POST-MARKET SUMMARY 31 August 2023

Post-market report and news around trending stocks.

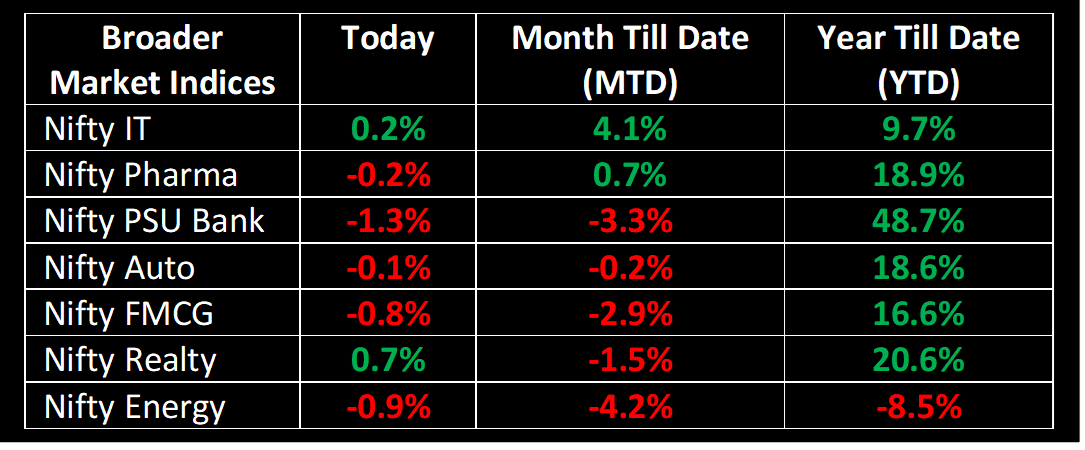

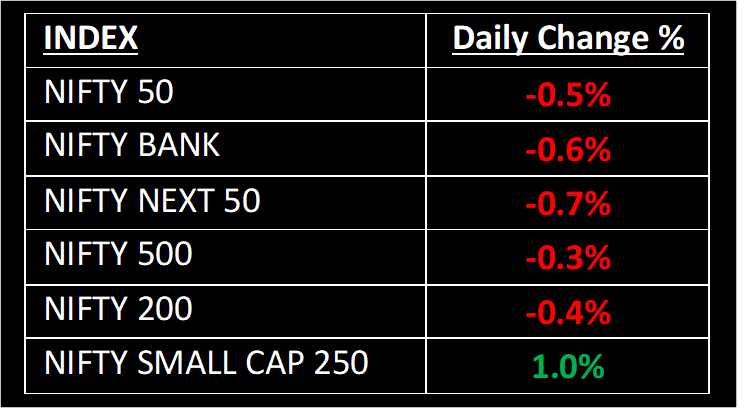

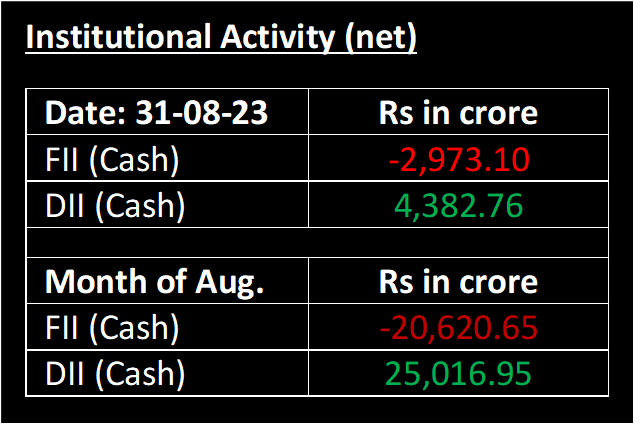

The market again witnessed last-hour profit-booking, which erased all the intra-day gains and broke its three-day winning run-on August 31 in a volatile session amid the August F&O expiry. Markets traded volatile on the monthly expiry day and lost nearly half a percent, in continuation to Wednesday’s fall. Meanwhile, mixed moves continued the sectoral front wherein realty and IT edged higher while energy and FMCG witnessed pressure.

NIFTY: The index opened 28 points higher at 19,375 and made a high of 19,388 before closing at 19,253. Nifty has formed a bearish candlestick pattern on the daily chart with significantly higher volumes on expiry day. Its immediate resistance level is now placed at 19,500 while immediate support is at 19,200.

BANK NIFTY: The index opened 33 points higher at 44,265 and closed at 43,989. Bank Nifty has formed a bearish candlestick pattern on the daily scale. Its immediate resistance level is now placed at 44,400 while support is at 43,600.

Stocks in Spotlight

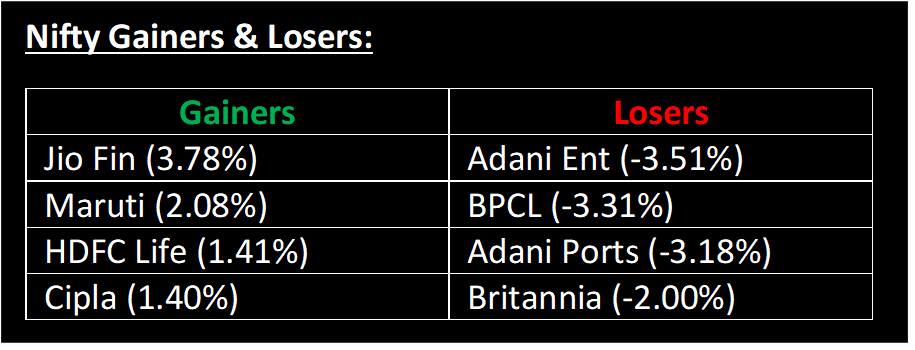

▪ Maruti Suzuki Ltd: Stock closed over 2% higher after hitting a 52-week high of Rs 10,064 intraday ahead of the release of monthly sales figures. Investors also cheered global brokerage JP Morgan's analysis that placed India's leading automobile manufacturer on the positive catalyst watch.

▪ Medplus Health Ltd: Stock plunged nearly 9% after a block deal involving a 12.8% stake, worth Rs 1,319 crore, took place on the bourses.

▪ Gallant Ispat Ltd: Stock zoomed 7% after the company announced having received one out of the two railway rakes purchased from the East Coast Railway

Global News

▪ Asia-Pacific markets were mixed on Thursday as China’s factory activity contracted for a fifth straight month in August.

▪ Hong Kong’s Hang Seng index slid 0.55% in its final hour of trade, paring earlier gains. Mainland Chinese stocks were also in negative territory, with the CSI 300 index down 0.61% and closing at 3,765.27.

▪ Gold firmed near one-month highs on Thursday to cap this month’s losses as the odds of another US interest rate hike were trimmed by data earlier this week pointing to a slowing labor market, while traders keep their eyes on the upcoming inflation reading.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.