POST-MARKET SUMMARY 5th February 2025

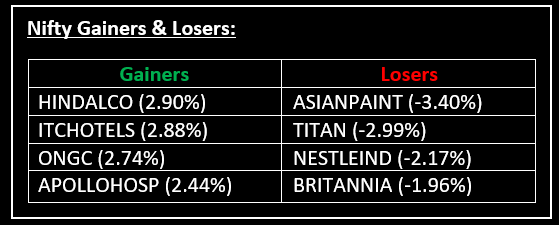

On February 5, Indian markets closed lower, weighed down by losses in consumer stocks amid weak earnings. Top Gainer: HINDALCO | Top Loser: ASIANPAINT

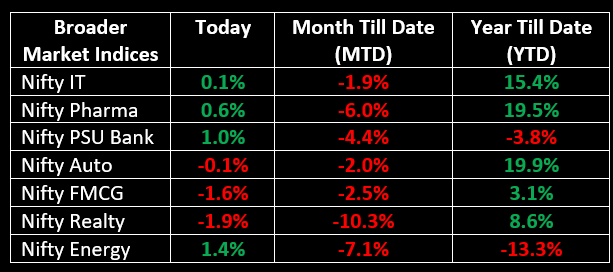

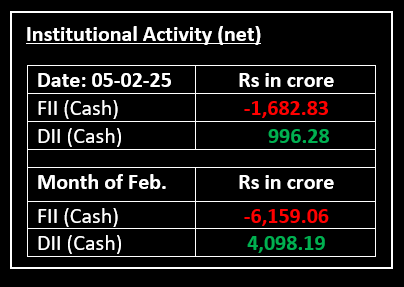

On February 5, Indian markets closed lower, weighed down by losses in consumer stocks amid weak earnings. Investor sentiment remained cautious ahead of the Reserve Bank of India's bi-monthly policy announcement on February 7. Sector-wise, pharma gained 0.6%, metal rose 1.5%, while realty and FMCG declined 1.9% and 1.6%, respectively.

Meanwhile, the Indian rupee hit a fresh low of 87.5 against the dollar as expectations of a rate cut intensified.

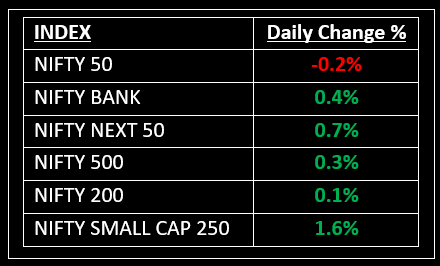

NIFTY: The index opened 62 points higher at 23,801 and made a high of 23,807 before closing at 23,696. Nifty has formed a small bearish candle on the daily chart. Its immediate resistance level is now placed at 23,800 while its immediate support is at 23,600.

BANK NIFTY: The index opened 402 points higher at 50,402 and closed at 50,343. Bank Nifty has formed an indecisive candle on the daily chart. Its major resistance level is now placed around 50,500 while immediate support is around 50,000.

Stocks in Spotlight

▪ Symphony: Stock slumped 9% after the company reported a net loss of Rs 10 crore, compared to a Rs 41 crore profit last year. The loss was due to a one-time Rs 46 crore impact, with no such item in the base quarter.

▪ Titan: Stock slipped nearly 3% after Q3 results showed a hit on net profit and margins due to lower customs duty on gold, along with a decline in the studded share and gross margin contraction.

▪ Force Motors: Stock surged 6% after strong January sales, with domestic SCV, LCV, UV, and SUV sales rising 39% YoY to 3,493 units. Overall sales, including exports, grew 20% to 3,597 units.

Global News

▪ European markets edged higher on Wednesday, supported by earnings beats that boosted stocks across multiple sectors.

▪ Asia-Pacific markets mostly rose on Wednesday after Wall Street climbed overnight, shrugging off Trump's tariffs and China’s retaliatory measures.

▪ Oil prices dropped over 1% on Wednesday as rising U.S. stockpiles and concerns about a new Sino-U.S. trade war fuelled fears of weaker economic growth, offsetting U.S. President Donald Trump's renewed push to eliminate Iranian crude exports.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.