POST-MARKET SUMMARY 3rd June 2025

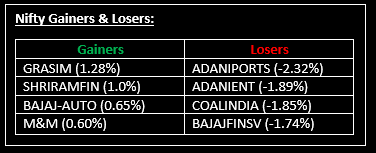

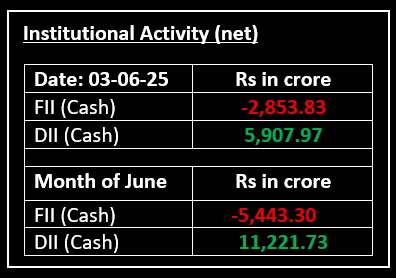

On June 3, Indian equity markets closed lower, marking a third consecutive day of losses amid weak global cues. Persistent foreign fund outflows, geopolitical tensions and tariff uncertainties continued to weigh on sentiment. Top Gainer: GRASIM | Top Loser: ADANIPORTS

On June 3, Indian equity markets closed lower, marking a third consecutive day of losses amid weak global cues. Persistent foreign fund outflows, geopolitical tensions and tariff uncertainties continued to weigh on sentiment.

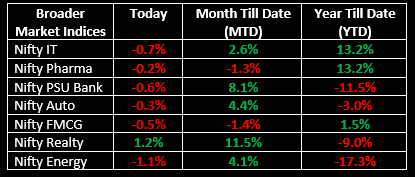

Among sectoral indices, the realty sector stood out, gaining 1%, while banks, capital goods, consumer durables, IT, oil & gas, and power declined between 0.5% and 1%.

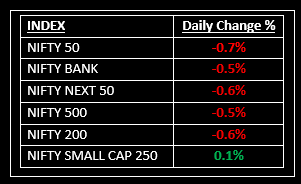

NIFTY: The index opened 70 points higher at 24,786 and made a high of 24,845 before closing at 24,542. Nifty has formed a bearish engulfing candle on the daily chart. Its immediate resistance level is now placed at 24,600 while its immediate support is at 24,450.

BANK NIFTY: The index opened 201 points higher at 56,104 and closed at 55,599. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 55,750 while immediate support is around 55,400.

Stocks in Spotlight

▪ Sansera Engineering: Stock jumped over 4% intraday after securing a Rs 160 crore contract with Airbus Defence & Space to supply airborne intensive care transport modules, marking Airbus’ first partnership with an Indian supplier for these critical systems.

▪ Indoco Remedies: Stock surged nearly 9% intraday after the company received final USFDA approval for its generic version of Allopurinol Tablets USP 200 mg. The drug, used to manage high uric acid levels and prevent complications from cancer treatments or kidney stones, will be marketed as a generic equivalent to Zyloprim 200 mg.

▪ Transrail Lighting: Stock ended 5% higher after the company bagged new orders worth Rs 534 crore. With this, its order intake for FY26 has surpassed Rs 1,600 crore.

Global News

▪ Asian markets climbed on Tuesday, reversing prior losses with broad strength across sectors, boosted by hopes of talks between President Trump and China’s Xi Jinping that could ease trade tensions.

▪ European markets trimmed earlier losses, recovering from a 1.1% drop to trade near their lowest level since early May, supported by weaker Eurozone inflation data that raised expectations of a 25-basis point ECB rate cut this week.

▪ Gold retreated on Tuesday after approaching a four-week high earlier, pressured by a stronger dollar and profit-taking, as investors remained cautious amid shifting U.S. trade policies.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.