POST-MARKET SUMMARY 30th May 2024

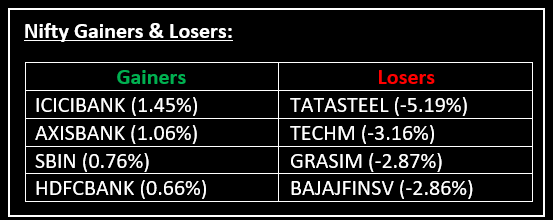

On May 30, bears tightened their control on Dalal Street as the benchmark indices extended their losing streak to five straight sessions. Top Gainer: ICICBANK | Top Loser: TATASTEEL

On May 30, bears tightened their control on Dalal Street as the benchmark indices extended their losing streak to five straight sessions, with Nifty finishing the May F&O expiry below 22,500.

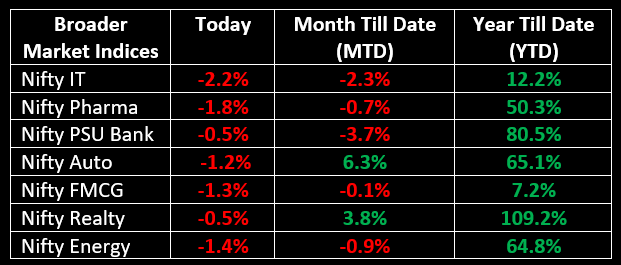

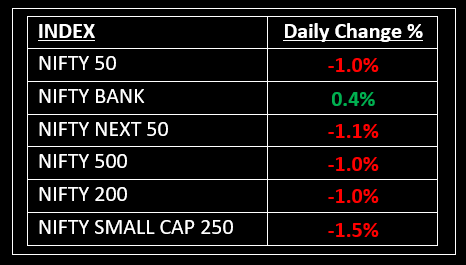

At close, the Sensex was down 617.30 points or 0.83% at 73,885.60, and the Nifty was down 216 points or 0.95% at 22,488.70. Among sectors, the Bank index gained 0.5%, while the Auto, FMCG, Metal, IT, and Healthcare indices shed 1-2%.

NIFTY: The index opened 87 points lower at 22,617 and made a high of 22,705 before closing at 22,488. Nifty has formed a bearish candlestick pattern with minor upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 22,580 while immediate support is at 22,420.

BANK NIFTY: The index opened 188 points lower at 48,313 and closed at 48,682. Bank Nifty has formed a bullish candlestick pattern on the daily chart with a long upper shadow. Its immediate resistance level is now placed at 48,900 while support is at 48,500.

Stocks in Spotlight

▪ ISGEC Heavy Engineering: Stock plunged over 16%, a day after the company reported disappointing earnings for the March quarter with net profit down 17%.

▪ Lemon Tree Hotels: Stock jumped over 6%, after the company reported a strong March quarter performance, with operating revenue climbing 30%.

▪ Edelweiss Financial Services: Stock tanked 12% after the RBI imposed restrictions on two of its financial services entities, citing material supervisory concerns.

Global News

▪ Gold prices steadied on Thursday, with market participants awaiting key U.S. economic data that could shed some light on the Federal Reserve’s next interest rate moves.

▪ The dollar dipped on Thursday after rising to a two-week high as a rout in U.S. Treasuries pushed up yields, boosting the currency’s allure.

▪ Asia-Pacific markets extended losses on Thursday, tracking Wall Street’s moves ahead of a slew of economic data from the region on Friday.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.