POST-MARKET SUMMARY 30th September 2024

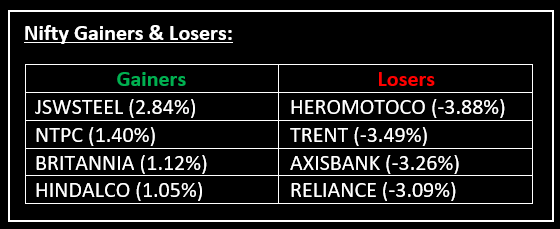

On September 30, bears took control of Dalal Street, dragging the BSE Sensex down by over 1,300 points and pulling the Nifty below 25,800 intraday. Top Gainer: JSWSTEEL | Top Loser: HEROMOTOCO

On September 30, bears took control of Dalal Street, dragging the BSE Sensex down by over 1,300 points and pulling the Nifty below 25,800 intraday, amid rising geopolitical tensions and anticipation of Federal Reserve Chair Jerome Powell's speech later tonight.

Additionally, investor sentiment was rattled by the upcoming SEBI meeting, which is expected to address critical regulatory proposals, along with the controversy surrounding Chairperson Madhabi Puri Buch. Read more: SEBI Board Meeting: Key Updates and Regulatory Proposals to Watch

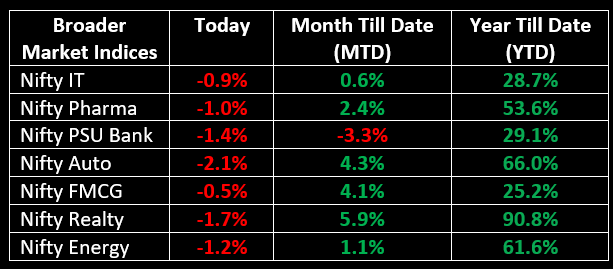

Among sectors, except for metal and media, which were up 1% each, all other sectoral indices ended in the red, with auto, banking, IT, telecom, pharma, and realty declining 1-2%.

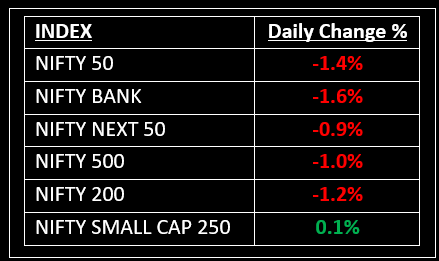

NIFTY: The index opened 117 points lower at 26,061 and made a high of 26,134 before closing at 25,810. Nifty has formed a long bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 25,900 while immediate support is at 25,730.

BANK NIFTY: The index opened 278 points lower at 53,556 and closed at 52,978. Bank Nifty has formed a long bearish candlestick pattern on the daily chart. Its major resistance level is now placed at 53,400 while major support is at 52,800.

Stocks in Spotlight

▪ MacroTech Developers: Stock tumbled 5% in response to an ANAROCK Research report revealing a 11% year-on-year drop in housing sales during the July-September quarter of 2024.

▪ NMDC: Stock jumped 4% supported by a spike in iron ore prices along with China's efforts to revive its battered property sector. Read more: NMDC Shares Climb Amid Surge in Global Iron Ore Prices

▪ Max Estates: Stock gained over 1% following the announcement of strong pre-sales for its Gurugram project - Estate 360.

Global News

▪ European stocks were lower on Monday, starting the week and the final trading session of September in negative territory.

▪ Gold prices eased on Monday but hovered near the record peak hit last week, setting bullion on track for its best quarter in over eight years following a jumbo U.S. rate cut decision and expectations of another outsized reduction in November.

▪ The euro strengthened on Monday after German inflation data, while commodity currencies rose on hopes for a turnaround in China’s economy. The Japanese yen steadied as traders reacted to the new prime minister’s call for a snap election.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.