POST-MARKET SUMMARY 3rd April 2024

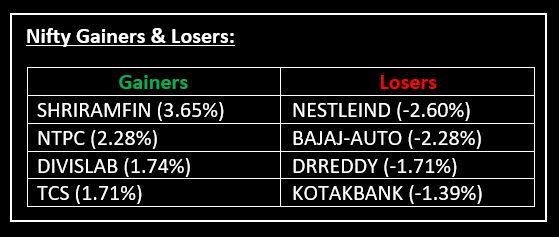

On April 3, the Indian market concluded with minimal change in a highly volatile session. At close, the Nifty saw a decline of 18.6 points, or 0.08%, ending at 22,434.70. Top Gainer: SHRIRAMFIN | Top Loser: NESTLEIND

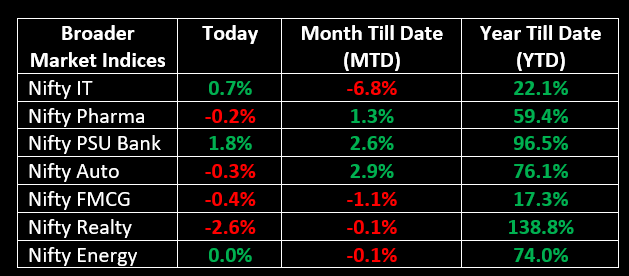

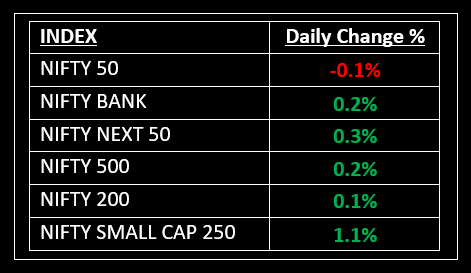

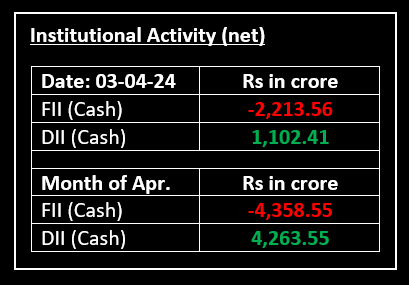

On April 3, the Indian market concluded with minimal change in a highly volatile session. At close, the Sensex slipped 27.09 points, equivalent to 0.04%, settling at 73,876.82, while the Nifty saw a decline of 18.6 points, or 0.08%, ending at 22,434.70. Despite a negative start prompted by weak global cues, the market managed to recover all losses during the initial trading hours, nearing record highs, buoyed by gains in IT, metal, oil & gas, and power sectors. However, a late-hour selling spree wiped out the intraday gains. Sector-wise, the Realty index observed a 2.5% decline, while the Auto index slipped by 0.4%. Conversely, Power and PSU Bank indices saw a rise of 1% each, with Information Technology and Media indices increasing by 0.5% each.

NIFTY: The index opened 68 points lower at 22,385 and made a high of 22,521 before closing at 22,434. Nifty has formed a small bullish candlestick pattern with upper shadow on the daily chart. Its immediate resistance level is now placed at 22,525 while immediate support is at 22,350.

BANK NIFTY: The index opened 195 points lower at 47,350 and closed at 47,624. Bank Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 47,700 while support is at 47,450.

Stocks in Spotlight

▪ Hindustan Zinc: Stock jumped nearly 4% after it reported highest-ever quarterly refined metal production at 273 kilo tonne (KT) in March on account of better plant availability.

▪ Moil: Stock gained over 3%, a day after the PSU announced that it recorded the best-ever production of any financial year since inception at 17.56 lakh tonnes, a jump of 35% on a yearly basis.

▪ Gensol Engineering: Stock advanced 5% to hit the upper circuit after the company posted highest ever revenue in FY24 of Rs 960 crore vs Rs 398 crore last year.

Global News

▪ The pan-European Stoxx 600 was slightly lower in early afternoon deals, down 0.01%, with sectors and the majority of bourses trading in mixed territory. Banks added 0.9% while mining stocks dropped 0.2%.

▪ The dollar index held near its highest level in over four months on Wednesday, pinning the yen close to its lowest in decades, though the increased threat of currency intervention by Tokyo capped further declines in the Japanese currency.

▪ Asia-Pacific stocks fell on Wednesday, tracking declines on Wall Street overnight, with shares of electric vehicle makers dropping on demand worries.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.