POST-MARKET SUMMARY 31st December 2024

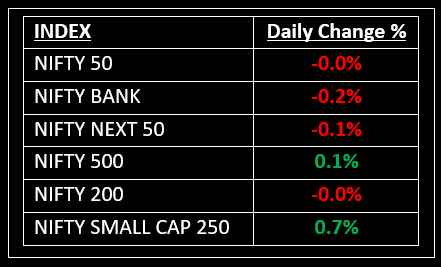

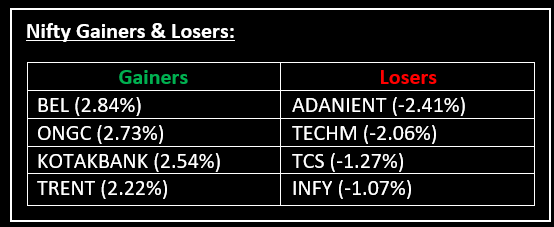

On December 31, 2024, the Nifty 50 showcased a sharp recovery, climbing nearly 200 points from the day's low due to a bullish counterattack, ultimately closing flat with a slight positive bias. Top Gainer: BEL | Top Loser: ADANIENT

On December 31, 2024, the Nifty 50 showcased a sharp recovery, climbing nearly 200 points from the day's low due to a bullish counterattack, ultimately closing flat with a slight positive bias.

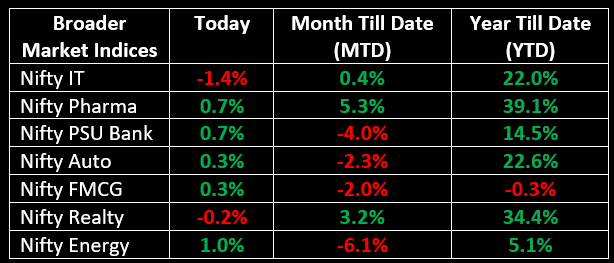

India's benchmark indices, Sensex and Nifty, closed the year with impressive annual gains of 8.17% and 8.8%, marking nine straight years of positive returns. However, Nifty Bank lagged, rising by just 5%. Explore our latest blog to see how other sectors fared and what’s in store for 2025: 2024 Market Recap: A Roller Coaster Year for Investors!

NIFTY: The index opened 84 points lower at 23,560 and made a high of 23,689 before closing at 23,644. Nifty has formed a bullish candlestick pattern with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 23,700 while immediate support is at 23,550.

BANK NIFTY: The index opened 304 points lower at 50,648 and closed at 50,860. Bank Nifty has formed a bullish candlestick on the daily chart. Its immediate resistance level is now placed around 51,000 while immediate support is around 50,600.

Stocks in Spotlight

▪ RVNL: Stock jumped nearly 8%, after the company emerged as the lowest bidder for two projects – one worth Rs 137 crore from the Central Railway and the other worth Rs 404 crore from the East Coast Railway.

▪ Adani Wilmar: Stock fell nearly 7% after Adani Enterprises announced plans to exit its JV with Wilmar International, selling its 44% stake.

▪ Shriram Properties: Stock jumped nearly 3% after the company announced the strategic sale of a 3.9-acre land parcel in Chennai.

Global News

▪ European markets crept higher on Tuesday although the trading session was muted ahead of the New Year holiday.

▪ Gold climbed above $2,600 per ounce on Tuesday, marking its strongest annual performance since 2010. The surge has been driven by US monetary easing, ongoing geopolitical tensions, and record central bank purchases.

▪ Brent crude oil futures rose to $74.5 per barrel on Tuesday, extending gains for a third consecutive session, buoyed by signs of recovery in China’s economy, the world’s largest crude importer.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.