POST-MARKET SUMMARY 3rd October 2024

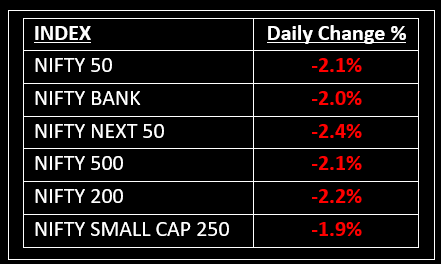

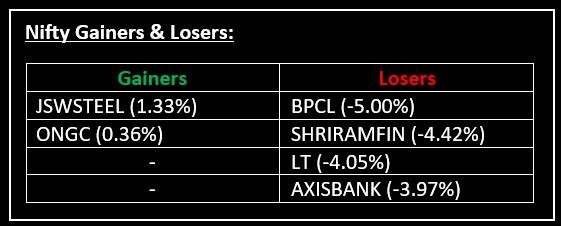

On October 3, Indian equity benchmarks Sensex and Nifty closed over 2% lower as broad-based selling hit the markets. Top Gainer: JSWSTEEL | Top Loser: BPCL

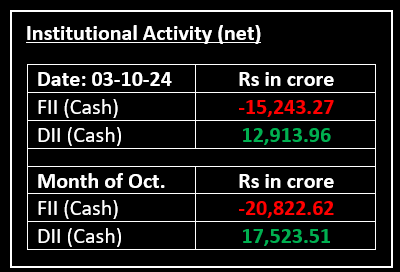

On October 3, Indian equity benchmarks Sensex and Nifty closed over 2% lower as broad-based selling hit the markets, driven by rising tensions in the Middle East, SEBI's stricter regulations on F&O trading, and a strong Chinese market drawing away foreign investors. Also read: Markets Plunge Over 2%: Analysing the Fall and What Investors Should Expect Next

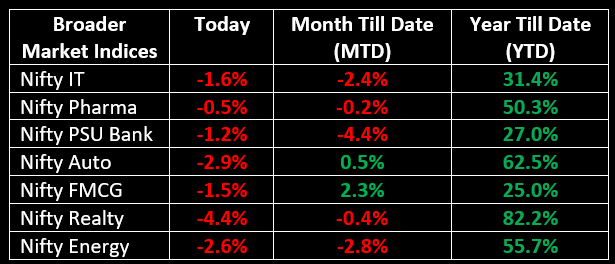

All 13 sectoral indices ended in the red, with Nifty Bank, Energy, and Auto leading the decline, each falling 2-3%. The Nifty Metal index ended its eight-session winning streak, dropping 0.7%.

NIFTY: The index opened 344 points lower at 25,452 and made a high of 25,639 before closing at 25,250. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 25,330 while immediate support is at 25,200.

BANK NIFTY: The index opened 608 points lower at 52,314 and closed at 51,845. Bank Nifty has formed a bearish candlestick pattern on the daily chart. Its major resistance level is now placed at 52,000 while major support is at 51,640.

Stocks in Spotlight

▪ BSE: Stock jumped over 3% after the new F&O norms released by SEBI turned out to be more lenient-than-expected.

▪ ITD Cementation: Stock zoomed 20% to hit the upper circuit after the company secured a new contract to construct a multi-story commercial building in Uttar Pradesh.

▪ Shivalik Rasayan: Stock skyrocketed 8.5% after the USFDA gave its approval for the company's API manufacturing facility in Dahej, Gujarat.

Global News

▪ The pan-European Stoxx 600 was down 0.82% by 1:50 p.m. London time, with all sectors and major bourses trading in the red. Construction and materials led losses, down 1.61% while mining stocks also lost 1.51%.

▪ Gold prices fell on Thursday as U.S. economic data tempered expectations of an aggressive rate cut in November, while investors awaited the upcoming payrolls report for more clarity on the Federal Reserve’s monetary policy easing plans.

▪ The dollar strengthened on Thursday on expectations the U.S. Federal Reserve will not rush to cut interest rates, while the pound lagged its developed markets peers after dovish comments from Bank of England Governor Andrew Bailey.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.