POST-MARKET SUMMARY 31st July 2024

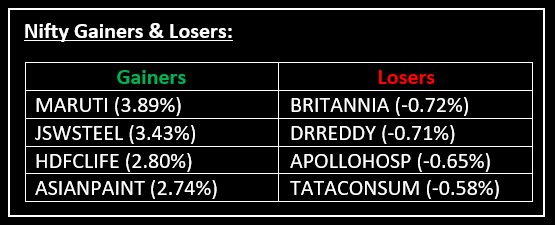

On July 31, Indian markets closed higher, mirroring trends in European and Asian equities ahead of the key US Federal Reserve's interest rate outcome, which is due later on Wednesday. Top Gainer: MARUTI | Top Loser: BRITANNIA

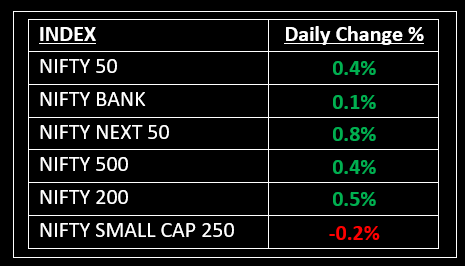

On July 31, Indian markets closed higher, mirroring trends in European and Asian equities ahead of the key US Federal Reserve's interest rate outcome, which is due later on Wednesday. At closing, the Sensex rose 0.35% (286 points) to 81,741 points, while the Nifty50 settled 0.38% higher at 24,951.15 points.

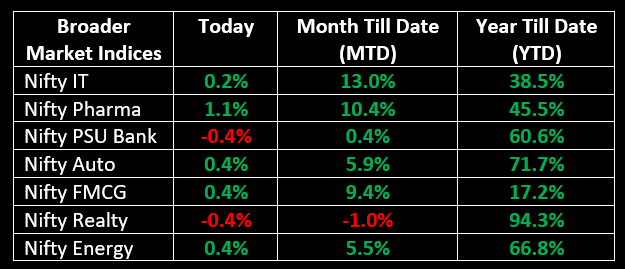

Among sectoral indices, Nifty Metal was the top gainer, up 1.2%, followed by Nifty Pharma and Media, each up over 1%. Nifty PSU Bank and Nifty Realty both fell 0.4%.

In related developments, SEBI has released a consultation paper suggesting new regulations for options trading, aiming to tighten controls in a market that has seen significant speculative activity from retail investors. Read more about it here

NIFTY: The index opened 29 points higher at 24,886 and made a high of 24,984 before closing at 24,951. Nifty has formed a small bullish candle on the daily chart. Its immediate resistance level is now placed at 25,000 while immediate support is at 24,900.

BANK NIFTY: The index opened 84 points higher at 51,583 and closed at 51,553. Bank Nifty has formed an indecisive candle on the daily chart. Its immediate resistance level is now placed at 51,775 while immediate support is at 51,350.

Stocks in Spotlight

▪ Torrent Power: Stock soared over 16% to hit a fresh record high of Rs 1,898 on NSE after the integrated power utility reported stellar earnings for the June quarter.

▪ IndiaMART InterMESH: Stock tumbled nearly 7% after the firm reported an addition of just 1,500 subscribers during the June quarter, falling sharply below Street estimates.

▪ GAIL India: Stock jumped over 3% after the country’s largest gas distributor reported a strong set of earnings for the June quarter.

Global News

▪ Gold prices firmed on Wednesday following the killing of Hamas leader in Iran, with the metal heading for a monthly gain driven by optimism about potential U.S. interest rate cuts as focus shifts to the Federal Reserve’s upcoming policy decision.

▪ The yen hit its strongest in over four months on Wednesday, as Bank of Japan (BOJ) Governor Kazuo Ueda flagged the possibility of more rate hikes after the central bank raised interest rates and unveiled a plan to taper its huge bond-buying programme.

▪ Asia-Pacific markets rose on Wednesday as investors assessed China’s business activity data, with Japan’s Nikkei 225 reversing course to log gains after the country’s central bank raised benchmark interest rates to around 0.25%.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.