POST-MARKET SUMMARY 3rd June 2024

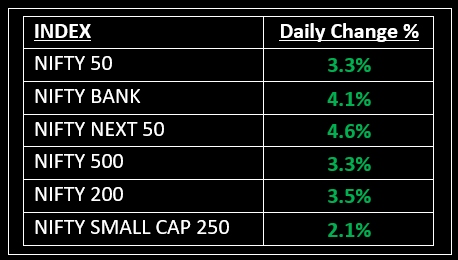

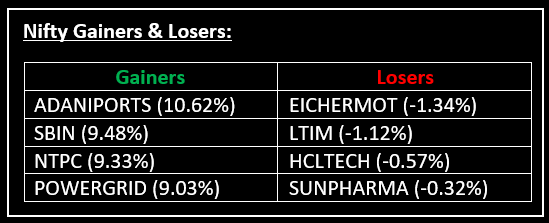

On June 3, Indian equity markets surged more than 3%, marking the biggest single-day gain in three years, as Dalal Street celebrated the outcome of most exit polls predicting a significant win for the BJP-led NDA for the third time in a row. Top Gainer: ADANIPORTS | Top Loser: EICHERMOT

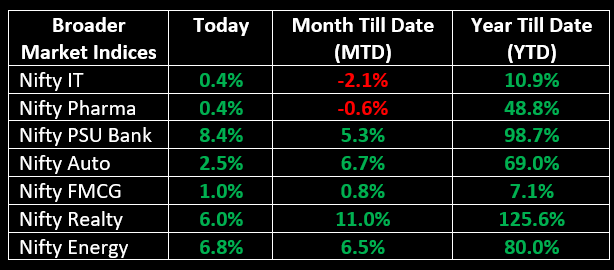

On June 3, Indian equity markets surged more than 3%, marking the biggest single-day gain in three years, as Dalal Street celebrated the outcome of most exit polls predicting a significant win for the BJP-led NDA for the third time in a row. All the sectoral indices ended in the green, with capital goods, PSU Bank, oil & gas, power, and realty rising by 5-8%.

After today's record-breaking rally, check out tomorrow’s predictions: How Will the Nifty and Sensex Move Post-Exit Polls?

NIFTY: The index opened 807 points higher at 23,337 and made a high of 23,338 before closing at 23,263. Nifty has formed a Hanging Man kind of pattern on the daily chart, with long upper and lower shadows. Its immediate resistance level is now placed at 23,340 while immediate support is at 23,140.

BANK NIFTY: The index opened 1,906 points higher at 50,889 and closed at 50,979. Bank Nifty has formed a small-bodied bullish candlestick pattern with a long lower shadow on the daily chart. Its immediate resistance level is now placed at 51,250 while support is at 50,700.

Stocks in Spotlight

▪ Ashoka Buildcon: Stock surged 6.5% after the company emerged as the lowest bidder for two projects worth Rs 2,153 crore awarded by the Maharashtra State Road Development Corporation.

▪ Power Grid: Stock closed 9% higher as market experts predict a political and policy continuity as captured in the exit polls.

▪ IRB Infrastructure: Stock leaped over 10% on reports that the center is likely to increase road toll charges between 3 percent and 5 percent after putting the annual increase on hold in April due to the country's general elections.

Global News

▪ European markets started the month higher on Monday, extending last week’s rally, as investors look ahead to the European Central Bank’s latest interest rate decision later this week.

▪ Gold prices ticked up on Monday, as investors awaited multiple U.S. economic reports this week for clues on health of the economy, after a recent inflation report suggested the Federal Reserve might have room for rate cuts in 2024.

▪ The dollar pulled back on Monday against a basket of currencies, as investors analysed manufacturing data and elections-affected emerging markets.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.