POST-MARKET SUMMARY 3rd January 2025

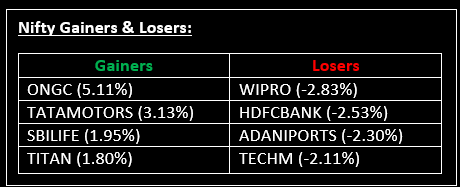

On January 3, the bears took control of Dalal Street, dragging Nifty close to slipping below a crucial level after solid gains in the first two sessions of the new year. Top Gainer: ONGC | Top Loser: WIPRO

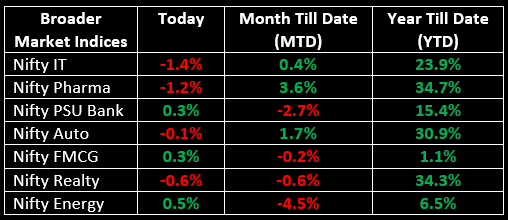

On January 3, the bears took control of Dalal Street, dragging Nifty close to slipping below a crucial level after solid gains in the first two sessions of the new year. The benchmark indices were under pressure as profit-booking in select heavyweights weighed on the market. Among sectors, banking, capital goods, IT, and pharma declined by 1% each, while oil & gas and media gained 1% each.

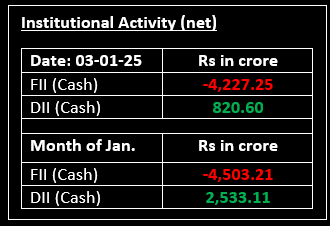

The cautious sentiment was driven by concerns over slowing economic growth, stretched valuations, foreign capital outflows, and uncertainty surrounding US trade policies ahead of Donald Trump assuming office on January 20.

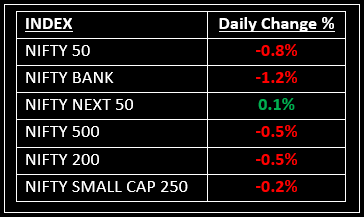

NIFTY: The index opened flat at 24,196 and made a high of 24,196 before closing at 24,004. Nifty has formed a Bearish Belt Hold candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,060 while immediate support is at 23,940.

BANK NIFTY: The index opened 24 points higher at 51,567 and closed at 50,988. Bank Nifty has formed a long bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed around 51,300 while immediate support is around 50,800.

Stocks in Spotlight

▪ Avenue Supermarts: Stock surged over 11% after the company released its business update for the December quarter, which showed a 17.5% YoY growth in operating revenue.

▪ Afcons Infra: Stock surged nearly 7% intraday following the announcement of a major order worth over Rs 1,000 crore from the DRDO. Get exclusive insights here.

▪ REC Ltd: Stock jumped nearly 4%, driven by a strong business update, with loan disbursements climbing 18% to Rs 54,692 crore in the December quarter.

Global News

▪ China stocks extended declines on Friday in a bumpy start to the new year, despite gains in the broader Asia-Pacific region, as investors assessed Beijing’s policy signals.

▪ The dollar held near a two-year high against a group of peers on Friday, buoyed by expectations that President-elect Donald Trump's policies will spur growth and inflation, leading to fewer Federal Reserve rate cuts and higher U.S. Treasury yields.

▪ Oil prices extended their gains on Friday after closing at their highest in more than two months in the previous session on hopes that governments worldwide may increase policy support to revive economic growth and boost fuel demand.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.