POST-MARKET SUMMARY 3rd September 2025

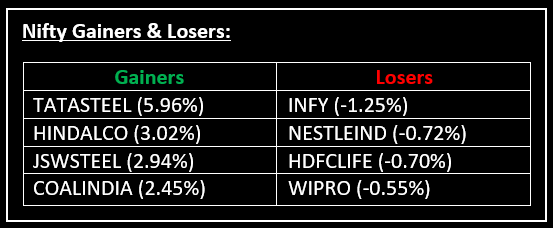

On September 3, Indian equities closed higher, reversing an initially mixed session, as optimism grew around a consumption-driven stimulus linked to potential GST slab rationalization. Top Gainer: TATASTEEL | Top Loser: INFY

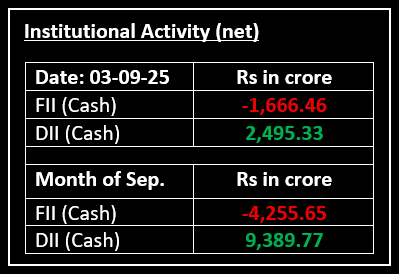

On September 3, Indian equities closed higher, reversing an initially mixed session, as optimism grew around a consumption-driven stimulus linked to potential GST slab rationalization. The market breadth remained strong, with the NSE advance-decline ratio at 2:1.

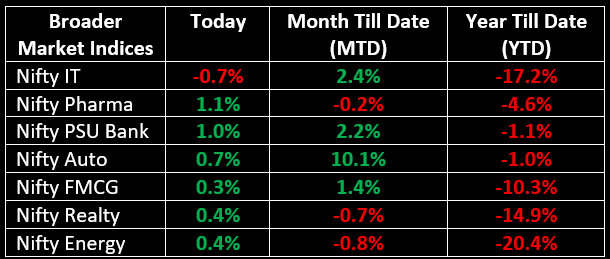

On the sectoral front, the Metals sector led the rally, marking a third consecutive day of gains, while PSU banks, auto, pharma and FMCG stocks also saw positive movement. Nifty Bank demonstrated a solid recovery. However, IT stocks remained under pressure, declining for the second consecutive day.

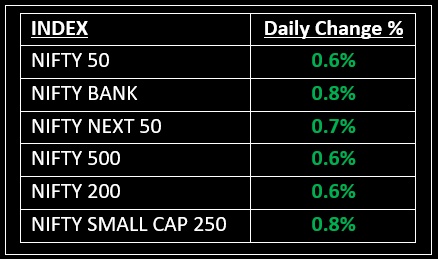

NIFTY: The index opened 37 points higher at 24,616 and made a high of 24,737 before closing at 24,715. Nifty has formed a bullish candle with a lower shadow on the daily chart. Its immediate resistance level is now placed at 24,760 while its immediate support is at 24,690.

BANK NIFTY: The index opened 31 points lower at 53,630 and closed at 54,067. Bank Nifty has also formed a long bullish candle on the daily chart. Its immediate resistance level is now placed around 54,400 while immediate support is around 53,500.

Stocks in Spotlight

▪ Netweb Technologies India: Stock surged over 11% after the company secured a Rs 1,734 crore order to power India’s sovereign AI infrastructure.

▪ E2E Networks: Stock hit the 10% upper circuit after the company won a Rs 177 crore contract from the Ministry of Electronics & Information Technology.

▪ Moil: Stock rose nearly 4% after the company reported a 17% increase in manganese ore production to 1.45 lakh tonnes in August, compared to the same month last year.

Global News

▪ Asian shares mostly declined on Wednesday, with cautious trading on the Tokyo Stock Exchange, amid ongoing political uncertainties.

▪ European stocks opened broadly higher, recovering from the previous session's negative sentiment, which had been driven by regional fiscal concerns.

▪ Oil prices fell about 2%, as traders braced for an OPEC+ meeting over the weekend that is expected to discuss increasing production targets in October.

▪ Gold surged to a new record high, consolidating gains above the key $3,500 level, as expectations for a Federal Reserve rate cut this month grew, coupled with ongoing political and economic risks.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.