POST-MARKET SUMMARY 4th September 2024

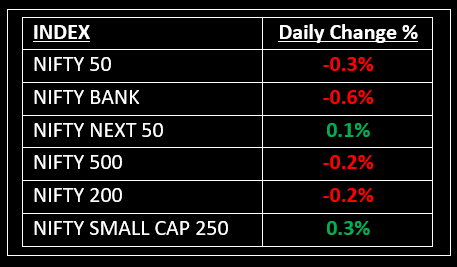

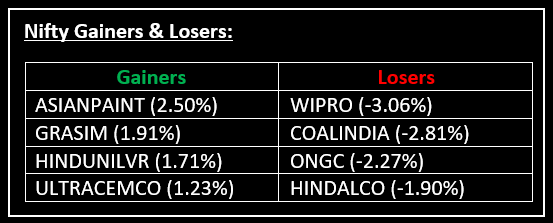

On September 4, Indian benchmark indices ended on a negative note, with Nifty breaking its 14-day winning streak and closing below 25,200 amid broad-based selling across sectors. Top Gainer: ASIANPAINT| Top Loser: WIPRO

On September 4, Indian benchmark indices ended on a negative note, with Nifty breaking its 14-day winning streak and closing below 25,200 amid broad-based selling across sectors. The downturn aligned with a broader sell-off in Asian and U.S. markets, spurred by renewed fears of a recession following discouraging economic data. For more details, click here.

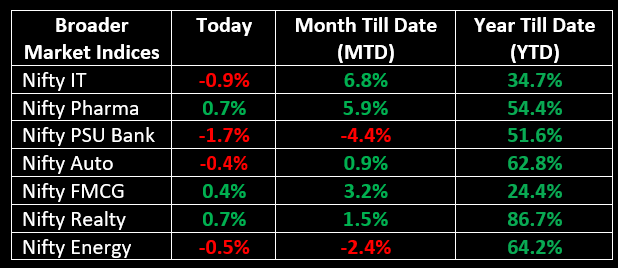

On the sectoral front, FMCG, realty, and pharma gained 0.5% each, while auto, bank, energy, IT, and metal sectors were down by 0.4-1%.

NIFTY: The index opened 190 points lower at 25,089 and made a high of 25,216 before closing at 25,198. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 25,260 while immediate support is at 25,100.

BANK NIFTY: The index opened 325 points lower at 51,364 and closed at 51,400. Bank Nifty has formed a Doji-like candlestick pattern on the daily chart. Its immediate resistance level is now placed at 51,560 while support is at 51,240.

Stocks in Spotlight

▪ Rama Steel Tubes: Stock soared 12% after the firm announced a strategic collaboration with Onix Renewable.

▪ General Insurance Corporation of India: Stock slumped 6% as the Centre looks to sell nearly 7% stake in the company through the offer for sale (OFS) route.

▪ Exicom Tele Systems: Stock fell 5%, a day after Rakesh Jhunjhunwala's RARE Enterprise trimmed its stake in the company.

Global News

▪ The pan-European Stoxx 600 index traded down 1% at 3:20 p.m. London time, with most sectors and major bourses in negative territory. Technology stocks dropped 3% to lead losses, while household goods fell 2%.

▪ Gold prices extended declines to a two-week low on Wednesday as a sharp sell-off in equities forced a rush to cover margin calls, adding pressure on bullion ahead of keenly awaited non-farm payrolls data due later this week.

▪ The Japanese yen and the Swiss franc firmed against the dollar on Wednesday as investors scurried to safer assets after a sharp selloff on Wall Street in the prior session sparked by concerns about the U.S. economy and tech sector valuations.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.