POST-MARKET SUMMARY 5th June 2025

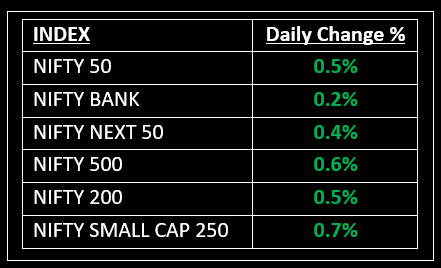

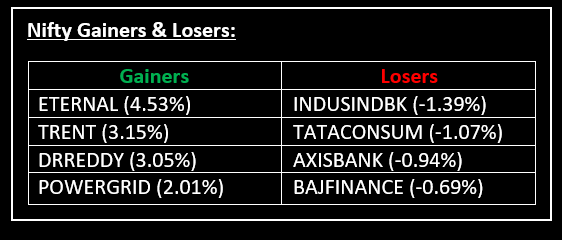

On June 5, Indian equity indices attempted to test higher levels ahead of the RBI’s monetary policy decision, with strength across Asian markets providing a boost. Top Gainer: ETERNAL | Top Loser: INDUSINDBK

On June 5, Indian equity indices attempted to test higher levels ahead of the RBI’s monetary policy decision, with strength across Asian markets providing a boost. The market saw broad-based buying, extending gains for a second consecutive day, on expectations of a 25 bps rate cut in the upcoming RBI meeting.

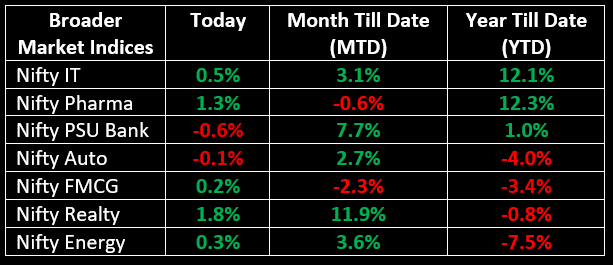

On the sectoral front, all indces except Banks, Media and Auto ended in the green. Notable gains were seen in IT, metals, pharma and realty, which rose between 0.5% and 1.7%.

NIFTY: The index opened 70 points higher at 24,691 and made a high of 24,899 before closing at 24,750. Nifty has formed a bullish candle on the daily chart. Its major resistance level is now placed at 24,840 while immediate support is at 24,660.

BANK NIFTY: The index opened 130 points higher at 55,806 and closed at 55,760. Bank Nifty has formed a Doji-like candle on the daily chart. Its immediate resistance level is now placed around 56,000 while immediate support is around 55,550.

Stocks in Spotlight

▪ Sobha: Stock jumped over 5% on growing expectations of a 25-basis-point rate cut by the RBI, with real estate stocks benefiting from hopes of lower mortgage rates and higher festive demand.

▪ Railtel Corporation: Stock rose over 4% after the company bagged an order worth Rs 274.4 crore from the Motor Vehicles Department of Maharashtra.

▪ Cochin Shipyard: Stock surged over 12% on optimism over defence orders and the government’s push for domestic naval production, supported by a strong Q4 performance and a healthy order pipeline.

Global News

▪ Asian markets continued their rally on Thursday, driven by broad sector gains and a rebound in China’s services activity for May, following a dip in April. This boosted investor sentiment across the region.

▪ European markets were mixed on Thursday as investors took a cautious stance ahead of the European Central Bank’s monetary policy decision.

▪ Gold prices extended their gains, reaching a nearly one-month high of $3,380 per ounce, driven by a new wave of weak US economic data and a dovish outlook from the Federal Reserve. This fuelled increased demand for safe-haven assets ahead of Friday’s nonfarm payroll report.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.