POST-MARKET SUMMARY 5th April 2024

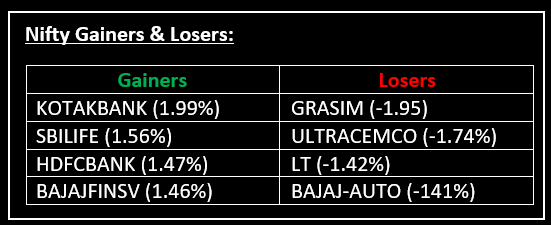

On April 5, Nifty remained steady in a volatile trading session following the decision of the Monetary Policy Committee of the Reserve Bank of India (RBI) to leave the key repo rate unchanged at 6.5%. Top Gainer: KOTAKBANK | Top Loser: GRASIM

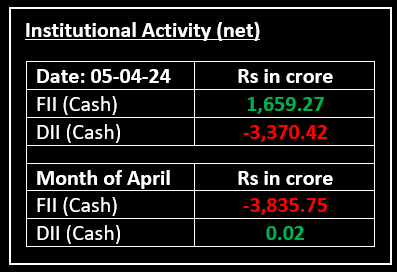

On April 5, Nifty remained steady in a volatile trading session following the decision of the Monetary Policy Committee of the Reserve Bank of India (RBI) to leave the key repo rate unchanged at 6.5%. However, the midcap index continued its upward trend for the tenth consecutive day. This marked the seventh consecutive instance where the RBI MPC opted to keep interest rates unaltered, maintaining the monetary stance at "withdrawal of accommodation" in the first meeting of FY25.

Also Read: RBI Policy Outcome | Market Insights & Forecasts

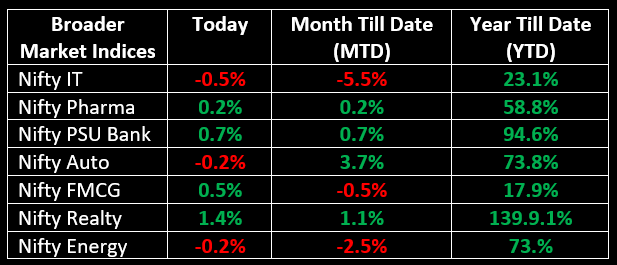

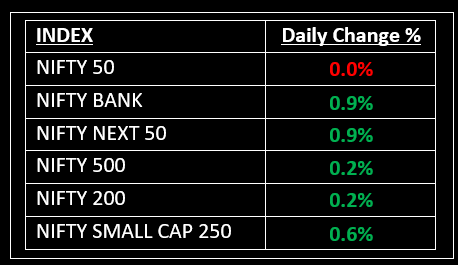

Furthermore, geopolitical tensions, escalating crude oil prices, and subdued global signals added to the downward pressure on sentiment. Amongst broader indices apart from banking, the FMCG and realty indices saw gains of 0.5-1.5%, whereas Information Technology and Media witnessed a decline of 0.4% each.

NIFTY: The index opened 28 points lower at 22,486 and made a high of 22,537 before closing at 22,513. Nifty has formed a small bodied bullish candlestick pattern with small upper & lower shadow on the daily chart. Its immediate resistance level is now placed at 22,550 while immediate support is at 22,450.

BANK NIFTY: The index opened 44 points higher at 48,104 and closed at 48,493. Bank Nifty has formed a long bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 48,640 while support is at 48,250.

Stocks in Spotlight

▪ Marico: Stock gained more than 3% after the company in its Q4 update said its international business has reverted to clocking double-digit constant currency growth.

▪ Globus Spirits: Stock jumped over 3% after the company announced a joint venture with ANSA McAL, a Trinidad and Tobago headquartered brand, for beer production and distribution in India.

▪ Ultratech Cement: Stock declined nearly 2% despite the company commissioning a 100-MW solar energy project in Rajasthan.

Global News

▪ U.S. Treasury yields moved slightly higher on Friday morning ahead of closely watched non-farm payrolls data for March.

▪ Gold prices were headed for their third straight week of gains on Friday ahead of the much-awaited U.S. non-farm payrolls data, supported by strong safe-haven inflows and prospects for lower U.S. interest rates this year.

▪ European markets were lower on Friday as investors wrapped up a lackluster first trading week of the new quarter.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.