POST-MARKET SUMMARY 4th March 2025

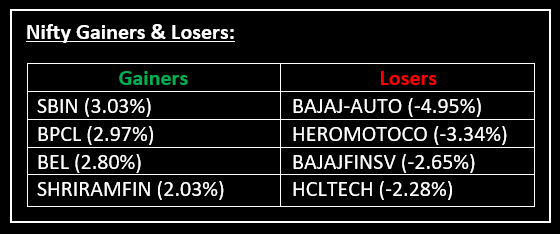

On March 4, Indian equity indices ended lower but recovered from the day's lows in a volatile session, with Nifty declining amid weak global markets. Top Gainer: SBIN | Top Loser: BAJAJ-AUTO

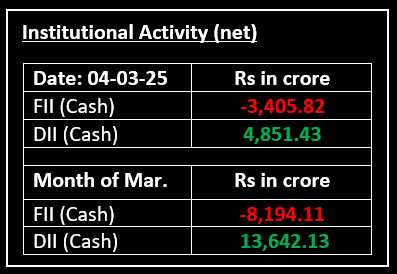

On March 4, Indian equity indices ended lower but recovered from the day's lows in a volatile session, with Nifty declining amid weak global markets. Investors grew concerned about a global trade war after Trump reaffirmed a 25% tariff on imports from Mexico and Canada, and announced new tariffs on "external" agricultural products starting April 2. Meanwhile, the Canadian Prime Minister also revealed retaliatory tariffs on the US, effective immediately. Read more about it here.

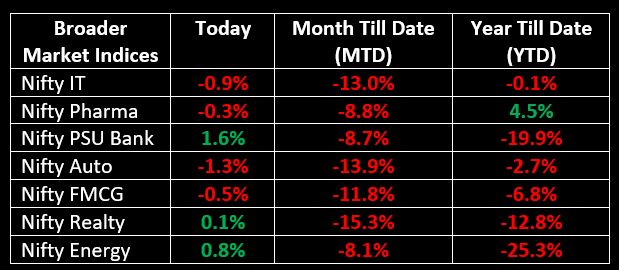

Among sectors, Auto, IT, Telecom, and FMCG fell by 0.4-1%, while Bank, Capital Goods, Oil & Gas, Media, and PSU Bank gained 0.5-2%.

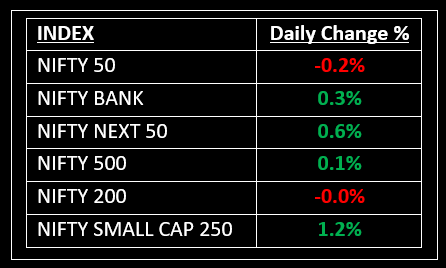

NIFTY: The index opened 145 points lower at 21,974 and made a high of 22,105 before closing at 22,082. Nifty has formed a bullish candle on the daily chart. Its immediate resistance level is now placed at 22,160 while its immediate support is at 22,000.

BANK NIFTY: The index opened 172 points lower at 47,942 and closed at 48,245. Bank Nifty has formed a bullish candle on the daily chart. Its immediate resistance level is now placed around 48,400 while immediate support is around 48,100.

Stocks in Spotlight

▪ Coffee Day Enterprises: Stock surged about 20% after an exchange filing on February 28 revealed that the Chennai-bench of the National Company Law Appellate Tribunal (NCLAT) ruled in favour of the company, dismissing a bankruptcy plea filed by IDBI Trusteeship over a Rs 228 crore default.

▪ Jupiter Wagons: Stock jumped over 5% intraday after the company announced a new manufacturing facility in Indore, Madhya Pradesh, by its e-mobility arm. The facility will produce the flagship electric light commercial vehicle, the JEM TEZ.

▪ Senores Pharma: Stock surged over 7% intraday after the company announced the acquisition of 14 Abbreviated New Drug Applications (ANDAs) from Dr. Reddy’s Laboratories.

Global News

▪ European markets were sharply lower on Tuesday as global investors braced for the impact of fresh U.S. tariffs on Mexico, Canada, and China, along with retaliatory actions.

▪ U.S. stock futures hovered below the flatline, reversing earlier gains, after the benchmark S&P 500 slumped to its worst day of the year so far in the prior session.

▪ Gold surged to $2,915 per ounce on Tuesday, approaching the record high of $2,950 touched last week after the U.S. implemented tariffs on major trading partners, triggering a global flight to safety.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.