POST-MARKET SUMMARY 3rd March 2025

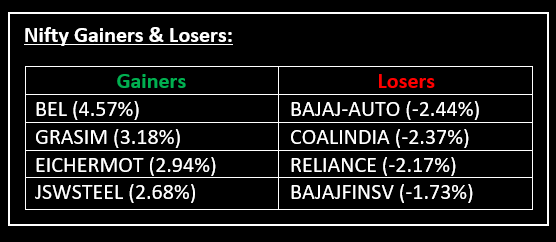

On March 3, Indian equity indices ended marginally lower amid high volatility, driven by mixed cues. Top Gainer: BEL| Top Loser: BAJAJ-AUTO

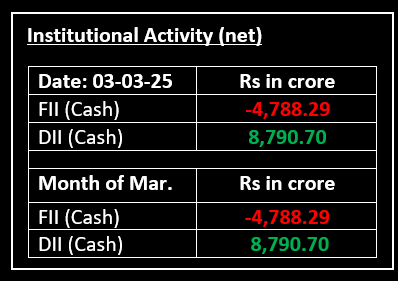

On March 3, Indian equity indices ended marginally lower amid high volatility, driven by mixed cues. Positive domestic data, including better GDP figures and rising GST collections, were overshadowed by uncertainty over global trade and the Ukraine peace deal. The Indian indices opened higher, fuelled by positive global cues, but turned negative in the initial hour.

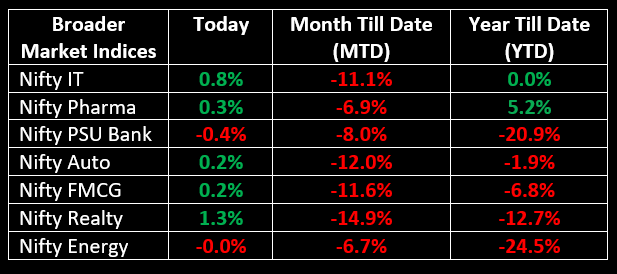

On the sectoral front, media, PSU Bank, and oil & gas sectors fell by 0.3-1%, while consumer durables, IT, metal, and realty sectors rose by 0.5-1%.

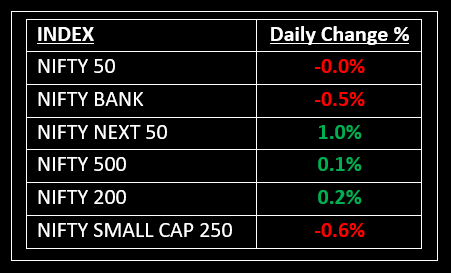

NIFTY: The index opened 70 points higher at 22,194 and made a high of 22,261 before closing at 22,119. Nifty has formed a bearish candlestick pattern on the daily charts. Its immediate resistance level is now placed at 22,200 while its immediate support is at 22,000.

BANK NIFTY: The index opened 134 points higher at 48,478 and closed at 48,114. Bank Nifty has formed a bearish candlestick pattern with a lower shadow on the daily charts. Its immediate resistance level is now placed around 48,260 while immediate support is around 47,850.

Stocks in Spotlight

▪ TVS Motor Company: Shares surged over 4% after the company reported strong February 2025 sales figures. Monthly sales grew 10% to 4,03,976 units, up from 3,68,424 units in February 2024.

▪ AstraZeneca Pharma: Shares rose over 2% after receiving regulatory approval to expand the use of Imfinzi for treating unresectable hepatocellular carcinoma (uHCC). The CDSCO authorized the import, sale, and distribution of Durvalumab (Imfinzi).

▪ Indian Overseas Bank: Shares dropped over 5% intraday after the company disclosed a ₹699.52 crore demand notice from the Deputy Commissioner, Chennai, for alleged GST liabilities for FY 2020-21, along with a ₹35.26 crore penalty.

Global News

▪ Euro strengthened to $1.04 at the start of March, bouncing back from a two-week low of $1.036 reached on Friday. The rise was driven by news of potential increases in Eurozone defence spending, which lifted market sentiment.

▪ Silver rose above $31 per ounce at the start of March, driven by a weaker dollar and safe haven buying amid concerns over shifting US trade policy.

▪ European markets rose on Monday, boosted by a 6% jump in defense stocks after security talks on increased military spending. The Stoxx 600 was up 0.59%.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.