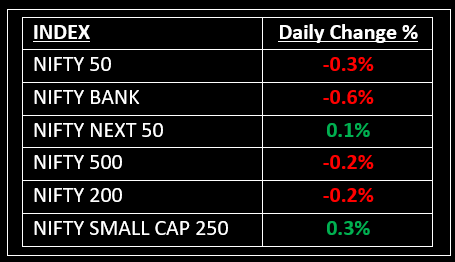

NIFTY: The index opened 52 points higher at 25,250 and made a high of 25,275 before closing at 25,145. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 25,200 while immediate support is at 25,090.

BANK NIFTY: The index opened 144 points higher at 51,544 and closed at 51,473. Bank Nifty has formed a spinning top candlestick pattern on the daily chart. Its immediate resistance level is now placed at 51,600 while support is at 51,200.

Stocks in Spotlight

▪ AU Small Finance Bank: Stock ended 2% higher a day after AU Small Finance Bank submitted its application to the RBI to transition from a small finance bank to a universal bank.

▪ Linde India: Stock surged over 3% after the company entered into an agreement with Tata Steel to acquire industrial gas supply assets at their Kalinganagar Phase 2 expansion project.

▪ Sona BLW: Stock surged over 4% after the company revealed plans to launch a Rs 2,400 crore Qualified Institutional Placement (QIP).

Global News

▪ Gold rose on Thursday fuelled by expectations of a deeper U.S. Federal Reserve rate-cutting cycle, which is widely expected to start this month.

▪ The dollar touched one-month lows against the yen and was under pressure against other major currencies on Thursday as growing concern over the U.S. economic outlook underpinned expectations of a supersized rate cut from the Federal Reserve next week.

▪ Asia-Pacific markets closed mixed on Thursday after a sell-off in the previous session, with Japan’s Nikkei leading losses in the region.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.