POST-MARKET SUMMARY 5th July 2024

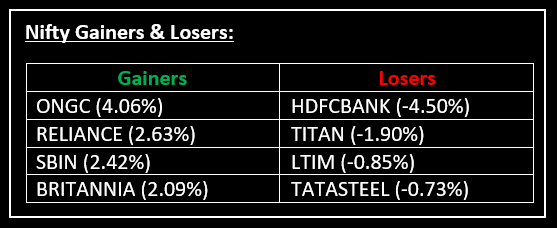

On July 5, Nifty and Sensex ended nearly unchanged after two days of hitting highs, as investor sentiment was dampened by private bank and financial service stocks. Top Gainer: ONGC | Top Loser: HDFCBANK

On July 5, Nifty and Sensex ended nearly unchanged after two days of hitting highs, as investor sentiment was dampened by private bank and financial service stocks.

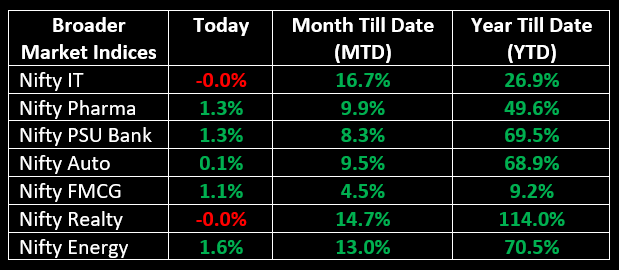

Among sectoral indices, 6 gained over a percent, with energy being the standout performer. Key contributors to the rally included major companies like Reliance, ONGC, and NTPC. Other sectors that saw gains were pharma, healthcare, PSU banks, FMCG, and infrastructure.

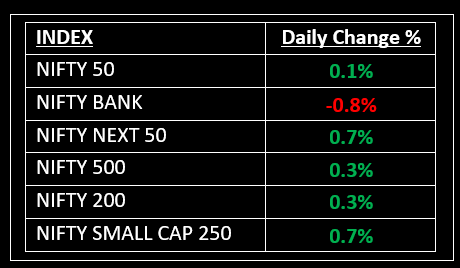

NIFTY: The index opened 89 points lower at 24,213 and made a high of 24,363 before closing at 24,323. Nifty has formed a small bullish candle on the daily chart with small upper and lower shadow. Its immediate resistance level is now placed at 24,400 while immediate support is at 24,230.

BANK NIFTY: The index opened 543 points lower at 52,560 and closed at 52,660. Bank Nifty has formed an indecisive candlestick pattern on the daily chart. Its immediate resistance level is now placed at 52,820 while support is at 52,360.

Stocks in Spotlight

▪ RBL Bank: Stock slipped over 1% after the lender reported a sequential decline in its total deposits and current account savings account (CASA) in the June quarter business update.

▪ Raymond: Stock hit a record high of Rs 3,240 after the company's board greenlit the demerger of its real estate business, Raymond Realty.

▪ HDFC Bank: Stock declined over 4% after the bank reported a soft June quarter business update.

Global News

▪ The FTSE 100 eased back on Friday afternoon as investors reacted to the Labour Party’s landslide U.K. election victory.

▪ Gold prices extended gains on Friday to their highest level in a month, following key U.S. jobs data the showed labor market was softening, lifting expectations around a Federal Reserve interest rate cut in September.

▪ Cryptocurrencies plunged on Friday as investors focused on the payout of nearly $9 billion to users of collapsed bitcoin exchange Mt. Gox.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.