POST-MARKET SUMMARY 4th July 2025

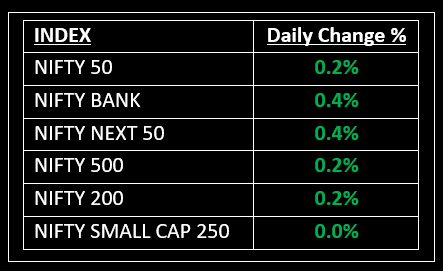

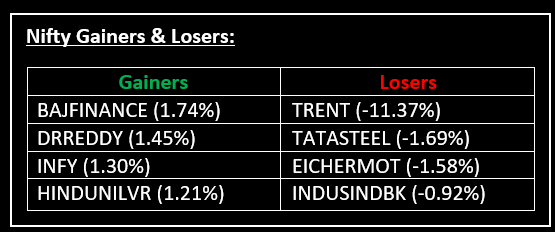

On July 4, the benchmark indices ended higher in a choppy session, with the Nifty closing around 25,450, supported by buying across most sectors except metals. Top Gainer: BAJFINANCE | Top Loser: TRENT

On July 4, the benchmark indices ended higher in a choppy session, with the Nifty closing around 25,450, supported by buying across most sectors except metals. The market started on a weak note but staged a steady recovery in the second half, led by gains in heavyweight stocks, which helped the index end near the day’s high.

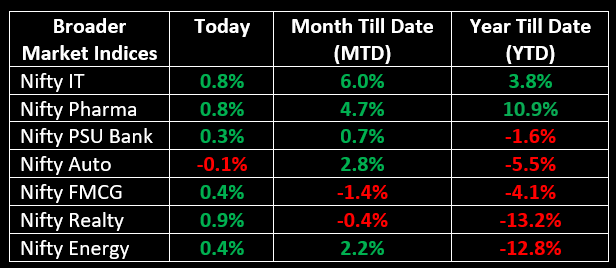

Sectoral performance was mixed. Metals, Consumption and Auto lagged while Banking, Pharma, Oil & Gas, IT, Realty and Media sectors gained between 0.4% and 1%.

NIFTY The index opened 23 points higher at 25,428 and made a high of 25,470 before closing at 25,461. Nifty has formed a small bodied bullish candle with a lower shadow on the daily chart. Its major resistance level is now placed at 25,600 while major support is at 25,300.

BANK NIFTY: The index opened 34 points higher at 56,825 and closed at 57,031. Bank Nifty has formed a bullish candle with a lower shadow on the daily chart. Its immediate resistance level is now placed around 57,200 while major support is around 56,650.

Stocks in Spotlight

▪ PC Jeweller: Stock surged 19% after the company released a strong business update. Standalone revenue grew ~80% compared to the same quarter last year. The management also indicated that the company aims to be debt-free in FY26.

▪ Bajaj Finance: Stock climbed 1.7% after the lender reported a 25% YoY rise in Assets Under Management (AUM) to Rs 4.41 lakh crore in Q1. The deposits book also showed healthy growth, rising 15% YoY to Rs 72,100 crore.

▪ Sapphire Foods: Stock surged over 5% following reports that Yum! Brands, the American parent of KFC and Pizza Hut, is in talks to merge its two Indian franchise partners—Devyani International Ltd (DIL) and Sapphire Foods.

Global News

▪ Global markets slipped on Friday as U.S. President Donald Trump secured passage of his signature tax cut bill, while focus shifted to the looming July 9 deadline for countries to strike trade deals with the U.S.

▪ Oil futures edged lower after Iran reaffirmed its commitment to nuclear non-proliferation, easing geopolitical tensions. Meanwhile, markets awaited an expected OPEC+ decision to raise output over the weekend.

▪ Gold prices rebounded, heading for a weekly gain, supported by a softer U.S. dollar and safe-haven demand as uncertainty over global trade negotiations intensified.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.