POST-MARKET SUMMARY 31 July 2023

Post-market report and news around trending stocks.

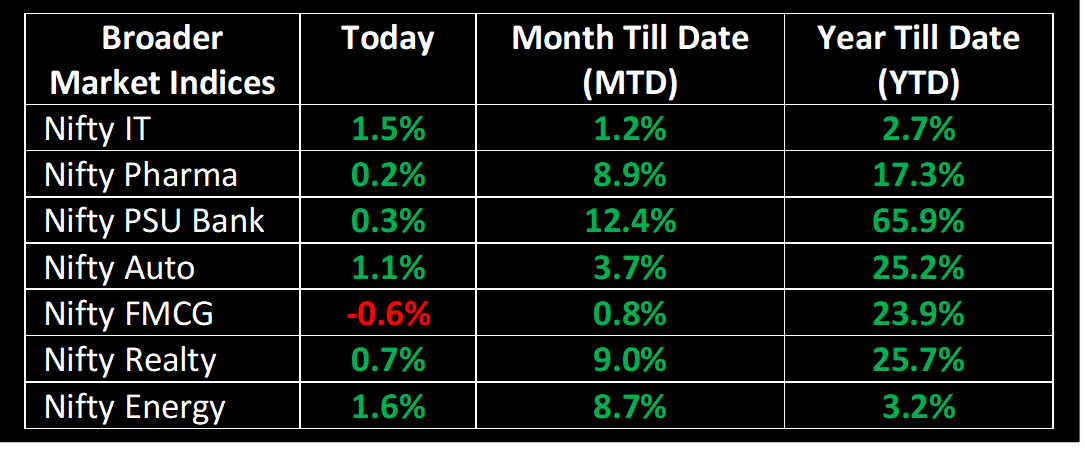

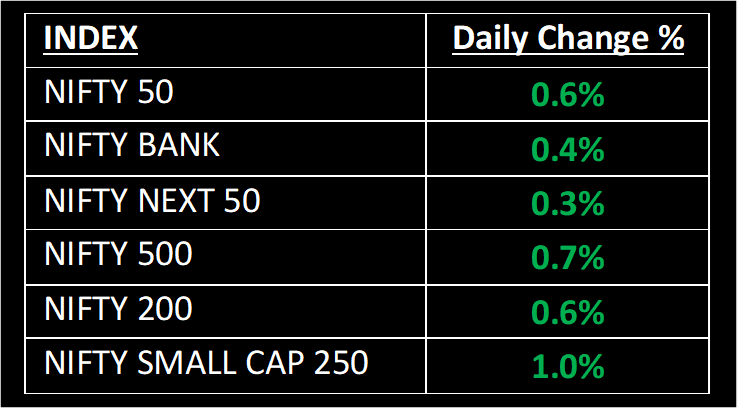

Benchmark indices commenced the week on a positive note, snapping a two-day losing streak. The Nifty climbed above 19,750, driven by favourable global cues and broad-based buying across sectors, except for FMCG companies. After a flat opening, the market swiftly rebounded during the early hours and continued to gain momentum throughout the day, eventually closing near its highest point for the day.

NIFTY: The index opened 20 points higher at 19,666 and made a high of 19,772 before closing at 19,753. Nifty has formed a bullish candlestick pattern with a small lower shadow on the daily chart, making a higher high- higher low formation. Its immediate resistance level is now placed at 19,850 while immediate support is at 19,600.

BANK NIFTY: The index opened 78 points higher at 45,546 and closed at 45,651. Bank Nifty has formed a small-bodied bullish candlestick with minor lower shadow on the daily chart. Its immediate resistance level is now placed at 45,800 while support is at 45,300.

Stocks in Spotlight

▪ Piramal Enterprises Ltd: Stock slumped 6% after the company reported a sharp drop in pre-provisioning operating profit (PPOP) – which excludes provision, exceptional items, and taxes – for the quarter ended June 2023.

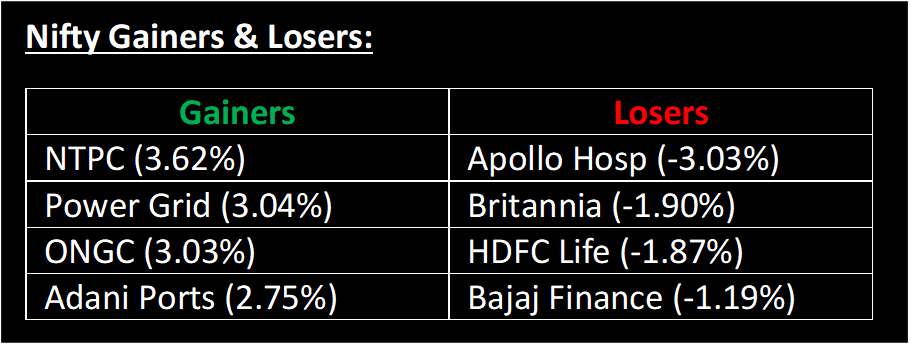

▪ NTPC Ltd: Stock rallied 4% despite lukewarm earnings in the quarter ended June. The company reported a standalone net profit of Rs 4,066 crore, up 9%.

▪ Power Grid Ltd: Stock spiked 3% after the company was declared a successful bidder for a host of inter-state transmission system projects.

Global News

▪ The Stoxx 600 index was up 0.2% in early afternoon trade after preliminary data showed headline inflation in the euro zone fell to 5.3% in July.

▪ Asia-Pacific markets rose on Monday as China’s factory activity for July remained in contraction territory for the fourth straight month. The official Manufacturing PMI came in at 49.3, higher than June’s figure of 49.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.